Here’s why Ripple’s XRP is ripe for a bearish breakdown

Ripple’s token has recovered after bottoming at $0.5078 on Oct. 3 following the announcement of its new US dollar stablecoin.

Ripple (XRP) was trading at $0.5500, bringing its market capitalization to $31.2 billion, making it the seventh-largest cryptocurrency.

Despite this, XRP has underperformed most cryptocurrencies, falling by 6.3% this year. In contrast, Bitcoin (BTC) has risen by 54.4%, while Pepe (PEPE) has surged by nearly 800%.

Ripple has achieved several milestones this year. It was fined just $125 million in its long-running lawsuit with the Securities and Exchange Commission, significantly lower than the $2 billion originally requested.

Ripple also launched its RLUSD stablecoin as it aims to compete with the likes of Tether, Circle, and PayPal. As was reported last week, the stablecoin will initially be available in several platforms like Uphold, Bitstamp, and MoonPay.

Stablecoins are a profitable business model in financial services, as demonstrated by Tether’s earnings. Recent filings revealed that Tether was more profitable than Blackrock, which manages over $11 trillion in assets.

Stablecoin issuers generate revenue by investing their funds in low-risk assets like Treasuries. However, the challenge for new issuers is competing with Tether, which has $120 billion in assets. For instance, PayPal’s PYUSD has only $632 million in assets, making it the ninth-largest stablecoin.

Ripple also introduced XRP Ledger, an open-source blockchain designed to be a better alternative to Ethereum and Solana. Although it initially recorded strong growth, the total value locked in the network has stagnated at around $14.6 million. However, data from Santiment shows that the number of wallets on the chain has increased recently.

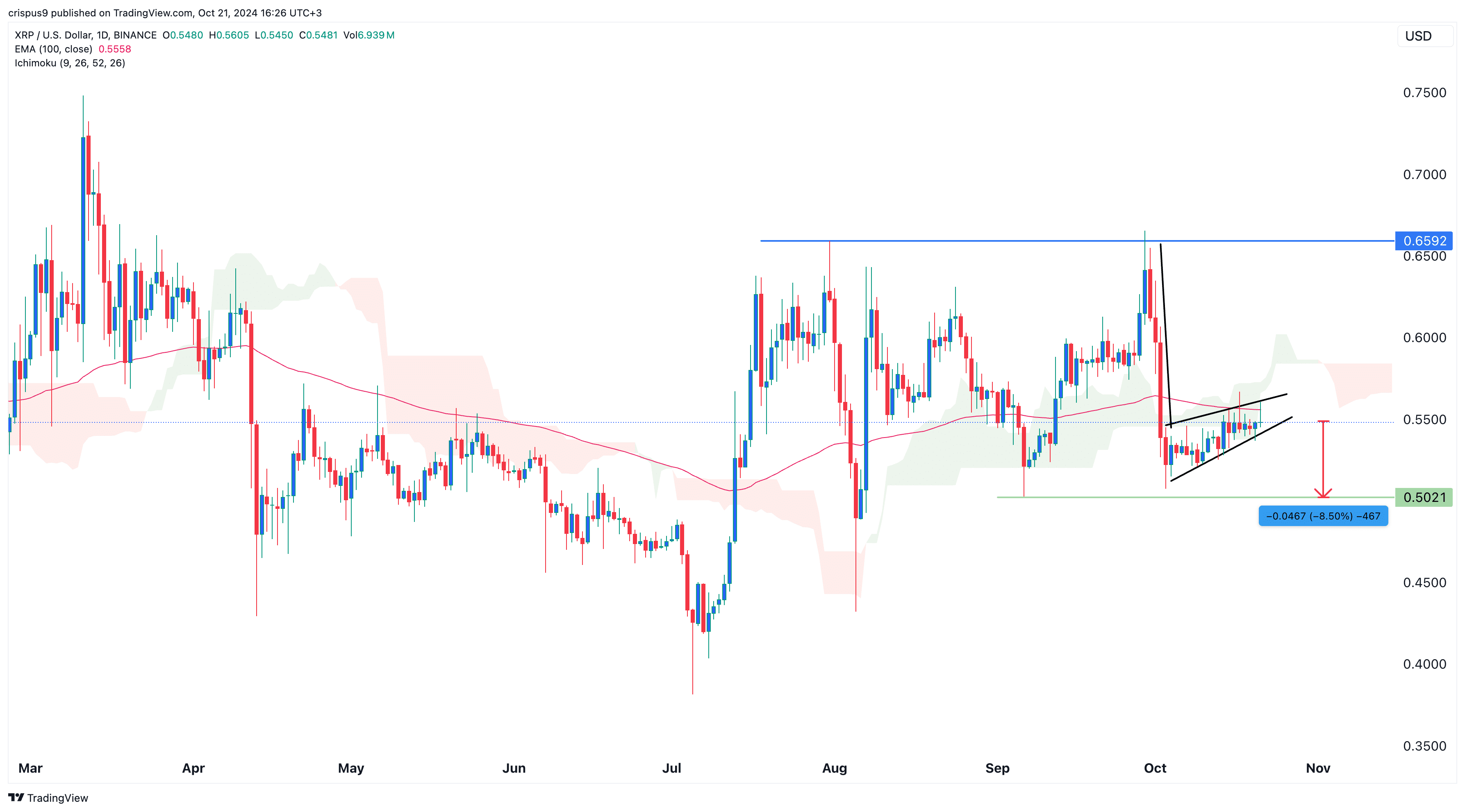

XRP price may have a bearish breakout

Ripple’s token has risen gradually this month. On the daily chart, it has moved below the Ichimoku cloud, a bearish indicator.

XRP has also formed a bearish flag pattern, characterized by a long flagpole and a flag-like pattern. The flag section resembles a rising wedge, another bearish sign.

Ripple remains below the 50-day moving average and has formed a double-top pattern at $0.6592. Therefore, the token will likely experience a bearish breakout in the near term. If this happens, the next point to watch will be $0.5021, the neckline of the double-top pattern, which is 8.50% below the current level.