Is Polygon a sleeping giant or a sinking ship? Analysis of MATIC’s next move

Is the current bearish trend for MATIC a precursor to a bullish run, or does it signal ongoing struggles? How do experts forecast its next steps?

Table of Contents

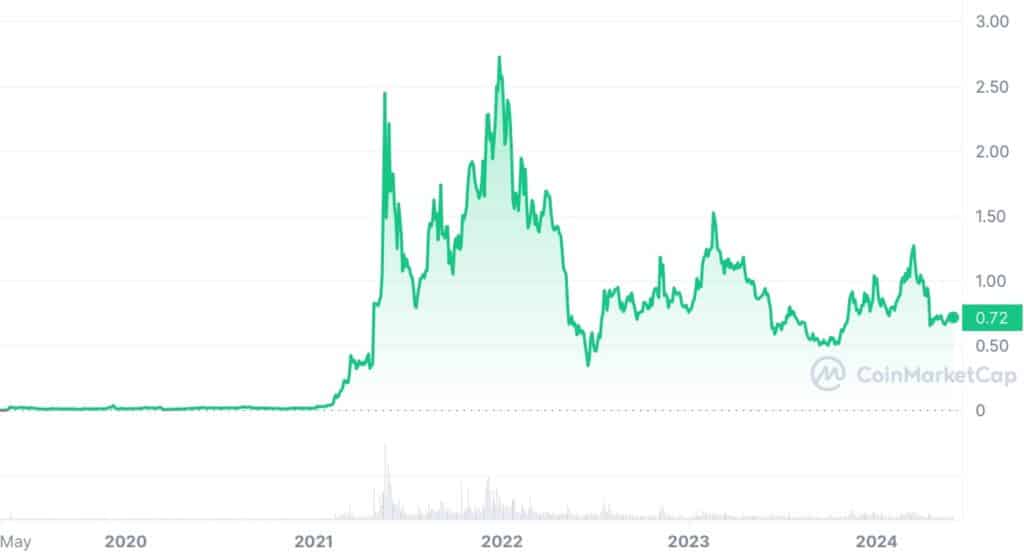

Polygon (MATIC) entered the crypto scene with grand promises. It aimed to tackle Ethereum’s (ETH) scalability issues, offering faster and cheaper transactions through its layer-2 solution. Despite these lofty goals, MATIC has experienced glaring price drops from its all-time highs.

MATIC, which peaked at $2.92 in December 2021, is trading at $0.71, a nearly 76% drop as of May 29. This decline becomes notable given the recent bullish trends in the broader crypto market, where many top cryptos have shown considerable gains.

Meanwhile, Polygon has recently undergone the Napoli upgrade, aimed at enhancing its scalability and performance. However, this has yet to translate into positive price action, with MATIC experiencing bearish trends and large-scale sell-offs by investors.

In this article, we will explore the factors contributing to the underperformance of MATIC, examining whether it is truly “dead” or simply in a phase of consolidation and potential rebound.

How is Polygon (MATIC) performing?

Let’s dive into how Polygon (MATIC) is doing and compare it with its rivals, Arbitrum (ARB) and Base. We’ll explore total value locked (TVL), user activity, transaction volumes, and decentralized applications (dApps) volume.

TVL

TVL is the total amount of money locked in a blockchain‘s smart contracts. Think of it as the total value of assets that people have entrusted to the blockchain. Higher TVL usually means more trust and more use.

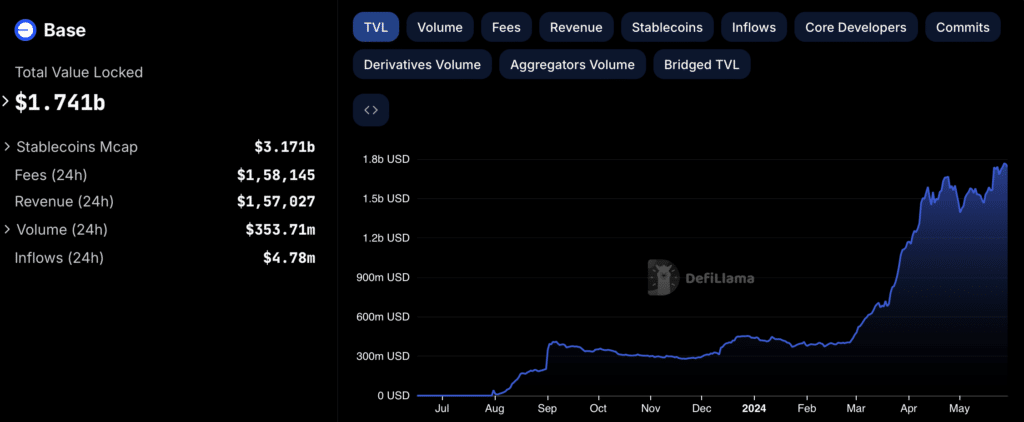

According to DeFi LIama, as of May 29, Polygon has a TVL of $971.38 million, placing it 11th among all blockchains. This sounds impressive, but let’s compare it to its competitors.

Arbitrum leads with $3.12 billion in TVL, ranking 5th, and Base follows with $1.741 billion, ranking 7th. Polygon is quite a bit behind these two. Additionally, Arbitrum and Base have experienced increasing TVL, whereas Polygon has seen a declining trend in its TVL.

Now, let’s compare the market cap to TVL ratio of Polygon and Arbitrum. This ratio helps us understand how the market values the blockchain relative to its TVL.

Polygon’s ratio is 6.93, meaning its market cap is almost seven times its TVL. In contrast, Arbitrum’s ratio is 1.02, indicating a more balanced valuation.

A high ratio for Polygon suggests that while the market is optimistic about its future potential, the actual value locked in the network is relatively low compared to its market cap.

This discrepancy can indicate that investor confidence is based more on speculative future growth rather than current utility and adoption within the network.

User activity and transactions

User activity

User activity is measured by the number of unique active wallets (UAW). According to Dapp Radar, In the last 30 days, as of May 29, Polygon has 6.76 million UAW, placing it 3rd in this category. Polygon’s UAW is higher than Arbitrum’s 5.78 million and Base’s 2.74 million.

A large number of active users generally indicates a healthy and engaged community, which is crucial for the long-term success of any blockchain.

Transaction volumes

As of May 29, Polygon has processed 55.75 million transactions in the last 30 days, which is impressive. Meanwhile, Arbitrum has processed 23.98 million transactions, and Base has processed 19.47 million transactions in the same period. However, let’s look deeper.

DApps volume

DApps are like apps on your phone but run on a blockchain. They drive user engagement and transaction volumes, making them crucial for any blockchain ecosystem.

In the last 30 days, as of May 29, Polygon’s dApps volume is $7.91 billion, which sounds substantial. But when you compare it to Arbitrum’s $30.42 billion and Base’s $8.64 billion, Polygon’s volume looks modest.

Moreover, despite having fewer transactions, Arbitrum’s dApps volume is far higher, and Base’s dApps volume is somewhat higher than Polygon’s.

The above data suggests that transactions on Arbitrum might involve larger amounts or more valuable activities, whereas Polygon, despite its higher transaction count, might be dealing with smaller-scale transactions.

How can Polygon improve its market standing?

- Faster transactions and lower fees: Polygon needs to speed up transactions and lower fees to attract more users. For instance, in the last 30 days, Arbitrum recorded a max TPS (transactions per second) of 532, much higher than Polygon’s 282. Additionally, the average fee on Polygon is around $0.01 per transaction, which is higher than Arbitrum’s $0.001. Lowering these fees and speeding up transactions can make Polygon more attractive.

- Better staking incentives: Offering higher rewards or unique benefits for staking can encourage users to lock their assets. Ethereum 2.0 has successfully used this strategy, attracting a lot of capital. For example, ETH staking platforms like Lido (LIDO) have seen outstanding growth due to attractive liquid staking rewards.

- High-demand dApps: Developing popular dApps can also drive more value into the ecosystem. DeFi applications like decentralized exchanges (DEXs) and lending platforms can attract large amounts of locked assets. Uniswap (UNI) on Ethereum is a prime example, boosting TVL through high transaction volumes and liquidity pools.

- Improved DeFi offerings: Offering competitive DeFi services like lending, borrowing, and yield farming can attract users looking for high returns. Aave (AAVE) is an excellent example of a platform that has attracted billions in TVL through its attractive DeFi services.

- Successful upgrades: Launching upgrades similar to the Napoli upgrade can enhance performance and scalability. These improvements can make the platform more attractive for users to lock their assets.

Mixed sentiments on Polygon: Reddit weighs in

Public sentiment on a Reddit thread about Polygon is a mixed bag, reflecting a range of opinions from optimism about its long-term potential to concerns about its recent performance and market position.

Many users are confident in Polygon’s future despite its recent price dip. They see MATIC as a “sleeping giant” with strong growth potential.

For instance, some users are holding large amounts of MATIC, bought at different price points, and have staked their tokens to earn passive income. Staking MATIC on-chain can yield returns of around 3%, which some users consider a good way to accumulate more tokens over time.

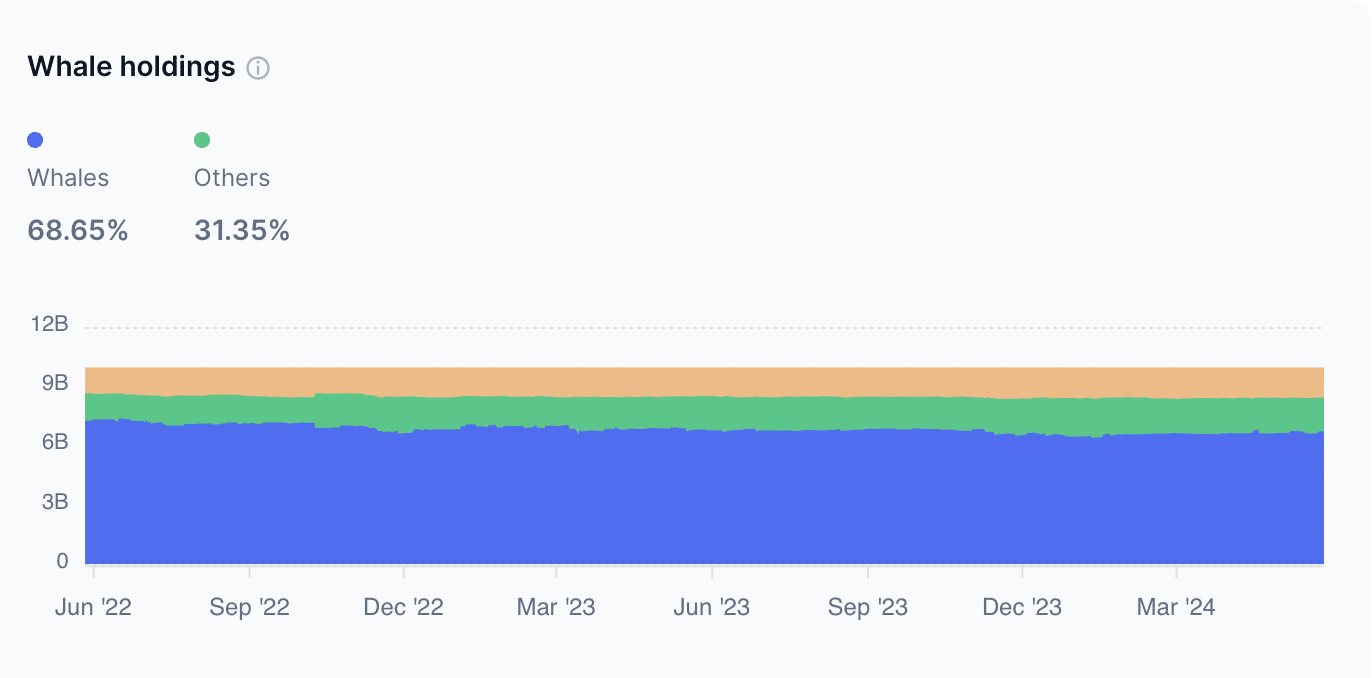

However, there are concerns about Polygon’s recent performance. Some users noted that MATIC has dropped recently while other crypto assets have risen, leading to frustration and skepticism. According to some users, this decline is due to large whale investors periodically dumping their holdings, creating selling pressure and impacting the token’s price.

Meanwhile, comparisons with other blockchains like Solana (SOL) highlight new challenges for Polygon. While Solana has seen a surge in use due to specific applications like meme coin transactions, MATIC, as the fee token for Polygon, hasn’t found a similar retail-driven use case.

Some users also point out that MATIC’s price action is part of its market cycle. They recall that MATIC bottomed out earlier than most other tokens during the bear market, suggesting its current performance might be just a phase.

Others believe that market attention often shifts to newer projects, leaving older ones to either innovate continuously or risk becoming irrelevant.

Overall, most users remain optimistic, viewing the current market as a precursor to an “alts season,” where alternative cryptocurrencies like MATIC could see gains. They believe that once the broader crypto market moves beyond Bitcoin (BTC) and meme coins, attention and investment might shift back to projects with strong fundamentals like Polygon.

What do experts think?

The expert opinions on Polygon are as varied as the public sentiment. Let’s delve into what some seasoned analysts have to say about MATIC’s current and future prospects.

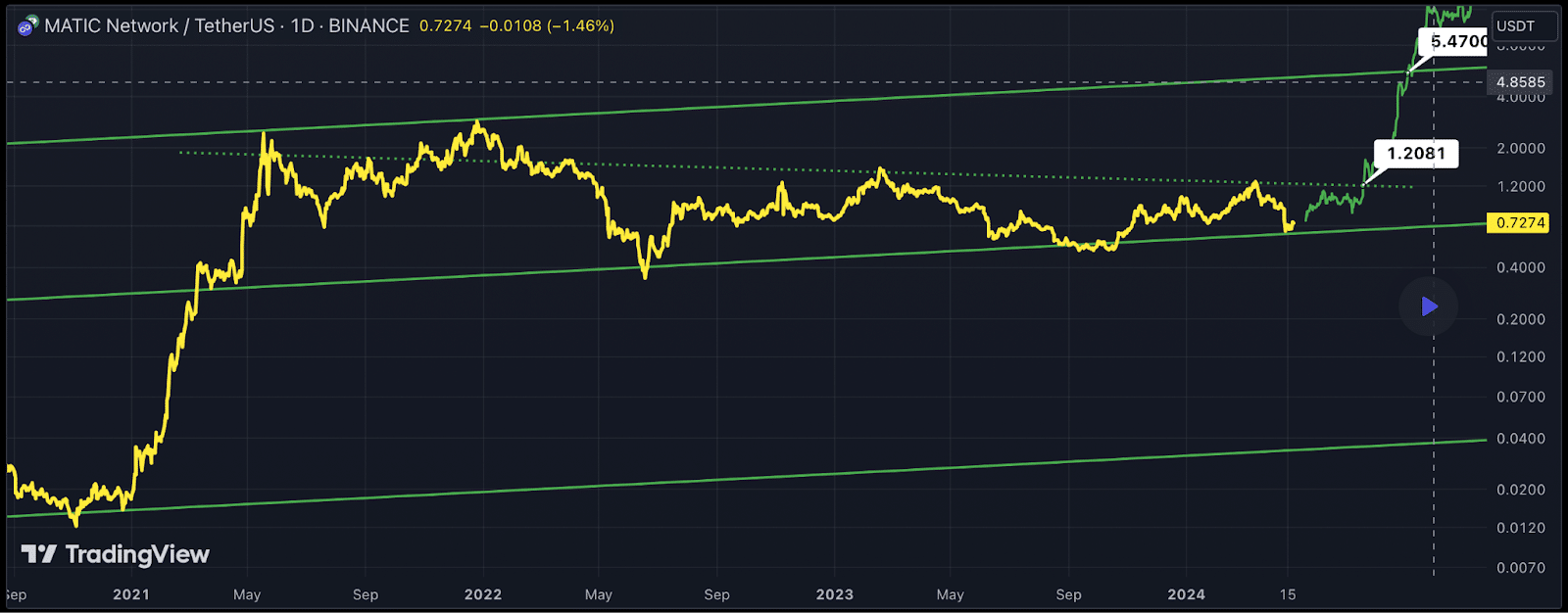

In a recent analysis on TradingView, a well-known crypto analyst named Bixley shared a bullish outlook for Polygon. Bixley pointed out that MATIC’s price is currently on a trend line just above $0.7. This position is crucial because trend lines need to be broken for a breakout to occur.

If MATIC fails to break this trend line, it could result in a bearish downturn. However, Bixley remains optimistic, predicting that MATIC will break through, leading to upward price movement.

Bixley drew parallels between MATIC’s price performance and that of Ethereum in its early days. If this comparison holds true, MATIC could be poised for a substantial increase.

Bixley outlined several target levels in his analysis. The first target is $1.2, representing a 70% increase from the current price. Further targets include $5.4, marking a 650% rise.

However, not all experts share Bixley’s optimism. Another analyst highlighted a concerning pattern: a death cross on MATIC’s weekly chart.

A death cross, where a short-term moving average crosses below a long-term one, often signals bearish trends. This analyst predicts a possible 70% drop, which would plunge MATIC’s price below $0.2.

To add another layer to the conversation, Twitter users have shared their perspectives on MATIC.

One tweet defended Polygon’s position despite its lack of recent gains. This user believes that writing off Polygon due to its current performance overlooks its long-term potential.

Another tweet raised the possibility that we might be witnessing the phasing out of certain altcoins. Historically, each market cycle sees some coins rise dramatically only to fade away, never reaching new all-time highs again.

As always, in the crypto world, you must weigh these diverse perspectives and make informed decisions based on the most comprehensive data available. Always remember never invest more than you can afford to lose.