Investing in Cryptocurrency with Index Tracking

Index tracking is a trading/investment strategy whereby an investor tracks a broad market index or a segment thereof. An approach like this involves investment in all of the securities within an index, or a representative number of them. Index tracking is often favoured by passive investors, who prefer maximising long-term returns by keeping trading or value investing to a minimum. By holding securities long term, investors avoid fees and performance drag associated with excessively frequent trading.

This type of strategy ditches the idea of cherry-picking securities based on the investor’s belief in their potential for success, and is instead designed to follow a set index. For cryptocurrencies, common indexes to follow might be coinmarketcap, CoinGecko, or WorldCoinIndex. The idea is that an investor tracks the top N coins by market cap in their portfolio, irrespective of their opinions or beliefs about their individual merits.

Why Index Tracking?

Due to the fast-moving decentralized economy, price volatility is high, presenting high risk for traders and investors alike. By dispersing capital across an array of coins, you are essentially hedging against the looming potential for value loss in digital assets. Many crypto traders claim that they make reliable, persistent returns by making using of index tracking.

Additionally, by removing emotion and opinions from the equation, we reduce the probability of finding ourselves in an unproductive and indecisive mindset whilst investing.

How?

There are two ways that you can carry out index tracking with cryptocurrencies. You can use a digital assets management platform, such as Iconomi, to invest and manage in cryptoassets, or you can do it all manually. In this post, we’re going to discuss manual index tracking; we are then open to discretion about rules and weighting.

The general steps are as follows:

- Allocate some funding towards index tracking. For the sake of example, we’ll allocate $1000.

- Decide which cryptocurrencies you want to track. Again, for the sake of example, we’ll say that we want to track the top 10. This leaves us with $100 to allocate to each of the top 10 currencies.

- Add weightings to each currency based on discretion. If we think that a particular currency has no long term performance potential, we underweight it. If we are very confident in a particular currency, we overweight it. However, we do not explicitly deny a currency entrance to our portfolio; the general idea is that we are not value investing, but are more broadly tracking a market index.

Using three month’s worth of historical snapshots from coinmarketcap.com, we are going to see how index tracking would work and the types of returns we would get. A few important guidelines for success with index tracking cryptocurrencies are listed:

- Bitcoin will comprise the bulk of our portfolio. The reasoning here is very simple; historically, BTC has seen stable growth, particularly in the last few years. Additionally, Bitcoin dominance remains high at around 47 percent as of early August 2017. Bitcoin continued success is likely, so unquestionably it is a sober investment.

- We do not neglect coins because we don’t have faith in them. Even if you are completely opposed to the ideologies behind a particular coin, market growth more often than not signals a good investment.

- We rotate our assets at a pre-defined frequency. For instance, we might rotate the coins on a weekly, bi-weekly or monthly basis.

May 2017

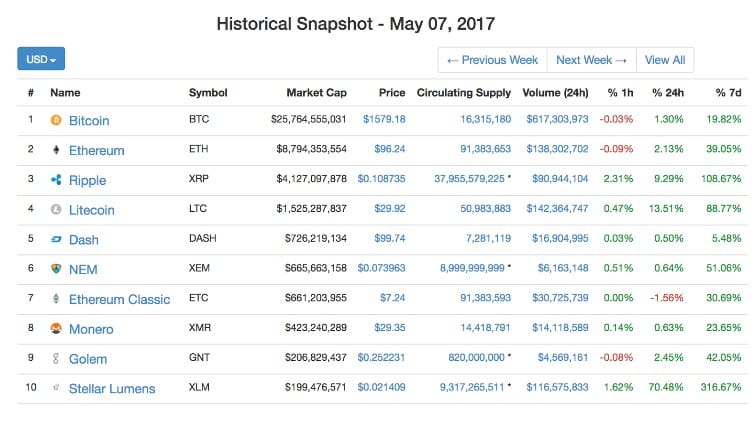

The screenshot below depicts the top 10 cryptocurrencies as of May 7, 2017:

Recall that we have $1000 to play with. The sum of the market caps here is $43.09 billion, which made up 90 percent of the asset class’s market cap. If we weight our investment based on market cap, it means that we should invest according to the table below:

Recall that we have $1000 to play with. The sum of the market caps here is $43.09 billion, which made up 90 percent of the asset class’s market cap. If we weight our investment based on market cap, it means that we should invest according to the table below:

| Coin | Portfolio Makeup |

| BTC | 53.9% |

| ETH | 18.4% |

| XRP | 8.6% |

| LTC | 3.2% |

| DASH | 1.5% |

| XEM | 1.4% |

| ETC | 1.4% |

| XMR | 0.9% |

| GNT | 0.4% |

| XLM | 0.4% |

We are free to weight these percentages based on our attitudes towards particular coins, perhaps cross referencing GitHub or CoinGecko for example. If we are particularly bullish on ETH, we could increase the 20.4 percent to a higher 30 percent, at the expense of decreasing weighting for some other coin. Weighting our portfolio based on the market caps of the largest coins stands as a very effective investment guideline.

June 2017

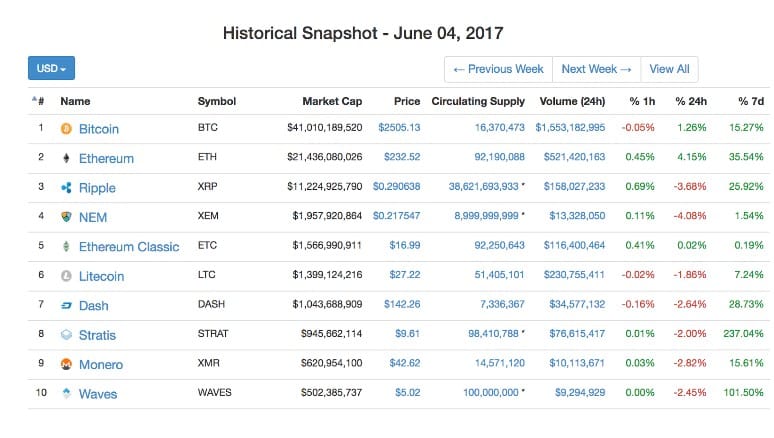

If we had followed through with this strategy (assuming we made no modifications to the weightings based on attitudes), we can calculate the returns we would have made. Nearly a month later, on June 4 2017, the market was looking like this:

Some of the coins we would have bought in May have now been displaced by other coins. For instance, Stratis is now in the top 10, and Stellar Lumens is not. With index tracking, we rotate our portfolio to reflect the top coins by market cap. In this case, we would trade our GNT and Stellar Lumens in our portfolio for Waves and Stratis.

Some of the coins we would have bought in May have now been displaced by other coins. For instance, Stratis is now in the top 10, and Stellar Lumens is not. With index tracking, we rotate our portfolio to reflect the top coins by market cap. In this case, we would trade our GNT and Stellar Lumens in our portfolio for Waves and Stratis.

The only coin that had a net decrease in value over this month was Litecoin; all other coins saw a rise in price. With these securities, we would have made returns of about $700-800 from our initial investment. There are two ways we can calculate these returns:

- Consider our investment to be a proportion of the market cap. As the market cap increases, our share increases in value. We take the ratio of the market cap now to the market cap before and multiply it by the initial investment in that security.

- Consider the coin costs and the number of coins we bought. This is more accurate, since it doesn’t account for circulating supply.

Continuing on, we trade our GNT and Stellar Lumens for Waves and Stratis. Our new portfolio reflects the top ten shown in the index above.

Including our returns from the previous month, we now have around $1700 to invest with. Weighting by market cap again means that we should invest in the following proportions:

| Coin | Portfolio Makeup |

| BTC | 50.2% |

| ETH | 26.2% |

| XRP | 13.7% |

| XEM | 2.4% |

| ETC | 1.9% |

| LTC | 1.7% |

| DASH | 1.3% |

| STRAT | 1.2% |

| XMR | 0.8% |

| WAVES | 0.6% |

We change our portfolio to reflect this by rebalancing our coins.

July 2017

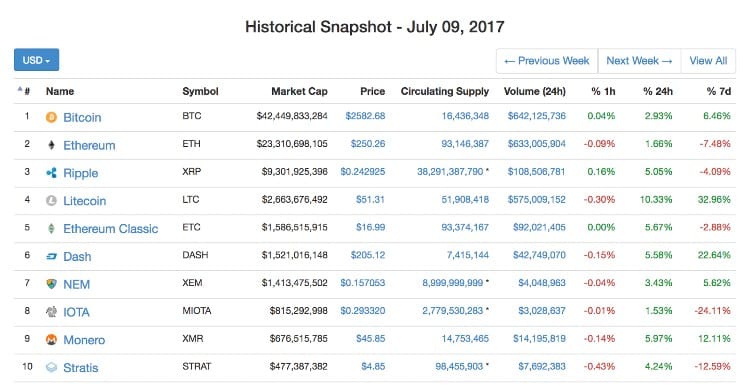

In early July, the market looked like this:

Again, almost all of the coins in our portfolio managed to retain their positions in the top 10, with the exception of Waves, which has been superseded by IOTA. July 2017 was a particularly bad month for cryptocurrencies in general, so naturally we did not make significant returns in this period. It is rationalized that there was a crash around this time due to ICOs cashing out and the darknet marketplaces AlphaBay and Hansa being seized, but the actual reason remains entirely unclear.

Still, a loss wasn’t realized. We made a small return of around $40 (calculated by ratio of market cap; give or take), despite the overall bearish trend in July.

Following the index tracking policy into the next month involves swapping out Waves for IOTA. With our rather minor $40 return, our portfolio is now worth around $1740. We rotate our coins and hold them until the next month.

Our new portfolio is below:

| Coin | Portfolio Makeup |

| BTC | 50.4% |

| ETH | 27.7% |

| XRP | 11.0% |

| LTC | 3.2% |

| ETC | 1.9% |

| DASH | 1.8% |

| XEM | 1.7% |

| IOTA | 1.0% |

| XMR | 0.8% |

| STRAT | 0.6% |

August 2017

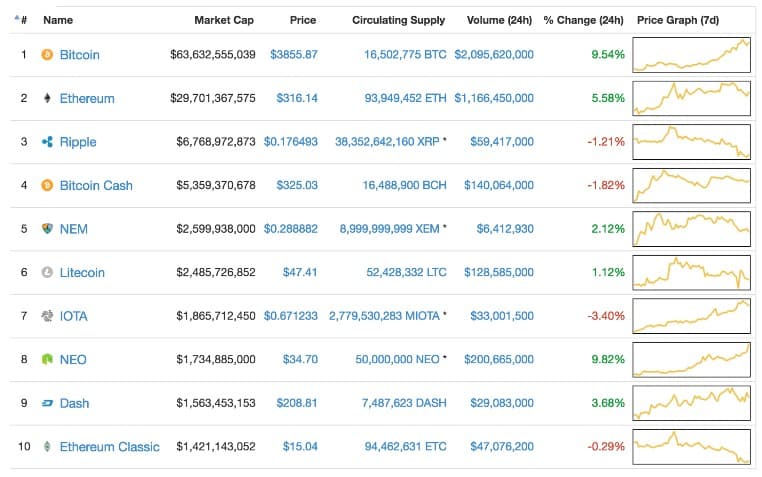

On August 13, at the time of writing, the market looks like this:

August 1 saw the inception of Bitcoin Cash, a hard fork of the Bitcoin blockchain. In short, this fork meant that holders of Bitcoin (who were in control of their private keys) before the fork had an equivalent quantity of Bitcoin Cash. Since hard forks might be considered an anomaly, we will ignore any returns that we made by virtue of Bitcoin Cash. We would have made around $85 from the fork alone (according to the data available in this snapshot and the previous).

Ignoring BCC, we would have made returns of around $550 this month. Early August has seen a significant bull run for BTC with a value increase of over $1000, and some steady growth for coins like Ether had also been observed.

Liquidation

After three months of index tracking, we could liquidate our returns for an attractive $2300; that’s a 130 percent return on our initial investment.

Summary

Some discretion is required for Index Tracking, however, as market capitalization is only a rough measurement. You could also determine the weighting of your cryptocurrency portfolio based on GitHub activity of the top 25-30 cryptocurrencies, or better yet, using CoinGecko’s top ten list instead of CoinMarketCap.com’s. CoinGecko’s list includes not just market capitalization but other factors such as public interest and development activity.

If we would have taken CoinGecko’s rankings into account from the beginning, there would be no good reason to exclude Monero from the portfolio. While Monero has a relatively low market capitalization, it possesses strong development activity and could be argued to be one of the most promising cryptocurrency projects. Although a 100 percent bitcoin holding would have led to greater gains in the example used above, a portfolio with heavier weights on top ranking coins like litecoin and monero would have performed very well over May to August 2017.

In summary, an index-tracking approach (with a touch of discretion) can cut through all of the personal biases that may inhibit you from making money in the cryptocurrency markets.