Grayscale’s Bitcoin ETF fund has lost half of assets since launch

The volume of Bitcoins managed by Grayscale Bitcoin Trust has decreased by almost 50% since the conversion to a spot ETF.

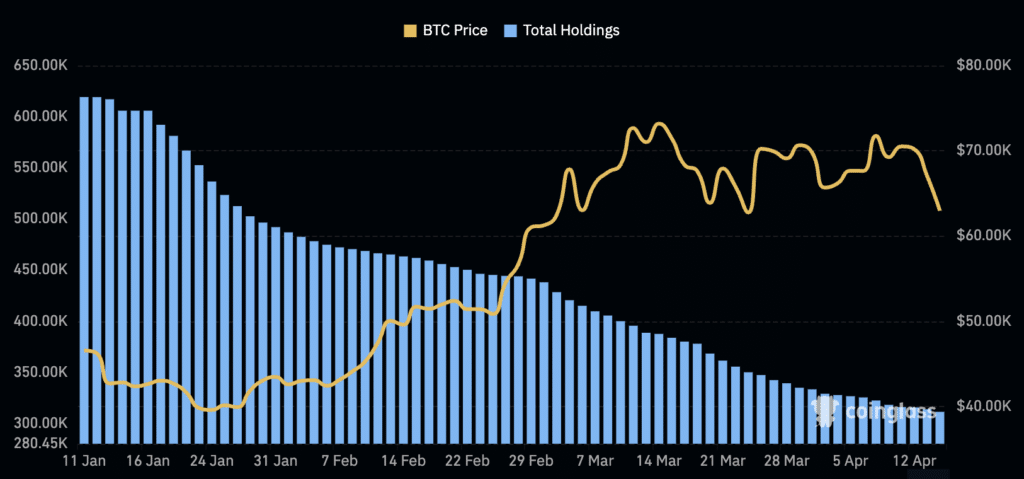

Unlike other issuers such as BlackRock or Fidelity, Grayscale’s investment vehicle launched on the New York Stock Exchange with approximately 619,220 BTC. According to Coinglass, the volume of cryptocurrency in Grayscale Bitcoin Trust (GBTC) had at its disposal as of April 16 has decreased to 311,621 BTC.

Since January, the value of assets under management (AUM) has decreased by only 31% from $28.7 billion to $19.6 billion due to the increase in BTC’s 38% price increase since the Jan. 11 launch.

BlackRock’s spot Bitcoin ETF came close to the leader with $17.2 billion. At the same time, the outflow of funds since the launch of the GBTC convertible fund amounted to $16.38 billion.

BlackRock and Grayscale were the only products that recorded any fund movement on April 15. According to SoSoValue, total net outflows from spot Bitcoin ETFs in the U.S. were $36.67 million.

Despite Grayscale CEO Michael Sonnenshein’s recent statement about stabilizing outflows from GBTC, withdrawals from the fund have continued.