Here are the biggest losers in the US banking crisis

There was a panic in the financial markets when Silicon Valley Bank collapsed under the pressure of large-scale withdrawals by depositors.

The saga spilled over to crypto via Circle’s USDC, which had reserves at the bank. It lost its peg on the news that it was a customer at SVB. This led to concerns that the stablecoin was no longer fully backed.

However, it was later confirmed that Circle’s reserves were secure, which provided some relief to the markets. Both centralized and decentralized markets experienced turmoil due to the failure of SVB.

U.S. regulators confirmed they took over Silicon Valley Bank (SVB) to quell the panic among depositors and prevent the spread of the crisis in the banking system. This brought back memories of the response to the 2008 financial crisis and the COVID-19 pandemic in 2020.

Within 48 hours, regulators formulated emergency measures to guarantee all deposits held at SVB and crypto-lender Signature Bank. Additionally, the Fed launched a lending facility to support other banks, ensuring the fulfillment of depositors’ demands.

Major cryptocurrency exchanges see a significant decrease in market depth

Market depth refers to the number of buy and sell orders at different price levels, indicating the market’s liquidity level. The decrease in market depth is a significant concern for cryptocurrency traders as it can lead to increased price volatility.

A decrease in market depth can make it more difficult for traders to execute large orders without moving the market price.

According to market data from Kaiko, major cryptocurrency exchanges have seen a substantial decrease in market depth due to disruptions in USD payment channels and the failures of crypto banks.

Coinbase and Binance were hit the hardest, dropping 50% and 29%, respectively. Meanwhile, Binance Global experienced a decrease of 13% in market depth.

The disruptions in USD payment channels and the failures of crypto banks have been recurring issues in the cryptocurrency market, causing concerns about the stability and reliability of the sector.

Circle suffers setback to USDC reserves

In a surprising turn of events, Circle, a financial technology firm, suffered a significant setback to its USDC reserves.

The company recently announced that $3.3 billion, which accounts for 8.2% of its total USDC reserve of $40 billion, is currently stuck in SVB seized accounts. This news has sent shockwaves throughout the financial industry, leading to widespread panic and requests for redemption.

The impact of Circle’s situation has been felt across various exchanges, with some forced to suspend their USDC conversion services. For example, Binance has suspended automatic USDC to BUSD conversions, while Coinbase has temporarily halted USDC to USD conversions.

Robinhood has also suspended USDC deposits and trading. Consequently, the value of USDC separated from the U.S. dollar and hit an all-time low of $0.87 on March 13.

The severity of Circle’s predicament and its ripple effect on the wider financial ecosystem has raised concerns about the stability of the digital currency market. This incident reminded everyone that the cryptocurrency market is highly unpredictable and volatile, despite gaining mainstream acceptance.

The stablecoin sector struggles

The stablecoin sector has been at the center of the carnage. The troubles began with the collapse of terraUSD in May 2022 and have since escalated, with regulators focusing their attention on stablecoins in recent weeks.

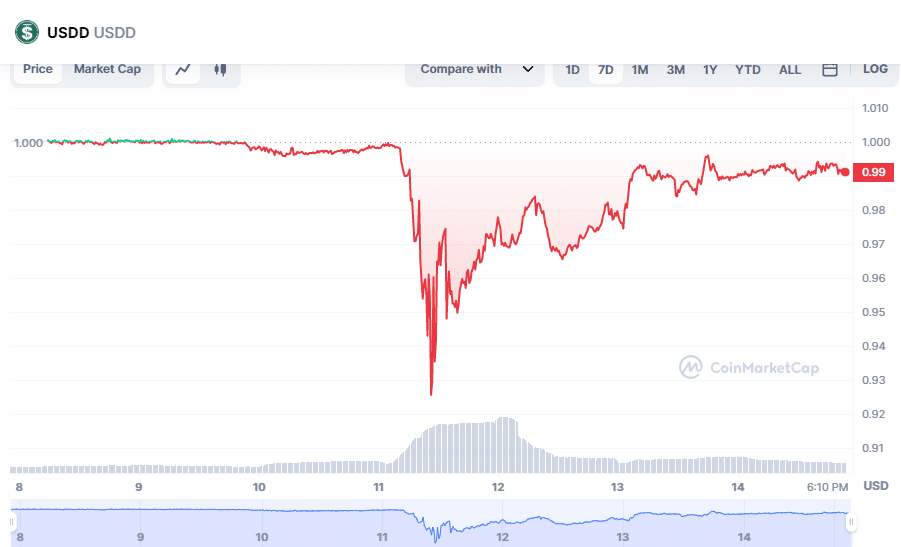

USDD

The USDC peg loss also impacted Tron’s USDD stablecoin. Investors sold their USDD leading it to lose its peg and trade as low as $0.93 at one point on March 11, 2023.

DAI

DAI, partially backed by USDC, traded as low as $0.90. Traders responded by flocking to tether, the world’s largest stablecoin, which has a market value of over $72 billion and is not exposed to SVB. However, concerns about Tether’s business practices and reserves remain.

The market began recovering on March 12 after Circle announced it would cover any shortfall using corporate resources. USDC and DAI have regained ground and are trading closer to their dollar peg.

Although DAI experienced a depegging due to a portion of its reserves being held in USDC, there is a positive aspect to the situation. Circle, the company behind USDC, still has other reserves in place, which means it is unlikely that USDC will completely lose its value.

Furthermore, only around 8% of USDC’s reserves were affected, indicating that the stablecoin is expected to recover and regain its stability.

Finance companies impacted by the U.S. banking crisis

Fears about the possibility of further bank failures after the bank collapses in the U.S. caused a decline in bank stocks. However, other market areas saw an increase in prices as investors hoped that the recent events would prompt the Fed to reconsider its strategy of raising interest rates, which has caused disruptions in the economy.

Western Alliance Bancorp

Despite attempts to reassure investors that other banks wouldn’t be impacted by the same issues as SVB. These concerns proved valid as Signature Bank became the third lender to shut down within a week, following the closure of crypto-friendly bank Silvergate.

The failure of SVB has put pressure on smaller lenders, causing shares in Western Alliance Bancorp to plummet. On March 13, the Arizona-based bank saw an 83% drop in its stock, preceding a 21% decline on March 10.

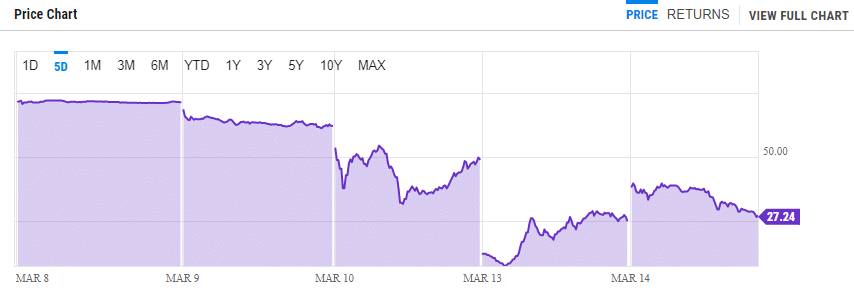

First Republic Bank

First Republic Bank’s stock experienced a significant decline of over 76%, indicating increased investor worries about the bank’s stability in the wake of SVB’s collapse on March 10.

Despite the regional bank’s efforts to address investor concerns regarding its financial health, the shares dropped by 15% on March 10 and plummeted to $19. Trading in the stock had to be paused multiple times due to high volatility.

In a filing made on March 12, it was announced that the company would receive $70 billion in funding from JPMorgan Chase and the Fed’s emergency lending program, which provides one-year loans to banks in exchange for some kinds of collateral.

Commerzbank and Santander

Share prices of banks such as Commerzbank and Santander dropped significantly by 12% and 7%, respectively, causing concerns over the sector’s health.

Despite HSBC agreeing to acquire SVB’s UK arm, the FTSE 100 index in London plunged 2.6%, and other stock markets in Frankfurt, Paris, and Milan faced sharp losses.

Analysts like George Godber, the fund manager at Polar Capital, attributed the market’s decline to investors’ fear of other unknown challenges that could arise. Although banks initially dragged down the U.S. markets, they recovered and closed flat.

FDIC takes over SVB

The FDIC has taken over the SVB to secure the depositors’ money is safe. The FDIC stated that it will make some payments for uninsured deposits by next week, with the possibility of additional payments as the regulator sells off SVB’s assets.

The recent wave of bank failures in the U.S. sparked fear, uncertainty, and doubt (FUD) among cryptocurrency investors, resulting in a significant drop in the prices of various digital currencies, including bitcoin (BTC).

President Biden has come out to calm the situation, saying that all depositors will be paid in full in due course.

The markets responded to the news positively, with major coins like BTC and ETH rallying with over 15% in hours. However, Biden also added that the bank’s investors would not be compensated as they ignored their task of looking closely into how SVB operates.

At the time of writing bitcoin has witnessed a surge in the past 24 hours, and its current price stands at above $24,500. BTC’s market capitalization crossed the $500 billion mark, with a market dominance of 43.7%.

According to recent data, ETH, the second-largest cryptocurrency, experienced a net inflow of approximately $1 billion, with a positive flow of $50.6 million to exchanges.

On the other hand, tether (USDT), the largest stablecoin, had a negative flow of $226.9 million from exchanges, as approximately $1.5 billion worth of USDT was deposited, while around $1.7 billion worth was withdrawn.

Binance coin (BNB) also saw a significant rise in value, with its current trading price at $316.83 and a 24-hour trading volume of $1,316,716,794 . This marks an impressive surge of 13.00% within the past 24 hours and a 7.85% increase over the last seven days.

Keep watching crypto.news for updates on macro-finance, bitcoin, and other crypto-related news.