Global Reserve Cryptocurrency: Ensuring Better Governance by Blockchain

USD as Global Reserve Currency

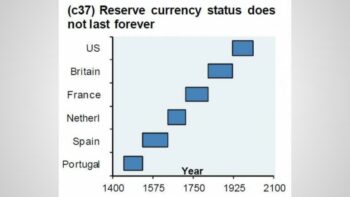

I don’t want to spend a lot of time on the inexorability of change. Whatever opinion one holds of the USA and its future prospects, history speaks loudest. Current events also show a concerted divestment from the Dollar, best illustrated by another chart.

Searching Zero Hedge for terms like “global reserve currency” will yield further evidence to support the view that the advent of the next global reserve currency is nigh; most such evidence regarding trade deals between China, Russia and the BRICS, as well as various alternatives being developed to the IMF and World Bank.

For example, former World Bank chief economist, Justin Yifu Liu, stated that “…the dominance of the greenback is the root cause of global financial and economic crises… the solution to this is to replace the national currency with a global currency.”

What’s Next? SDRs, Currency Basket, Gold… Why Not BITCOIN?

Lately the idea of Bitcoin as global reserve currency has garnered attention, even from such sinister, tentacular entities as the Council on Foreign Relations.

Coinbase CEO Brian Armstrong, who’s either hopping aboard the hype-train or got a tentacular tap on the shoulder, chimed in late July 2015 as follows:

“Many will find this crazy, but I think Bitcoin could surpass the dollar as reserve currency within 10-15 years.”

Well, Brian, that’s only crazy if bitcoin remains decentralised and is truly the product of an independent genius or collaboration thereof and not, in fact, owned by whichever deep state techno-Leviathan might mobilise its servile politicians, greasy bankers, and other assorted agents to push bitcoin as global reserve. Further, given bitcoin’s universal nature, we must assume any such deep state to be supranational and comprising at least the two biggest players in bitcoin / the world: America (coding) and China (mining).

It doesn’t track that the US Fed or People’s Bank – any world central bank for that matter – as a component of such a powerful nexus would push for a “Bitcoin Woods” re-organisation of the global financial system… unless they hold the key to Satoshi’s quadrillions (or whatever units come next), as Bitcoin’s price rises commensurate with its role as the world’s prime unit of exchange.

Further, I can’t see world governments creating new and likely competing sovereigns through multiplying the already considerable wealth of early bitcoin adopters. The economic old guard, placing a motley assortment of independent coders, cryptographers, miners and crypto-anarchists on the same economic level as minor countries and major corporations? Doubtful, especially considering how generally ill-disposed such pioneer personalities are toward the limitation-defining state.

All of that is pretty far down the rabbit-hole, so for the purposes of this article I’m going to assume bitcoin remains decentralised and unrooted. So then, assuming Satoshi to be a “true prophet,” the above reasoning eliminates bitcoin as a potential global reserve currency, barring the total loss of control by the powers that be. Arising from such an outcome, survivors would get to choose their own monetary system, rather than having it imposed from above—and they might well choose bitcoin.

Such a failure of the status quo is certainly possible (although not the sort of doomily contrarian view I’d expect from Brian Armstrong) if the prevailing financial system, in all its over-indebted and over-leveraged morbidity, experiences an uncontrolled collapse. Bullion, barter, bullets, and bitcoin might be the only acceptable trading methods once the dust settles. However, it’s far more likely that the current global reserve system will instead experience a controlled demolition of sorts, once insiders have placed and hedged their bets accordingly. In which case, implementation of an altcoin as global reserve currency is probable.

Which Alt?

Bitcoin XT, perhaps? Certainly a fork with brand recognition under the control of a clever fool known for trying to neuter Bitcoin’s fungibility and pseudo-anonymity to make it more palatable to the “mainstream” would suit the suits. If Bitcoin XT gets a big media push proclaiming it to be like bitcoin but better, due to being safe for children and free from terrorists, that’d a be a clue.

Then again, banks like Citi are currently messing around with permissioned blockchains sans Bitcoin, which Andreas Antonopoulos aptly compares to intranets vs the internet.

Eventually though, banks might hit on something which works for their purposes. It’s this mutant future-fork which could be either the model or the candidate for GRC.

Why a blockchain protocol for the next reserve currency? Why not gold?

In a word: programmability. Let’s say you’re a megalomaniacal economic central-planner. Chances are you’re busier than a one-armed wallpaper hanger, what with keeping the world going round with your various monetary levers. You have to:

- decide the exact rate at which you’ll leach the accumulated wealth of your host population (or control interest rates to “manage inflation,” if you prefer),

- set the price of every needful thing, from food to gasoline to Pikachu bobbleheads, while denouncing the evils of the free black market,

- siphon value from the real economy into the stock market to keep your banker buddies in the green, and so on, ad infinitum.

Programmable currency is your new best friend as it lets you put a lot of this work on algorithmic auto-pilot. Simply feed the Artificial Intelligence raw data from your pervasive surveillance network and it’ll happily pull the relevant levers whilst you nap in your coffin; surely every central banker’s dream.

To put it more seriously, if we have a top-down shift to global reserve cryptocurrency (GRC), it’ll be because it’s the most powerful and convenient tool with which elites can direct world affairs.

Sure, its imposers might throw in the sop of backing by whatever fiats are still functional at that point, maybe some precious metal too if things get medieval, but crypto will form the structure if not the cladding. Citizens will go along, given how deeply enmeshed most are within technological society and how well-adapted crypto is to such an economy.

GRC Mutation #1: Permissioned Blockchain

For similar reasons as to why they’ll reject bitcoin, the last thing the moustache-twirling financial elites want is for some well-funded guys in a garage to invent a ninja mining chip and 51% their shiny new global reserve system. In their ideal world, there will be authorised miners only, probably hashing from deep within the vaults of participating central banks; plebs verboten. Technically, this should be easy to achieve if the network requires an authorisation before you broadcast or receive transactions.

GRC Mutation #2: Rate-Limited Mining

Although a system with minor players gravitating toward competing supernodes would largely be business as usual post-Pax Americana, I doubt uber-monopolists would want to trigger a hashrate arms race, competition famously being bad for business.

That said, getting all nations to buy into the system, even assuming a fair launch, is hard if they know China is fully geared up to mine an increasing majority of blocks from genesis onwards.

What’s needed diplomatically, assuming the next global reserve currency isn’t imposed on a defeated world by the last man standing, is a way to balance the economic influence of nations in relation to their power. This gives at least the appearance of fairness and equal opportunity.

Mining rate or reward-split determined by national or regional factors, be it some mash of population, GDP, gold reserve, military power, environmental rating or whatever, is what has the best chance to achieve consensus and buy-in.

GRC Mutation #3: Infinite Block Rewards

Given how well the stealth tax of inflation has worked out for the arch scammers so far, I expect Dogetastic infinite block rewards from GRCcoin.

People’s Global Money for the Folks

As cynical as this might read, I do think that even a rate-limited GRC, albeit inflationary and permissioned, offers a glorious, epochal political opportunity, not just for the 1% fat-cats but for the rest of us IF we do it right.

Here’s how: we can make the rate-limiting factor a measure of public satisfaction with local governments and regional alliances. If government coffers were to shrink beneath transparent public block-records when politicians fail to deliver the goods, well… That might keep them honest. And if EU-style conglomerations wanted financing they’d similarly need to keep up their satisfaction ratings.

The 3 GRC Scenarios

To sum up, I think they run as follows:

- Bitcoin. In the event of systemic crash, in which supply chains fail and counterparty risk is flatly refused, Bitcoin will be the only option for distant trade. Precious metal or useful goods may serve for local trade. In this scenario, the resilient survive and the anti-fragile prosper; everyone and everything else is dust.

- If we continue along the boiling frogs path, with intermittent crises but nothing completely unmanageable, then by hook and by crook we’ll get a thoroughly centralised, oppressive and ultimately debt-enslaving form of digital “cash,” potentially far worse than fiat. Implanted wallet chips, the mark of the Doge; insert further nightmare scenarios here.

- In the event of WW3, we’ll end up using the global reserve currency of the victor. The GRC in question will likely be similar to that described in 2), the only difference being its arrival through conflict rather than manufactured consent.

- If we wake enough people up to the political possibilities of the blockchain to keep power and wealth distributed according to meritocratic principles, which accord in turn with some unselfish measure of greater harmony, we profit-driven coingeeks could usher in a new golden age of enlightenment and prosperity.

No pressure.