Fidelity Confirms That Bitcoin’s Volatility Is Worth It and Recommends Investing 5% of One’s Portfolio

Fidelity Digital Assets shared a new report, published on October 13, 2020, stating that Bitcoin has a notably low correlation with other traditional assets like stocks or gold and that Bitcoin’s market cap has plenty of upside opportunities. In line with this, the firm considers investing 5% in BTC in one’s diversified portfolio.

Fidelity recommends an active rebalancing strategy of 5% in Bitcoin in a multi-asset portfolio. Should Bitcoin rise substantially and outperform one’s other holdings, the report dictates that the excess BTC may be sold and used to buy other assets in your portfolio. If the opposite occurs and Bitcoin dumps, it is recommended that one’s holdings in other assets “above their target allocation” should be sold to buy more Bitcoin and raise it back to become 5% of your portfolio.

No Relationship Between Bitcoin and Other Assets

Director of Fidelity Research Ria Bhutoria stated that the crypto’s ongoing market capitalization is not correlated with markets Bitcoin could disturb.

We are excited to share the second report in our Bitcoin Investment Thesis series by @riabhutoria.

In this piece, we explore bitcoin’s role as an uncorrelated alternative investment that may provide portfolio optimization benefits.

Please download: https://t.co/XRLQGSvFpw pic.twitter.com/xuLqS2zdm8

— Fidelity Digital Assets (@DigitalAssets) October 13, 2020

Fidelity’s long report, dubbed Bitcoin Investment Thesis: Bitcoin’s Role As An Alternative Investment, explains not only a lack of association between Bitcoin’s price and traditional financial assets, but also more eminent returns for BTC investors over a long-term time period.

The research was carried by questioning investors and crypto industry specialists from companies like ARK Invest, CoinShares, and Fidelity Investments. In it, the company explained “Bitcoin’s role as an alternative investment.”

BTC Manager had previously reported near the end of August that the firm had filed for a Bitcoin Fund with the SEC. And the new report appears to cement their bullish stance on the digital asset.

Bitcoin’s Correlation Is Just .11 With Other Assets

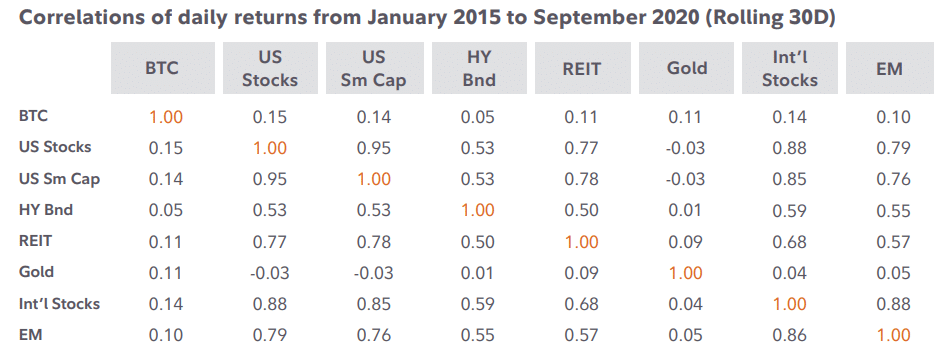

(Source: Fidelity Digital Assets)

The research found that Bitcoin as an investment medium had a correlation of just .11 to other stocks on a 30-day standard between January 2015 and September 2020. Correlation estimates vary from 1 to -1, based on whether an asset price increases with a completely correlated asset or against an uncorrelated asset.

The .11 number indicates that Bitcoin prices neither increase nor decrease compared over 30 days with any asset such as gold or the more comprehensive US stock market.

Alternative asset classes are winning investors with multi-asset securities that include different stocks and other holdings since they are more likely to maintain greater value when traditional assets are not performing well. The report also stated that the reason behind Bitcoin’s disassociation with other assets could be somewhat due to a new age of retail interest motivated by social media engagement.