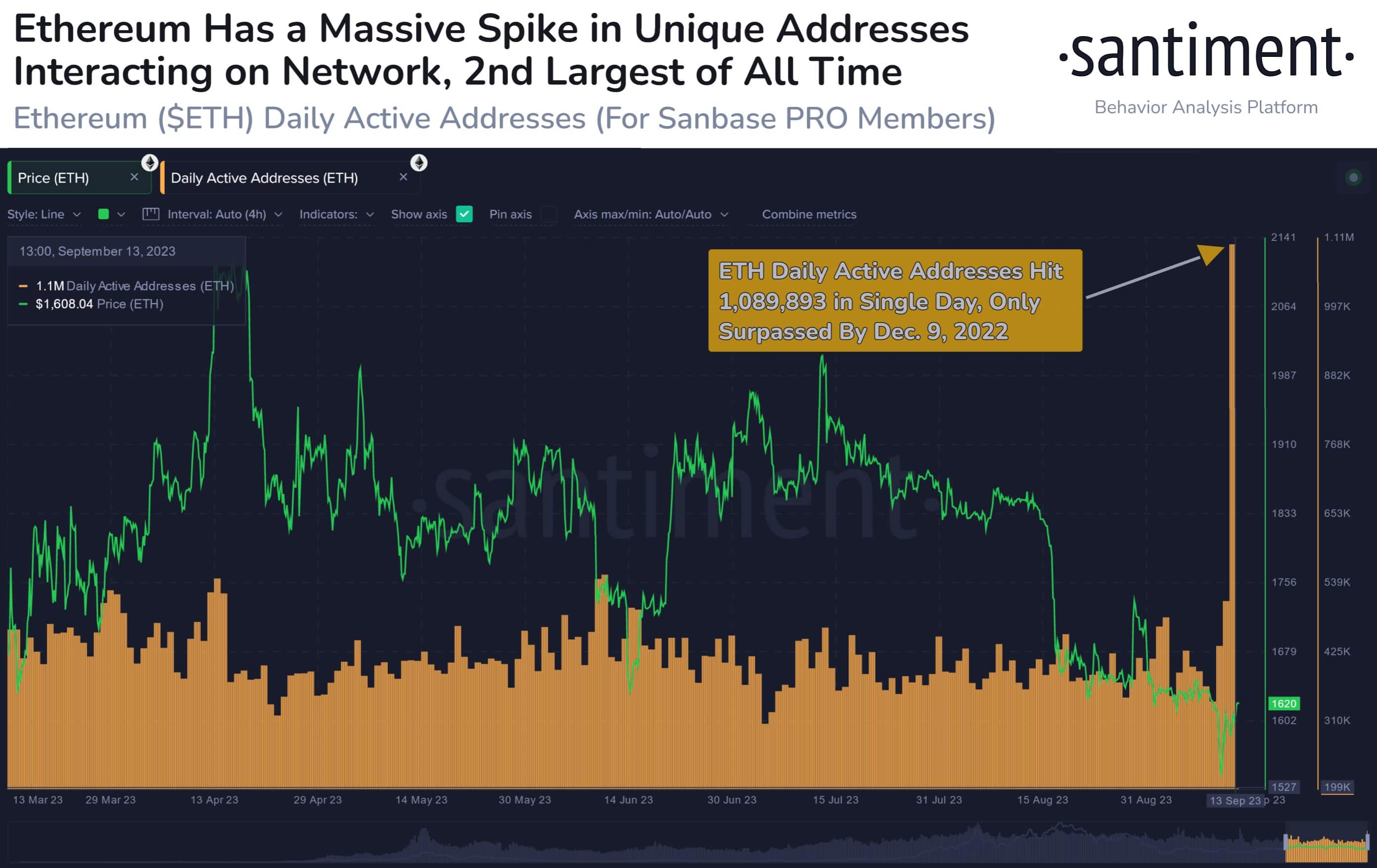

Ethereum sees second-highest on-chain activity in history

The network saw over 1 million unique active wallets accepting or sending ETH, the second-highest amount in the asset’s history.

The Ethereum (ETH) network registered a spark of activity on Sept. 13, as the number of unique active wallets (UAW) connected to the network hit 1,089,893.

In an X post, Blockchain analysts at Santiment said this was the second-highest amount of UAW in Ethereum’s 8+ year history, suggesting that such spikes “could be the capitulation signal needed for prices to rebound.”

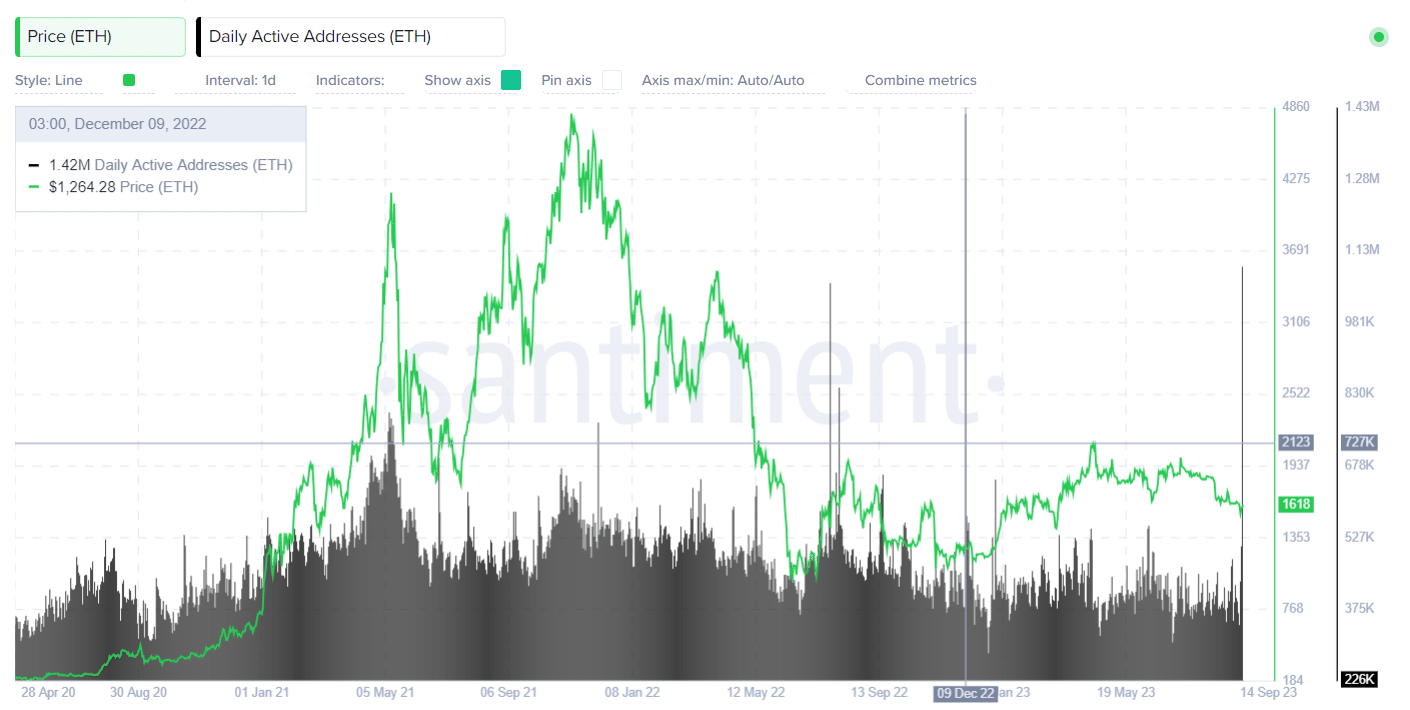

The last time the Ethereum network witnessed a spike in on-chain activity was on Dec. 9, 2022, when the amount of UAW set an all-time high at 1.42 million, with ETH trading at around $1,265, according to data from Santiment.

FTX liquidations as a possible trigger

Although the real reason behind the activity remains unclear, the spark came when U.S. Bankruptcy Judge John Dorsey approved FTX’s request to sell up to $100 million weekly to return funds to its creditors.

As crypto.news reported, the ceiling can be increased to $200 million. However, any adjustments will be evaluated on an individual token basis. Before selling high-profile digital currencies such as Bitcoin (BTC) and Ethereum (ETH), the estate must provide a 10-day advance notice to the US Trustee’s office. FTX is set to sell $3.4 billion worth of crypto in total.

Nonetheless, the crypto market seems to rise despite the US Consumer Price Index (CPI) coming higher than expected and FTX’s liquidation approval. According to data provided by CoinGecko, the global crypto market capitalization rose from $1.031 trillion to $1.086 trillion at the time of writing. This indicates a $55 billion hike despite the two bearish events on Sept. 13.