Ex-Credit Suisse banker’s risky crypto bets lead to JAR Capital’s shutdown

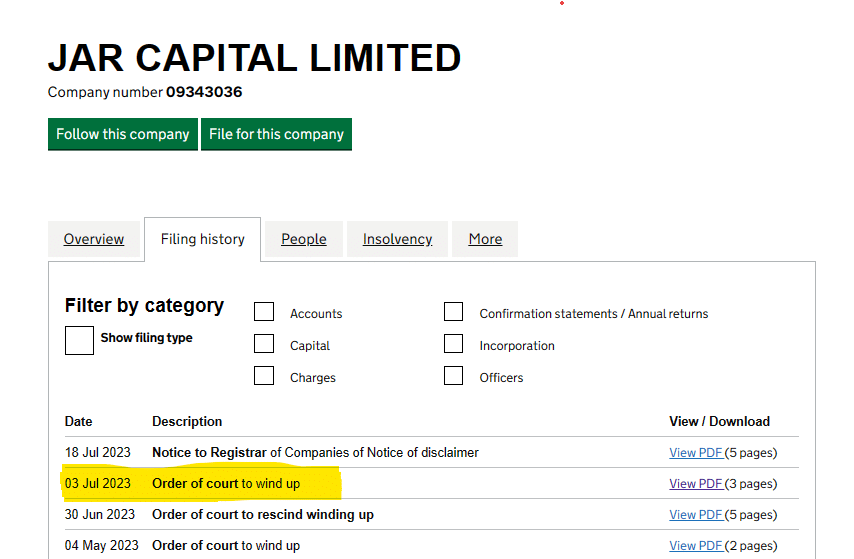

Francis Menassa’s JAR Capital has been ordered to shut down after losing capital over risky crypto and leisure park investments.

Francis Menassa, former Credit Suisse banker and founder of JAR Capital, faces the closure of his wealth management firm following a court mandate.

The court ruling comes as a result of unpaid debts that have accrued partly from unsuccessful ventures into cryptocurrency and leisure assets, as well as a botched attempt to acquire a banking institution, per official documents.

Unfortunate crypto and VC investments

JAR Capital’s missteps began with a gamble on The Wave, an inland surfing park in southwest England with a budget of roughly £25 million. This venture, described by Menassa as “unique,” launched just before the onset of the global pandemic. According to financial documents from JAR Financial Management, where Menassa is the principal shareholder, the pandemic-induced shutdowns led to “severe strain” on investors.

Further augmenting the firm’s troubles were ill-fated financial activities that date back to 2018.

The company sunk more than £2 million into BlockEx, a cryptocurrency trading platform that later proved difficult to divest as the digital asset market experienced a downturn. BlockEx initially raised $24 million in initial coin offering (ICO) back in 2018 but crashed within a year due to a series of setbacks. Menassa failed to offload his share of the firm in time, which led to loss of his investment.

Official records indicate that the holding company responsible for Menassa’s portfolio, including JAR Capital, was in debt to unsecured creditors to approximately £8.8 million ($11 million) as of late April, Bloomberg reported.

This marks a pronounced decline for a man who was previously celebrated among the UK’s premier private client advisors. Menassa started his illustrious career at Merrill Lynch before his tenure at Credit Suisse.

JAR Capital was once a formidable name in London’s Mayfair district, boasting an office on the prestigious Savile Row and disclosing assets exceeding $1 billion across its wealth and asset management sectors.