What is a crypto market cap? Market cap explained

Market cap is one of the most common and effective ways in which investors measure the real value of cryptocurrencies.

Table of Contents

In this article, we’ll discuss what is a crypto market cap, how to calculate it, and why exactly is the market cap for any cryptocurrency an important metric to know before investing in it.

What is market cap in cryptocurrency?

Market cap is the short form of market capitalization and is one of the most followed metrics in both traditional finance and cryptocurrency markets as well.

In cryptocurrency, a market that’s relatively new and developing, the market cap is a gauge of liquidity and, on a sentimental level, the popularity of a given project.

Broadly, the market capitalization of any company refers to the total value of its outstanding shares. In simpler terms, it’s how much money people would be willing to invest in that company if they could.

Panning over to crypto, the market capitalization of a project tells you how much value it has in the greater scheme of things at any point in time.

Now that we have explained the crypto market cap, let’s learn what is the total market capitalization of the cryptocurrency markets.

What is the total market cap of cryptocurrency?

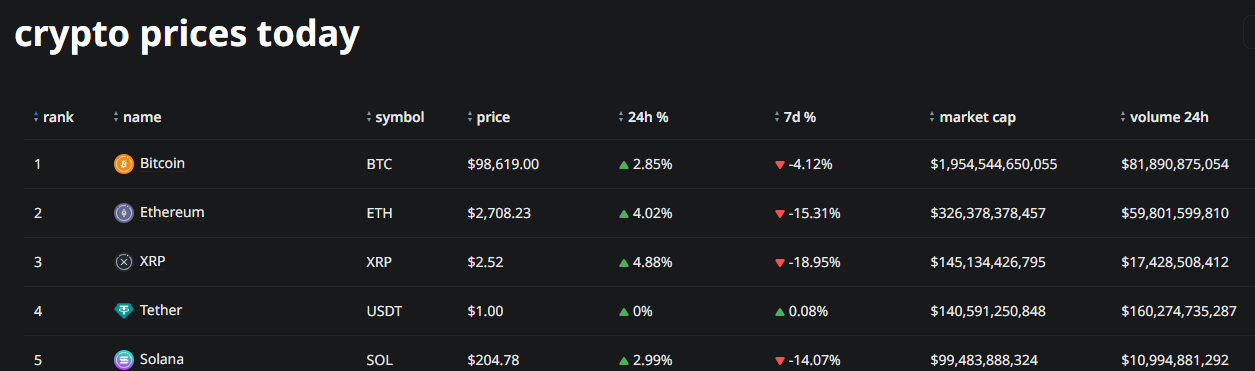

According to Coinstats, the total market cap of cryptocurrencies stands at $3.3 trillion. Of this total, Bitcoin (BTC) takes the lion’s share as it has a market cap of $1.94 trillion, followed by Ethereum and XRP whose market caps are valued at $326 billion and $144 billion respectively.

It is a good practice to analyze the market caps of major cryptocurrencies and their drop or increase in value over time, as it can help you make an informed investment decision.

How to calculate market capitalization?

The formula for calculating cryptocurrency market capitalization is pretty simple. It is calculated by multiplying the spot price of the coin by its circulating supply.

Here’s an illustration to help you understand the market cap better.

Let’s say a project has 10k coins in circulation. Each costs $1 in the secondary market. The total market cap will be 10,000*$1 for $100,000.

If these coins’ value rose to $10, the market cap would be $1,000,000.

The good news is that market cap calculation work has been made easy for users. At any time, interested persons can automatically find the market cap details of almost all popular cryptocurrency projects on tracking websites like crypto.news, CoinMarketCap, Coingecko, and many others.

Still, a trader should know that the circulating supply of a coin—which is used in this calculation—is different from the total supply.

Circulating supply is the number of coins available for trading at any point and is always lower than the total supply. On the flip side, the “total supply” of a coin indicates the total number of coins to be ever minted by the project.

Why does market cap matter in crypto investing?

A cryptocurrency’s market capitalization is essential when deciding which tokens are worth looking at and investing in.

Since the market cap measures liquidity and investor interest, any token with a high market cap is worth researching more thoroughly since many more investors and traders keep it in their tabs.

On the flip side, tokens with a low market cap may demand more research. However, that doesn’t mean the project is low quality. In some instances, low market cap tokens may exponentially rise in value over time as they build their community and gradually grow their valuation. They could be worth investing in when their market cap is lower and undervalued spot rates.

The main limitation of market capitalization is that it doesn’t account for the rate at which the tokens are expected to increase in value. The rate at which a token’s price will increase in the future is usually a lot more critical than the current value of a cryptocurrency.

Market cap vs. other metrics

If you just rely on market cap alone, it won’t give you the full picture. Other important metrics like liquidity, volume, and fully diluted valuation of any crypto project provide key insights that can help you make an important investment decision. It is also important to correlate the price of a token with its rising market cap, and also the overall sentiment of the market that is coming in reaction to this increase in adoption of the cryptocurrency asset.

Finally, having a broader market view of global trends is important before analyzing key metrics like market cap, to make sure that the growth of any cryptocurrency is sustainable in the long run as well.

What does market cap mean in cryptocurrency?

The total value of any cryptocurrency is denoted by a single number, which is known as its market cap. To calculate it, you have to multiply the asset’s circulating supply with its current price in the market.

How does market cap effect crypto price?

The higher market cap for any token, for example, BTC, which has a market cap of around $2 trillion at the time of writing, indicates investor trust, price stability, and growth potential. Meanwhile, projects with low market cap may or may not succeed in the long term as higher volatility may be seen in these assets.

Does market cap matter in crypto?

Yes, market cap matters in the crypto market as it tells you exactly how much a cryptocurrency is worth in the real market. On paper, any project can make big claims, but its potential is truly tested when it reaches a decent market cap and also sustains it overtime.

What is fully diluted market cap in crypto?

The fully diluted market cap in crypto means that all coins or tokens have been released into the market by the creators of the project. Since there is no more supply of the token to be released, it becomes easy for investors to make a buying or selling decision based on the price performance of the token.