Grayscale’s Bitcoin ETF hits $1.6b outflows hours before halving

Grayscale’s spot Bitcoin ETF continued a five-day outflow sprint leading to the halving, a code change that occurs every four years to help maintain BTC scarcity.

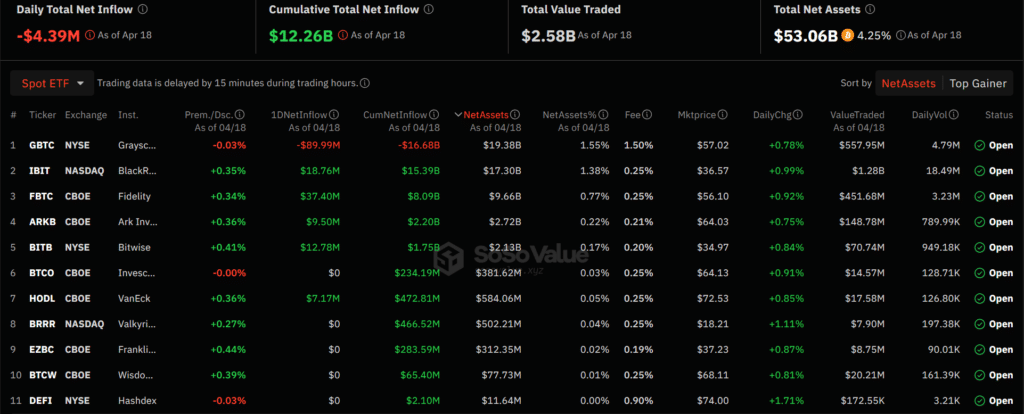

Data gathered by SoSoValue showed $89.9 million in Grayscale exits, bringing GBTC’s total net outflows to $1.6 billion since trading opened back in January.

For all 10 spot Bitcoin (BTC) ETFs, cumulative outflows were recorded as $4.3 million, as Fidelity and BlackRock garnered demand to offset some of GBTC’s liquidations. Fidelity’s FBTC net inflows came in at $37.3 million, outpacing $18.7 million, boasted BlackRock’s IBIT.

April 18 marked a rare occurrence where BlackRock was outclassed by a competitor for inflows in the spot BTC ETF market.

Grayscale AUM down 50% in four months

GBTC may have been the largest spot Bitcoin ETF at launch due to its 10-year headstart, but the BTC-backed investment product has lost huge market share to new players like BlackRock.

As crypto.news reported, GBTC has declined around 50% in assets under management (AUM) in four months of trading. Grayscale had less than $20 billion in AUM, while BlackRock commands over $17 billion in investor demand.

Experts like Bloomberg’s Eric Balchunas attributed swathes of GBTC exits to ongoing bankruptcy proceedings like FTX and Genesis. Other observers have also mentioned Grayscale’s industry-high fund fee of 1.5% as another contributing factor to liquidations.

In response, Grayscale CEO Michael Sonnenshein shared plans to slash GBTC fees “over time.” The company also proposed a Bitcoin Mini Trust ETF to field lower fees and recapture demand in the market.