Investors Eye Bitcoin Again After ‘Tokyo Whale’ Submerges

Amid speculation that a trustee of the now-defunct Tokyo Bitcoin exchange Mt. Gox has contributed to flat or even declining interest in the virtual currency, said trustee has finally stopped selling off Bitcoin to settle creditors. For now, at least.

Bulls Come out of the Gate

Legal practitioner and court-appointed trustee Nobuaki Kobayashi has already sold off around $400 million in bitcoin to reimburse creditors of the once-hopeful exchange.

While there are remaining assets and creditors to settle, the next defraying of debt won’t come about until September 2018, based on the court’s oversight of the process.

For the uninitiated, Mt. Gox filed for bankruptcy in 2014 after a mammoth theft of some 850,000 bitcoins

As the slow roll of court-ordered liquidation proceeds, analysts are predicting that the interim cessation of Kobayashi’s colossal coin dump will aid positive sentiment towards Bitcoin and cryptocurrencies in general.

The CEO of BKCM, Brian Kelly, was quoted as saying that:

“It’s still hanging over but now we’ve got six months or so before that’s an issue. In terms of the Tokyo Whale, it’s a supply issue, but it’s also a sentiment issue.”

News about the Japanese trustee’s sell-off halt has spurred renewed interest from observers who have been enduring severe volatility of the coin. It is anticipated that Kobayashi’s cessation will allow for more robust uptake and an increase in Bitcoin values.

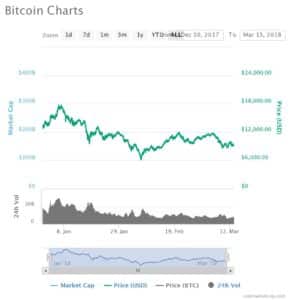

(Source: Coinmarketcap.com)

Others are far less reserved in their appraisal, claiming that Kobayashi’s actions had been directly responsible for wiping around 75 percent of Bitcoin’s value off the map, putting an end to 2017’s meteoric rise of the virtual currency’s value.

All analysts, however, broadly agree that now that he has ceased, a positive sentiment is likely to return and a bull run might well ensue.

An Unpopular Position to Be in

Kobayashi has already sold off around 35,000 bitcoins. He is awaiting regulatory approval to liquidate the remaining 166 million bitcoins, worth approximately $1.55 billion at the price at press time.

Twitter was abuzz with commentary and confirmation of the fact that there will be a lull in such negatively impactful transacting from the trustee.

A managing partner at Doyle Capital Management, Jack Tatar, was broader in his appraisal of the Tokyo Whale’s impact on the market.

“This is just one factor that’s impacting Bitcoin at this point.”

Kelly added that “It’s down 70 percent from top but at some point you run out of sellers. It looks as though the market’s trying to bottom out.”

Without court approval, Kobayashi’s hands are tied and the earliest date for another coin dump seems set for September 2018. The situation at Mt. Gox has “impacted the entire market,” Tatar said, although he pondered “with this off the table, if Bitcoin will rise in price.”

Bitcoin prices were on the upswing as the week began March 12, 2018, rising some six percent from March 9, 2018’s closing price to a new high of $9,885.22.

Although Kelly insists that the coin dump was a significant contributor to Bitcoin’s slump, Tatar sees more contributing factors perhaps masked by the singular event enabled by Kobayashi.

Other news of the possibly successful hacking of a Hong Kong-based exchange alongside a statement issued by the U.S. Securities and Exchange Commission (SEC) about proactively extending its regulatory authority to cryptocurrency exchanges have also dampened spirits.

Some CBOE Bitcoin futures contracts expire on Wednesday, March 14, 2018, and Tatar feels that this could also add to a downward price move on Bitcoin.