Gnosis (GNO) Unveil Gnosis Protocol to Maximize Asset Liquidity via Ring Trades

Decentralized finance (DeFi) startup Gnosis on April 15, 2020, announced the launch of Gnosis Protocol, a new decentralized exchange (DEX) that seeks to provide much-required liquidity to the typically illiquid digital assets in the crypto space.

Introducing Ring Trades to Bring Market Liquidity

With a vision to bring increased liquidity to the booming DeFi ecosystem, Consensys-spinoff Gnosis today announced the launch of the Gnosis Protocol. The newly unveiled DEX leverages innovative “ring trades” to maximize digital asset liquidity.

According to the official announcement, ring trades significantly improve liquidity for typically illiquid or “long tail” digital tokens by enabling trades not normally possible on traditional trading platforms.

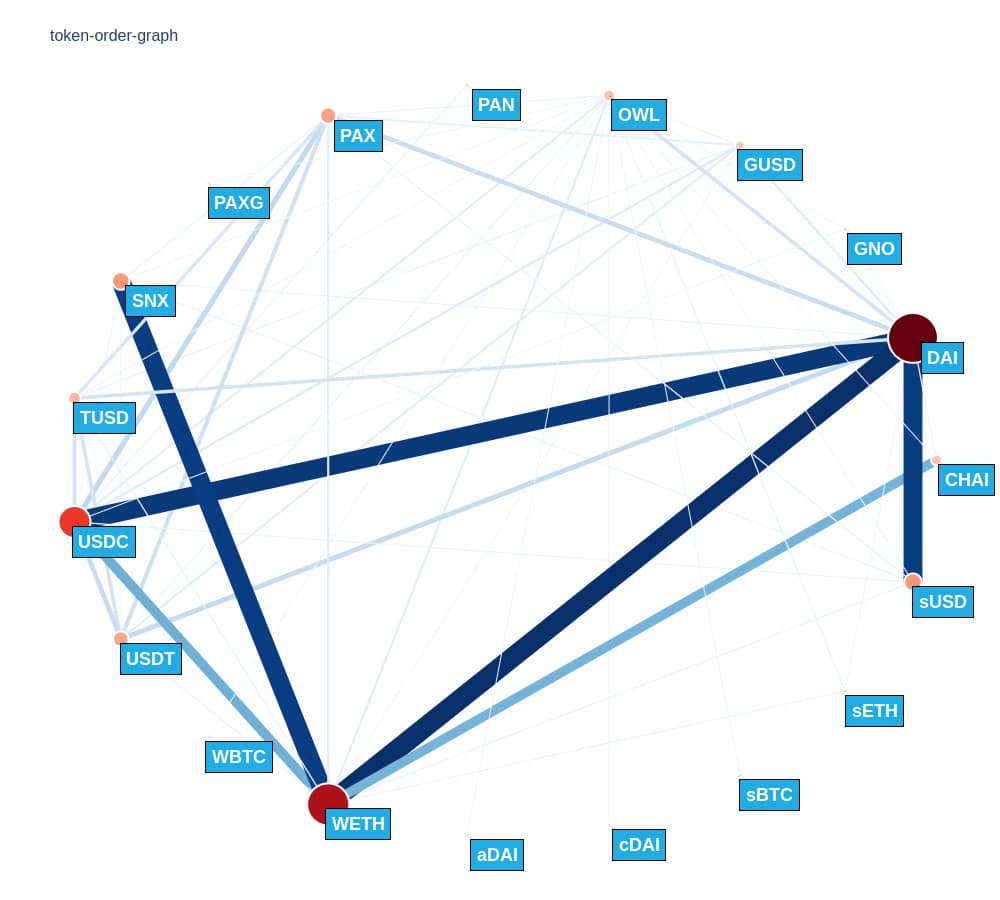

Essentially, ring trades are order settlements that distribute liquidity across all orders placed at a time, rather than a single token pair. This approach to trading will make life easier for traders who struggle to find ready market liquidity for their illiquid assets.

(Source: Gnosis Protocol)

Ring trades trump traditional exchange trades in that rather than matching one buyer with one seller for a transaction at a time, they allow more than two traders with more than two assets to trade and settle their transactions simultaneously.

By enabling convenient trade of illiquid digital assets, the Gnosis Protocol opens a huge door of opportunity for decentralized open finance where an increasing number of assets are getting tokenized with every passing day.

How Does It Work?

Gnosis Protocol stays true to its decentralized business DNA by allowing anyone to list a token on the protocol.

A user can place an order on the DEX for any token pair and set a limit price based on which the order can be executed.

Next, the protocol will bunch all similar orders together into a bundle – or as Gnosis would call it, batches – and search for other users who are willing to settle the transaction in the most efficient manner. To encourage the other users, aka, “solvers” to settle such transactions, Gnosis incentivizes them by promising 50% of the trading fees.

Such batch auctions will last for five minutes, after which the orders that are yet to be settled in the previous batch are passed to the next one, and so on.

Notably, Gnosis Protocol has processed transactions worth over $2 million during its private beta. Now, with the protocol open to all, and the upward trending demand for DeFi trading solutions, the exchange can rightfully hope to increase its business exponentially.