What is yield farming? A complete beginner’s guide

Since the decentralized finance (DeFi) industry’s breakthrough year of 2020, the total value locked in DeFi apps has skyrocketed up to almost $100 billion at the time of writing.

Much of this growth can be attributed to yield farming — a rewarding way of providing funds or liquidity to decentralized protocols in order to earn rewards paid in tokens. This guide will see yield farming explained in a simple manner that you’ll be able to refer to as you progress along your yield farming journey.

Table of Contents

What is yield farming?

Yield farming, also known as liquidity mining, involves deploying digital assets in decentralized finance protocols to earn token rewards for providing liquidity in the DeFi markets. To understand yield farming explained.

A yield farmer (also known as a liquidity provider) typically deposits crypto assets in an autonomous trading or lending pool in exchange for trading fees or interest payments plus yield farming rewards paid out in protocol tokens to earn additional yield.

How does yield farming work?

Yield farming is somewhat similar to fixed deposits in traditional finance but in a more complex and technical way. It typically involves investors known as liquidity providers (or yield farmers) depositing funds in smart contracts known as liquidity pools in hope of earning above-average yield on their assets.

Yield farmers use their funds to provide liquidity to decentralized liquidity pools, and in turn, the fees paid by users of these dApps are distributed to farmers according to the share of liquidity they contributed. Beyond this, yield farming provides exciting mechanisms that enable investors to maximize their earnings through somewhat complex farming techniques.

For example, when farmers provide liquidity to Curve Finance, they receive a token that represents their share of liquidity on a particular liquidity pool on Curve. They can decide to deposit this token to a different protocol and mint another separate token, which acts as an extra yield. The process can become highly complex and also highly rewarding for yield farmers.

Additionally, yield farming, or crypto farming, also serves as a way for investors to earn new crypto tokens without directly purchasing them from exchanges. Some protocols attract liquidity by distributing additional tokens to liquidity providers — this may be a governance token or one that provides other utilities in the protocol’s ecosystem.

Types of yield farming

There are different ways yield farmers earn yields in the DeFi market. Let’s take a look at three examples of crypto farming explained from liquidity provision, lending and borrowing, and NFT farming.

Liquidity provision

Acting as a liquidity provider in a decentralized trading platform involves locking up your tokens in the liquidity pool of a protocol to earn rewards. Decentralized exchanges charge a small fee on all trades and distribute it to liquidity providers in proportion to the percentage of liquidity provided.

Additionally, some decentralized trading apps provide an additional incentive through liquidity pool (LP) tokens that liquidity providers receive and can stake to earn yield farming rewards.

Lending and borrowing

DeFi lending and borrowing involves DeFi investors providing tokens as liquidity to enable DApps to lend to borrowers. Borrowers, on the other hand, usually over-collateralize their loans because of the high volatility of cryptocurrencies to ensure the security of the LP’s funds. Borrowers on lending apps like Compound and Aave receive the protocol’s governance token as an additional incentive on top of interest payments to deposit funds and provide liquidity to the lending pools.

NFT Farming

A new yield farming trend that has emerged with the rise of NFTs is NFT farming. Farming NFTs involve staking non-fungible tokens in a staking contract for a reward paid in tokens or staking tokens for a reward paid in the form of an NFT.

How to yield farm on Compound

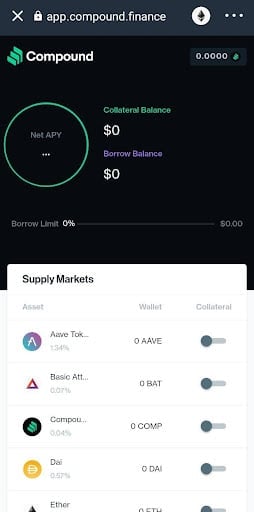

To show the process of yield farming on DeFi protocols, we’ll use Compound as an example of how yield farming works.

Compound is a DeFi borrowing and lending platform that allows investors to earn interest on their cryptocurrencies by using them to provide liquidity on its pools. Let’s take a look at how you can yield farm on Compound.

- Open your browser and type in compound.finance to access the lending DApp.

- Click on ‘App’ and connect DeFi Wallet DeFi wallet to access Compound’s lending and borrowing markets.

- Next, choose your preferred network — Ethereum, BNB Smart Chain, Avalanche C-Chain, etc. — at the top right corner of your screen beside the three dots.

- Navigate through the market and choose the cryptocurrency you want to provide liquidity for as a lender.

- Click ENABLE. The protocol will make a smart contract call to your wallet.

- Deposit the crypto token you want to lend.

- Sign the transaction, and you’ll start earning yield on your crypto asset immediately.

- To withdraw your tokens, follow the same process and navigate to withdraw.

- You’ve successfully completed the yield farming process.

That’s one example of how to yield farm on a specific protocol within the DeFi ecosystem.

Yield farming protocols

Uniswap

Uniswap is a trustless and permissionless decentralized exchange protocol that allows users to swap crypto tokens without any intermediaries or third parties. Investors will deposit an equivalent of two tokens in a 50/50 ratio to create a market to enable peer-to-peer trading. By supplying tokens to Uniswap’s liquidity pools, users will earn rewards from the proportion of the transaction fees as well as the UNI governance token. Uniswap currently has a TVL of $5.9 billion.

Curve Finance

Curve is one of the largest DEX that facilitates stablecoin swaps with over $5B tokens locked in its liquidity pools. Liquidity providers supply tokens to the pools, and in compensation for their effort, they earn CRV tokens as part of their rewards. With the huge token supply, users can exchange their crypto assets efficiently while maintaining a low slippage and transaction fees.

Pancakeswap

Pancakeswap is a DEX built on the BNB Smart Chain that enables users to swap BEP-20 tokens. It utilizes the popular AMM model that allows users to trade against a liquidity pool. Liquidity providers receive an LP token representing their share of the popular pools on Pancakeswap that can be staked to earn CAKE tokens.

Risks of yield farming

Yield farming is a high-risk venture. Let’s take a look at yield farming risks you have to be aware of before depositing your first tokens in a yield farming DApp.

Impermanent loss

Impermanent loss occurs when the assets in a liquidity pool become imbalanced due to a heavy sale or buy of either asset in the pool. Impermanent loss isn’t technically a loss if LPs haven’t withdrawn their tokens from the liquidity pool and should even out again over time.

Smart contract risks

While DeFi’s open-source nature allows people to easily audit the codes of protocols and spot flaws, this can also be dangerous. Hackers have exploited vulnerabilities in the codes of many DeFi protocols to drain their liquidity pools.

Rug pulls

A rug pull is an exit scam where the developers behind a DeFi project abscond with all the funds of users in its liquidity pools and abandon the project. Most of these projects attract users by promising extraordinary returns on little investments. It’s important you research a protocol before providing liquidity to ensure if the founders built in any exit mechanism.

Increased volatility

The high volatility of cryptocurrencies can cause the value of your token to crash while locked up. Hence, you will have no means to cash out in times of extreme volatility. However, most yield farming protocols are now making their lockup periods and mechanisms more flexible to attract LPs.

Regulatory concerns

The decentralized finance market is largely unregulated, which means that there’s often no legal recourse when there’s a loss of funds.

Future of yield farming

Yield farming has already seen major changes over the last few years, with a more complex ecosystem developing around the initial applications launched to facilitate staking liquidity and receiving rewards.

While the practice of earning interest at a higher rate than offered in traditional finance continues, the methodology has grown, and will continue to grow, into new areas. For one thing, environmental sustainability has become more commonly discussed when it comes to yield farming protocols, with many investors now being more discerning when it comes to protocols with high energy consumption.

While we’ve seen many catastrophic security breaches in DeFi over the years, the rate of these breaches has dropped. Hackers stole over $3 billion from DeFi protocols in 2022 compared to $1 billion in 2023, indicating a gradual shift towards better security protection.

Finally, it’s likely that DeFi will integrate more with traditional finance as time goes on. More and more, crypto and DeFi are seen as attractive investment opportunities for mainstream financial institutions as well as retail investors historically interested in stocks and shares. Of course, a major obstacle here is the lack of regulatory clarity and the difficulty in enforcing regulations around DeFi, and this will likely see major change over the next few years as DeFi continues to gain momentum.

FAQs

Who pays interest to liquidity providers?

In yield farming, the whole process is managed by smart contracts that automatically distribute interest to each investor according to the share of liquidity they contribute.

Is yield farming safe?

While yield farming, or crypto farming, is an exciting opportunity to potentially make money in the crypto markets, the process is somewhat technical and involves many risks. Without proper research and a good strategy, liquidity providers may suffer from impermanent losses, rug pulls, smart contract risks, or good old fashion market risk, and end up losing money.

Can anyone become a yield farmer?

Yes, anyone with cryptocurrencies and a web3 wallet can use them to provide liquidity to earn a yield on their digital assets.

What is Total Value Locked (TVL)?

TVL is a term that represents the aggregate funds or total amount of money locked in a DeFi protocol. It’s a metric often used to measure the overall health of the yield farming market and the market share of different DeFi protocols. You can use platforms like DeFi llama, DeFi Pulse, DappRadar, and Dune Analytics to keep track of the TVL of top DeFi protocols.