How Latin America became an important player in the crypto landscape?

Fractured Latin America is turning its attention to cryptocurrencies. What is happening in these countries?

Table of Contents

Review

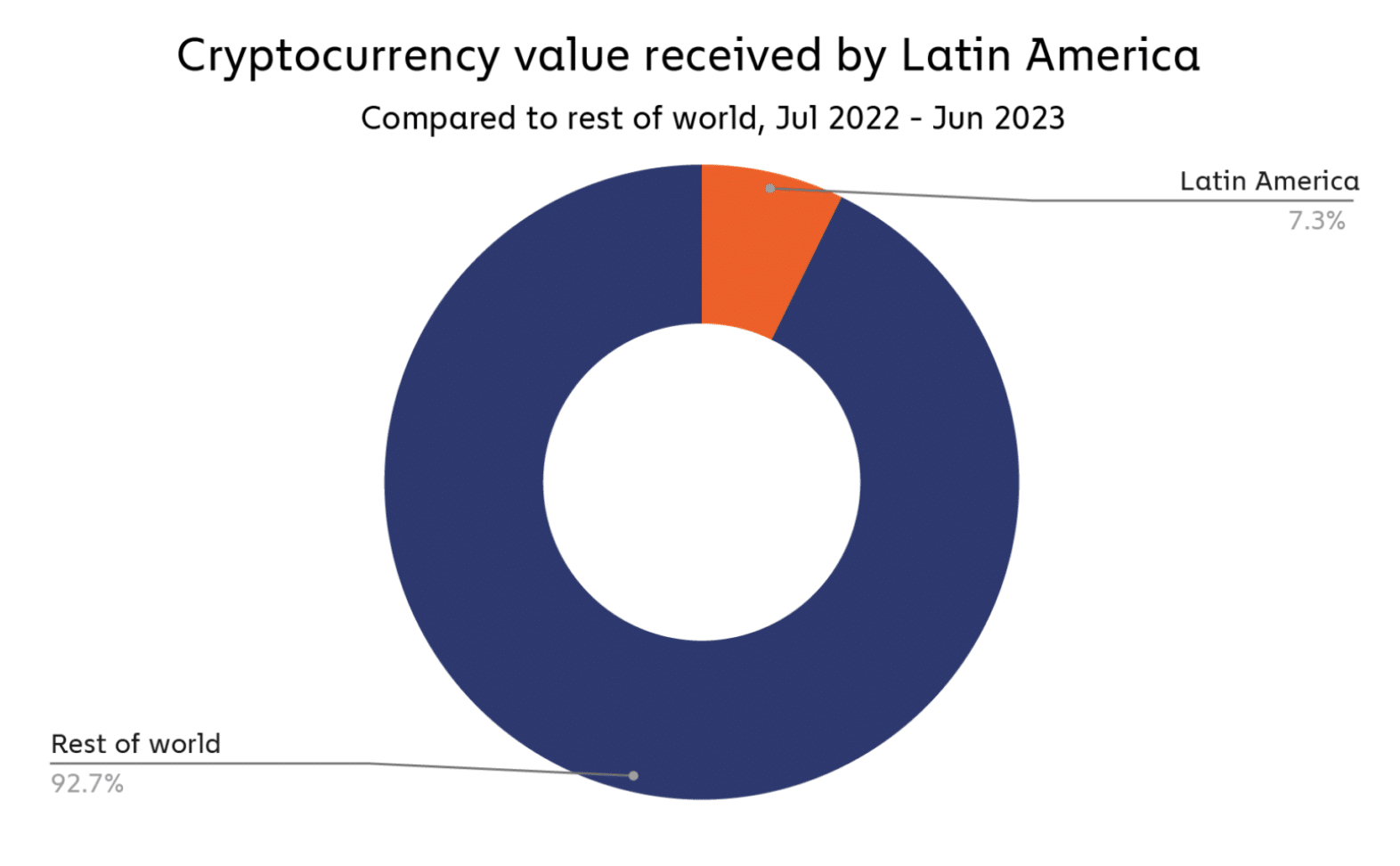

According to Chainalysis research, Latin America is the seventh largest crypto economy globally, accounting for 7.3% of the market. Region residents often use digital assets as a store of value amid the devaluation of national currencies and as a weapon against authoritarianism.

Experts also note that, by the end of 2023, a shift toward mass adoption of blockchain and cryptocurrencies into everyday life is underway, and Latin America is playing a leading role in this. From mid-2022 to 2023, 51% of residents in the region bought various things with digital currencies.

Circle attributes this dynamic to its strong developer base. About a million people in the region are actively involved in offshore development. These developers significantly impact the local market, increasing the value and accessibility of Latin America’s financial sector.

“Taken together, Latin America’s well-established market demand, policy support and widespread dollar usage make the region a natural fit for broader stablecoin adoption.”

Circle research

However, several other reasons contributed to the active introduction or abandonment of cryptocurrencies in Latin America.

The most prominent countries in the implementation of cryptocurrencies: an overview

Significant differences exist in patterns of digital asset use across jurisdictions in the region.

El Salvador

El Salvador is the first country in the world to recognize Bitcoin (BTC) as legal tender. As part of his policy to support cryptocurrencies, the current President of the country, Nayib Bukele, promised to buy one BTC daily.

Now the Latin American state has accumulated more than $300 million in Bitcoin in two years. Bukele does not seem to be planning to sell Bitcoins — he insists that BTC allows for developing tourism, innovation, and the economy.

In addition, El Salvador has launched several cryptocurrency initiatives. These include obtaining citizenship by investing in cryptocurrencies and mining BTC using volcanic energy.

Argentina

Last year, cryptocurrency supporter Javier Milei became President of Argentina. He promised to significantly reduce the public sector of the economy and government spending, combat triple-digit inflation, eliminate the Central Bank, and replace the peso with the U.S. dollar.

He is considered an outspoken opponent of central banks and supports Bitcoin, believing that digital gold’s significant advantage is its limited supply. After Milei’s victory in the presidential election, the Bitcoin exchange rate against the Argentine peso approached a historical high.

Since then, the country has seen an active increase in cryptocurrency loyalty. Currently, the country’s regulation of the digital asset industry is actively moving forward. Thus, in January, the Government of Argentina, headed by the President, decided not to introduce a new tax on previously undeclared cryptocurrencies.

In addition, Argentine regulators are discussing the regulation of Bitcoin and other digital assets with El Salvador’s authorities. The countries plan to create a financial alliance in which Bitcoin will play a key role.

Representatives of the Argentine regulator praised El Salvador’s authorities for creating favorable conditions for using the first cryptocurrency and developing legislation that allows cryptocurrency startups to grow in the country.

Paraguay

In October 2023, Bitcoin miner Sazmining launched the first farm in Paraguay that runs entirely on renewable energy. The miner chose Paraguay because of its vast energy potential and low tariff.

Since then, Paraguay has been actively revising its policy towards Bitcoin miners, offering them more comfortable working conditions. This decision was made after considering a bill to ban mining, which was presented in early April temporarily.

This strategy will allow the state to attract additional funds to finance infrastructure projects without increasing energy tariffs for the population. Thus, Paraguay is softening its policy towards cryptocurrency miners, which may contribute to developing the country’s mining industry.

Brazil

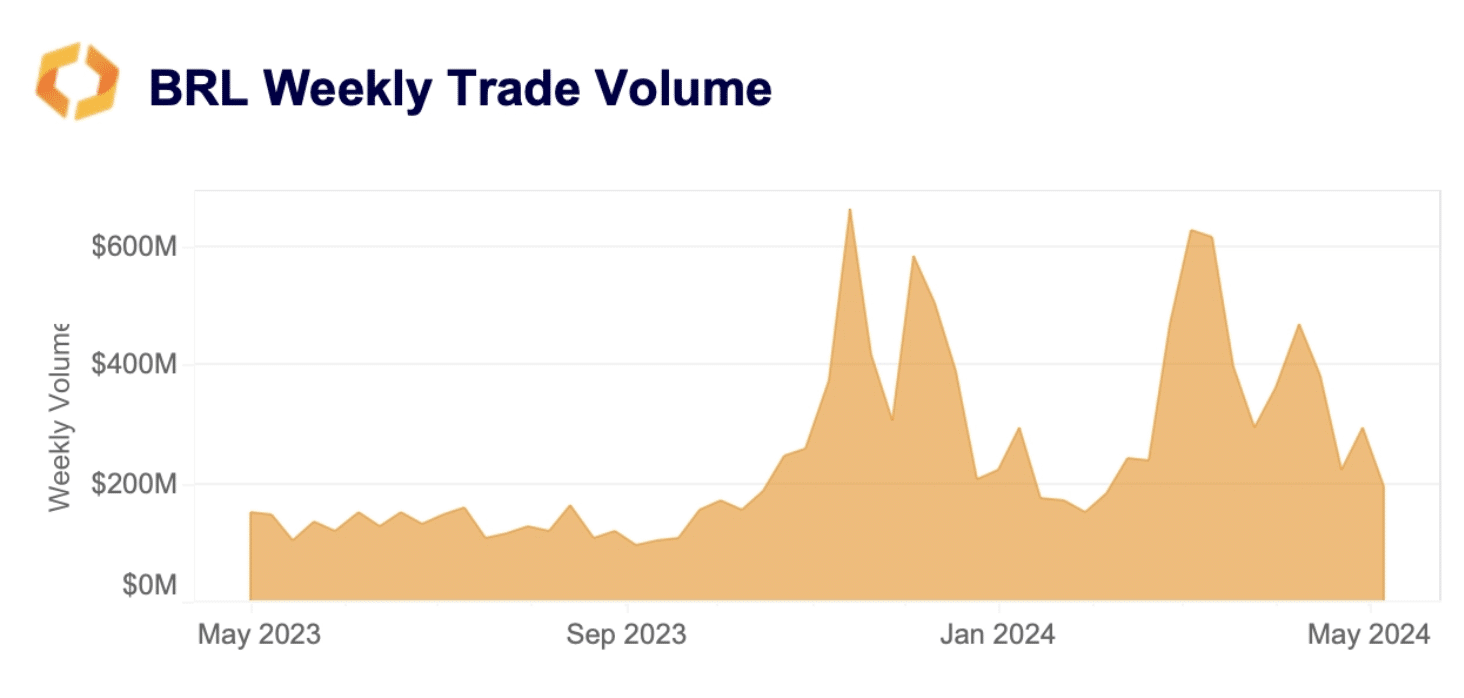

According to Kaiko, digital currency trading volume in Brazil increased by 30% in 2024. In January-April, the volume of transactions with cryptocurrencies exceeded $6 billion. Brazil is seventh in the world ranking of countries in terms of the volume of transactions with cryptocurrencies paired with fiat currency.

Against the backdrop of widespread interest among citizens in cryptocurrencies, the Central Bank of Brazil is actively developing regulation of digital assets. It is expected to be operational by the end of 2024.

The country’s authorities plan to launch a program to introduce the regulation of digital asset transactions gradually. Initially, the Central Bank is implementing a plan to register crypto companies. They must obtain a license and enter a unique database of virtual service providers (VASP).

During the second stage, increased control over transactions with virtual currencies will begin. Particular attention will be paid to the supervision of stablecoins.

Mexico

In 2018, Mexico became the first Latin American country to begin regulating crypto exchanges and other platforms used for transactions with cryptocurrencies.

Chainalysis experts say that Mexico is now the second country in the world regarding cross-border crypto transactions. About $61 billion worth of assets are transferred annually, mainly from the United States.

Updates on the legal regulation of cryptocurrencies in Mexico are needed. However, the country’s authorities are actively working on a digital peso.

“Industry participants will likely be interested to see if that share rises in the coming years, both for Mexico and other Latin American countries with large remittance markets.”

Chainalysis research

The regulator intends to implement functions such as automation and programmability mechanisms with the asset’s help. In 2023, the Bank of Mexico pushed up the timeline for the launch of the digital peso from 2024 to 2025.

Summing up

Ripio CEO Sebastian Serrano admits that Latin America is becoming a center of development for the global cryptocurrency market. Retail investors are showing the most significant interest in tokens. Companies are also gradually switching to this instrument, which allows the free movement of capital worldwide.

Thus, the use of cryptocurrencies in Latin America will increase in the coming years. Brazilian importers are already using virtual currencies to pay for Chinese suppliers of goods.