Grayscale updates crypto assets under consideration, most bullish on Maple, Geodnet, and Story

Asset management giant Grayscale has updated its lists of crypto assets under consideration and included in its products, naming Maple, Geodnet, and Story as the projects it’s most bullish on this quarter.

On April 10, Grayscale Investments updated its lists of crypto assets under consideration and included in its products. Among the new additions in the DeFi sector are Mantra (OM), Maple (SYRUP), and Pendle (PENDLE), and Lombard (LMBR).

In the AI and Data Oracles sector, Grayscale has added Sentient (SENT), Prime Intellect (PRIME), and Space and Time (STT). For Smart Contract Platforms, the new assets include Babylon (BABY), Berachain (BERA), Celestia (TIA), and Hedera Hashgraph (HBAR). For Decentralized Identity and Web3, Toncoin (TON), Arbitrum (ARB), TRON (TRX), and VeChain (VET) are now under consideration.

As for the NFTs and Metaverse sectors, Grayscale has added Immutable (IMX), Story (IP), and Aixbt (AIXBT). Lastly, in Utilities & Services, Grayscale has included DeepBook (DEEP), Eigen Layer (EIGEN), and Geodnet (GEOD).

It’s important to note that just because an asset is under consideration, it will become part of Grayscale’s investment products. Whether these assets make it into a product depends on the ongoing evaluations and assessments by Grayscale’s research team. Grayscale aims to update its asset lists as frequently as 15 days after each quarter ends, with the next update scheduled for mid-July 2025.

The projects that go into Grayscale’s Assets Under Consideration list are identified through Grayscale’s quarterly research efforts, where the team reviews a wide range of digital assets to inform adjustments to the FTSE/Grayscale Crypto Sectors indexes.

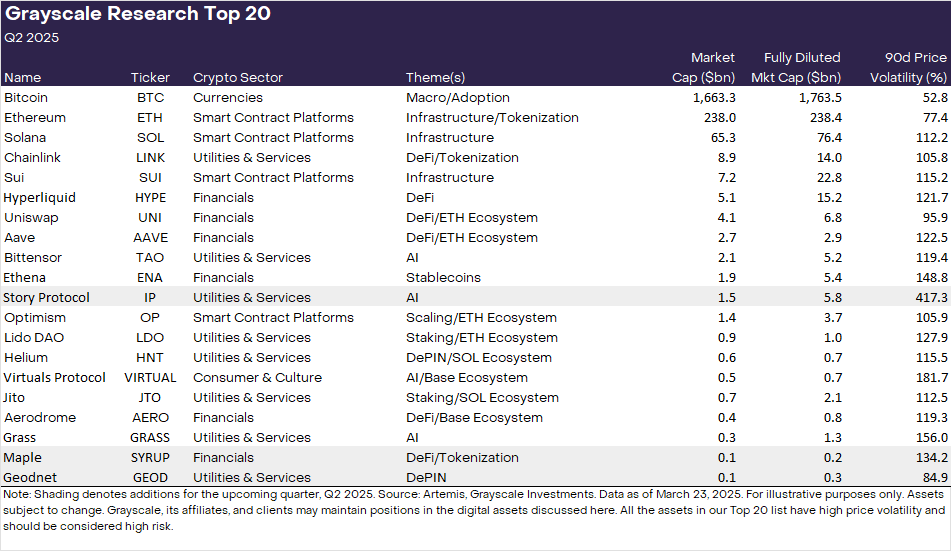

From this research, the team compiles a Top 20 list—a snapshot of projects showing strong potential for growth in the upcoming quarter based on factors such as network growth, potential future developments, the sustainability of underlying fundamentals, token valuation, inflation of token supply, and possible risks.

Over the last quarter, Grayscale Research has observed promising developments at the application layer rather than just the infrastructure layer. This quarter, they’re focusing on tokens that demonstrate practical, non-speculative uses of blockchain technology across three key narratives: tokenization of real-world assets, decentralized physical infrastructure, and intellectual property.

In particular, Grayscale has highlighted Maple, Geodnet, and Story Protocol as projects it’s most bullish on this quarter.