Huobi’s HT token drops amid layoffs and insolvency reports

Huobi’s native token plunges, as the reports across crypto media and crypto Twitter hint at layoffs and potential insolvency.

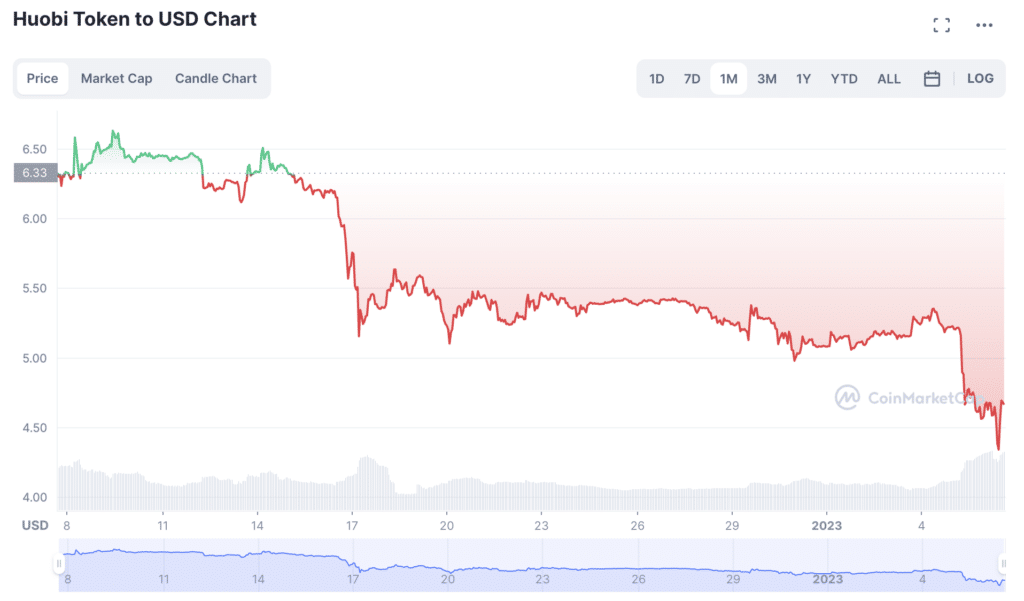

HT price down 30% in one month

Data from the crypto ranking website CoinMarketCap shows the price of Huobi’s HT token has decreased by 9% over the last seven days. In the last 30 days, the token’s value decreased by about 30.4%.

In a recent tweet, crypto stats website CoinGecko attributed the drop in HT’s price to reports that the Seychelles-based Huobi had shut down internal staff communication channels and insisted employees take their salaries in stablecoins.

Salaries in stablecoins

Huobi’s demand for employees to accept salaries in stablecoins was also confirmed by Chinese blogger Colin Wu. He wrote that Huobi’s human resources department had communicated with the employees, asking them to change their salary from cash to USD Coin (USDC) or Tether (USDT). Those who failed to heed the new instructions were allegedly liable for dismissal.

Other Twitter users claimed that the crypto exchange had blocked employees’ access to company communication channels, raising concerns of an internal rebellion that could allegedly lead to Huobi programmers creating backdoor Trojans on the platform.

Huobi reacts to the FUD

Tron founder and Huobi advisor Justin Sun previously denied the rumors of internal strife, including the prior reports on Huobi cutting off yearly bonuses. On Jan. 6, he urged his Twitter subscribers to ignore the FUD and keep building.

However, his optimism comes in late, as Huobi’s official spokesperson has already confirmed layoffs to Reuters, citing bear market conditions:

“The planned layoff ratio is about 20%, but it is not implemented now. With the current state of the bear market, a very lean team will be maintained going forward.”

Huobi to Reuters

Concern has also been growing over Huobi’s post-FTX reserves’ quality. According to a recent analysis from CryptoQuant, Huobi uses its own token to denominate the majority of its reserves, which many analysts consider a red flag.