Institutions hold $13b of Bitcoin ETF shares

U.S. Bitcoin exchange-traded funds have captured institutional demand after legacy firms initially expressed skepticism toward Wall Street’s new crypto asset class.

American institutions have acquired $13 billion worth of spot Bitcoin (BTC) ETF shares since trading opened in January, CryptoQuant CEO Ki Young Ju said on Oct. 22 via X. Citing Form 13F filings, a quarterly document wealth managers use to disclose U.S. equity holdings, Young Ju noted that 1,179 institutions have amassed 193,064 BTC in 10 months.

Traditional finance juggernauts like Millennium Management and Jane Street control 20% of $65 billion, or 961,645 BTC, spread across 11 spot Bitcoin ETFs issued by BlackRock, Bitwise, Grayscale, and Fidelity, among others.

The growing institutional adoption of spot BTC ETFs indicates that the initial aversion to Bitcoin-related funds was brief. Experts like Bloomberg’s Eric Balchunas and James Seyffart have often said asset managers slowly adjust to new products.

Less than a year after launching, a BTC product offered by BlackRock became the fastest-growing ETF in U.S. financial history. Data also showed BlackRock’s IBIT recorded the third-largest inflows, rivaling ETFs that have been around for over 20 years.

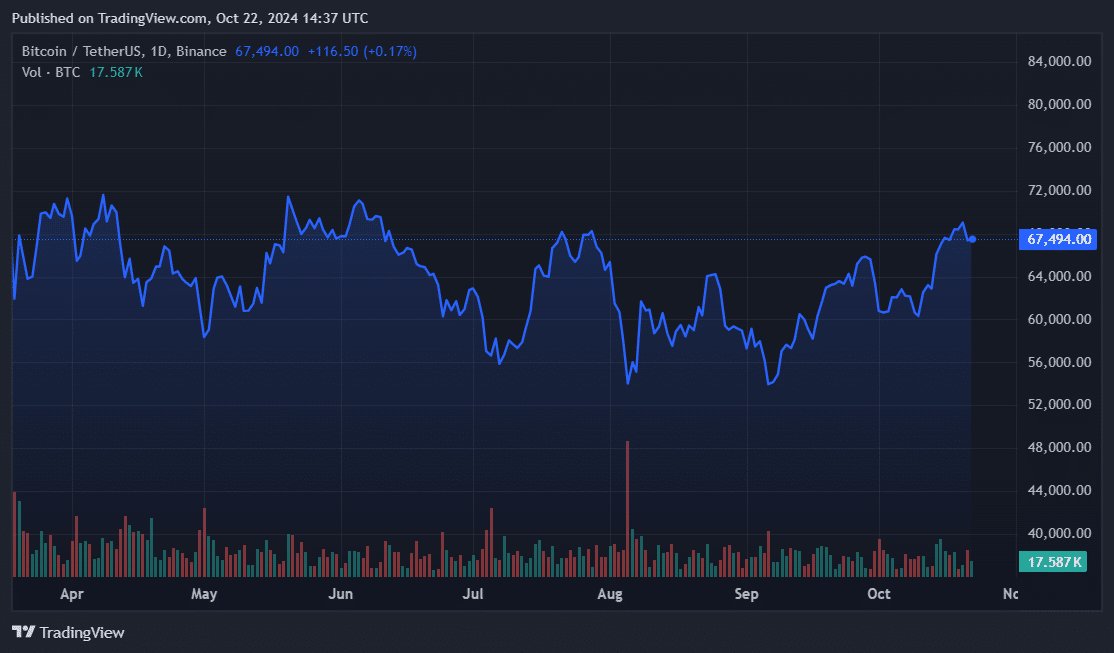

Analysts have singled out spot BTC ETF demand, especially in the U.S., as a major catalyst for Bitcoin’s expected price rally. One BTC cost around $67,000 at press time, as a market-wide correction slowed the asset’s recent surge.

Firms like QCP Capital believe short-term volatility may affect BTC and digital asset markets leading into the U.S. presidential election. However, researchers predict that price swings will ease, and historical patterns will repeat. General market sentiment suggests that Bitcoin will trade above $100,000 by early 2025, and BTC evangelists like MicroStrategy’s Michael Saylor foresee a $13 million Bitcoin by 2045.