IVVIA concept: A new path to property ownership through tokenization | Opinion

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

In my previous article on real estate tokenization, I explored how this promising innovation has stalled despite the early excitement around its potential. The truth is that tokenization without a clear economic purpose is doomed to remain a niche concept. We have yet to see the broad adoption we anticipated because the economic rationale just isn’t there.

For years, I’ve advocated for a blockchain estate registry, which would introduce title tokens that directly represent property rights, not just securities or investment claims. While governments have been slow to adopt this idea, I’ve continued to explore how tokenization can serve a real, practical purpose in real estate.

And then it struck me: an innovative approach that merges tokenization with decentralized finance to create a fourth way to acquire property. Something entirely different—what I’ve named IVVIA. Derived from the Latin ‘IV via,’ meaning the fourth way, IVVIA offers a new path for property acquisition.

Introducing the fourth way: IVVIA

We all know the traditional paths to acquiring real estate: cash, mortgages, or leasing. Each of these has its drawbacks. Cash purchases are unattainable for many, mortgages come with long-term commitments and high fees, and acquiring through a lease offers no path to ownership or investment returns. So, what if there was a fourth way that combined the benefits of ownership and investment with the flexibility of tokenization?

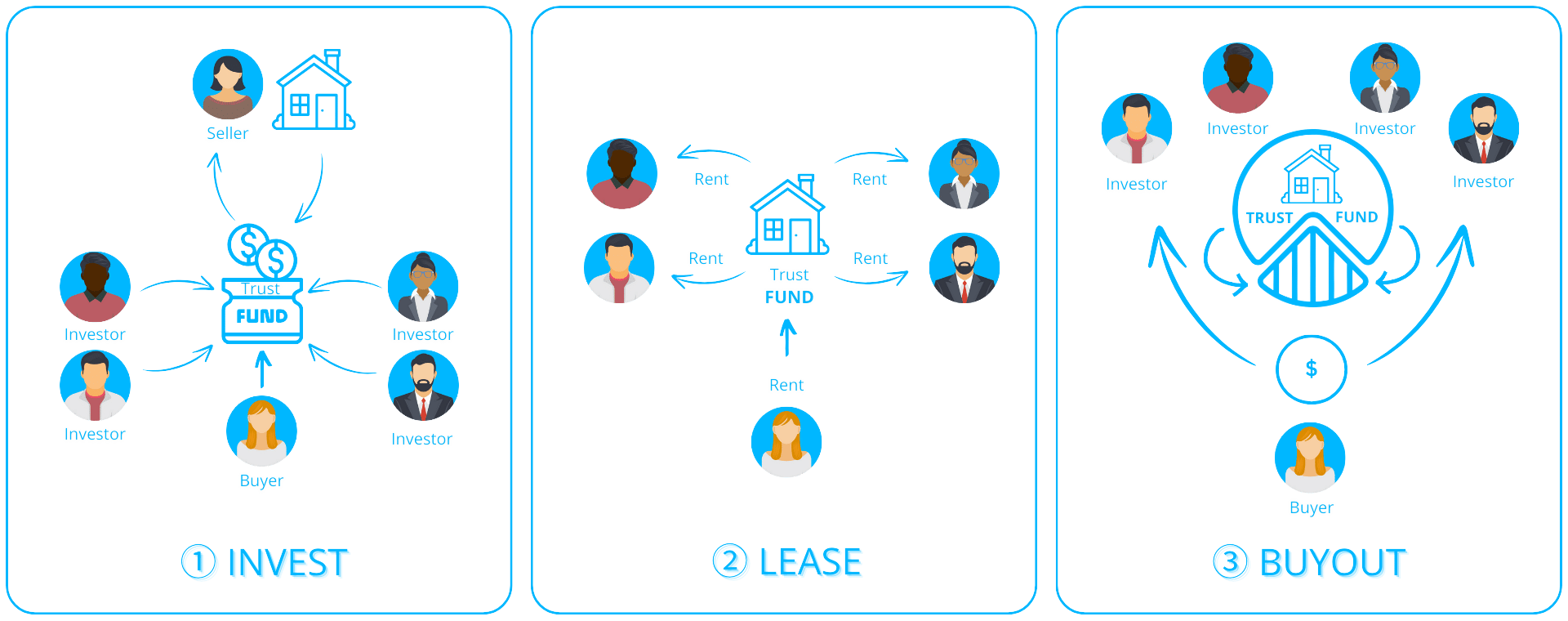

The idea of IVVIA is rather simple—it allows a property buyer, let us call them an “ivviator,” to gradually purchase their home by acquiring tokens that represent fractions of the property. It’s similar to a mortgage in that buyers can make monthly payments, but without the rigidity of a bank loan. Instead, they partner with real estate investors—called “ivviatees”—who hold the tokens. The ivviators buy these tokens over time at market value, much like paying off a mortgage, but with far more flexibility and fewer fees.

Unlike a mortgage, where you’re locked into a 20-year financial agreement, IVVIA lets you buy out tokens at your own pace. If the ivviator (home occupier), say, needs to move to another city, they can sell their accrued tokens at market value and walk away. Investors, on the other hand, enjoy liquidity. They can sell their tokens to the ivviator or on the open market at any time.

The relations are governed by a smart contract, which automates many of the routine transactions, from token sales to monthly rent payments. The beauty of this model lies in its flexibility and transparency, all powered by blockchain.

The economics of IVVIA: A real-world scenario

To test the feasibility of this concept, I turned to two decades of historical market data from the Australian Bureau of Statistics, including information on property prices, mortgage rates, rent, and bank deposit rates. I modeled the potential outcomes for both traditional mortgages and the IVVIA system, and the results were striking.

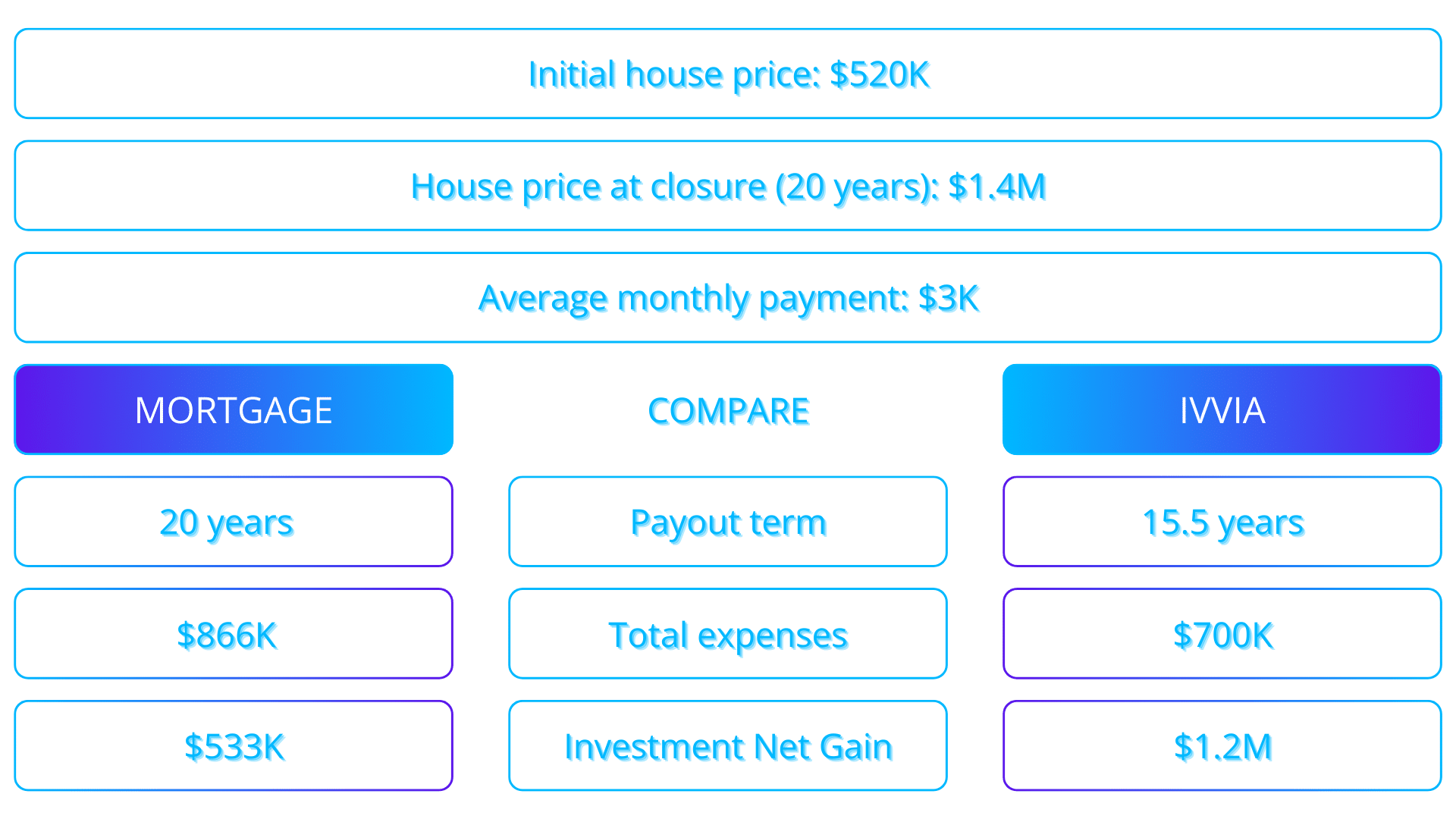

Let’s consider the case of Alice, who, in 2004, bought a two-bedroom house in Auburn, a middle-ring suburb of Sydney, for $520,000. With a 20% down payment of $104,000, she took out a 20-year mortgage at an average interest rate of 6.44%. This meant monthly repayments of $3,175. Over 20 years, her total expenses, i.e., the loan interest and the house price, amount to $866,000. Fast forward to 2024, and the property is now valued at $1,400,000. If Alice decides to sell, her net profit would be $533,000 ($1.4M minus $866K in total costs).

Now, let’s compare this to how things would unfold in the IVVIA system. Instead of taking out a mortgage, Alice partners with four investors—Bob, Chuck, Dave, and Eve—who each contribute $104,000 (equal to Alice’s 20% down payment). They are also typical individual real estate investors, who would otherwise go to the bank. Instead together, they form a unit trust, purchase the house, and tokenize it, with each member receiving an equivalent share of tokens.

In this scenario, Alice continues to pay $3,175 per month, the same as she would have under a mortgage, which we’ll refer to as her Expenditure Cap. However, instead of repaying a bank loan, Alice allocates her monthly Expenditure Cap between renting and buying out her investors’ tokens.

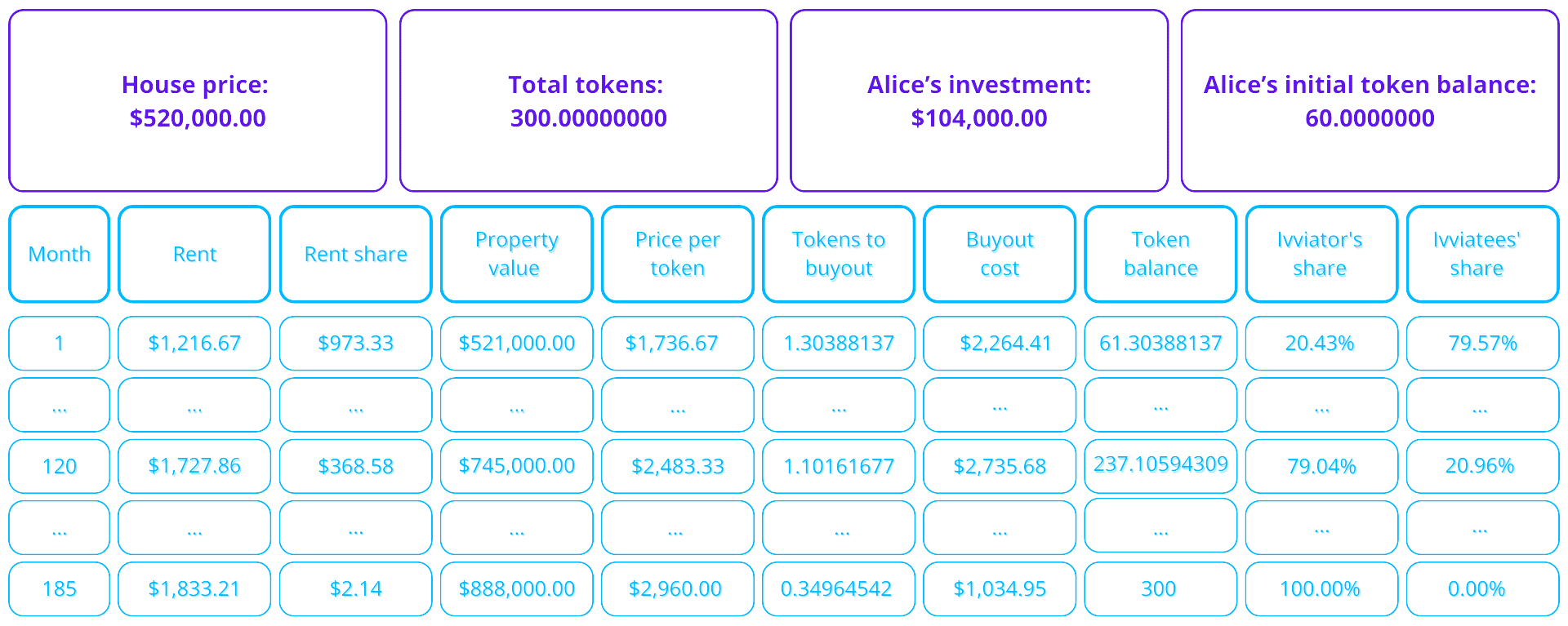

Here’s how it works: Initially, Alice would pay rent to her co-investors based on their ownership of the property. With Alice owning 20% of the tokens, she would pay 80% of the rent to the other investors. Assuming an initial market rent of $1,216 per month, Alice’s share of the rent would be $973 (80% of the total). The remaining $2,202 from her monthly Expenditure Cap would be used to buy tokens from her co-investors, at a price reflecting the current market value of the property.

In the first month, Alice could afford to buy 1.30 tokens at the property’s new value of $521,000, bringing her total ownership to 20.44%. Over time, as Alice’s ownership share increases, her rent decreases. After ten years, she would own nearly 79% of the property, reducing her rent payments to just 21% of the market rent—$368 per month. By this point, the house’s value would have risen to $745,000, and Alice would be buying around 1.1 tokens monthly.

After 15.5 years, Alice would fully own the property, having spent a total of $700,000, including the initial down payment, rent, and token buyouts. This represents a significant saving of approximately $166,000 compared to the traditional mortgage route.

The investor’s perspective

What about investors? The basic scenario for them mirrors Alice’s mortgage. In IVVIA, investors earn profits from both rent and the difference between the initial token price and the selling price, starting the next month after the house purchase, based on their share. A simple calculation shows that an investment of $104,000 could yield a total return of $44,000.

However, to make this comparable to a mortgage, we need to add some conditions. While IVVIA allows investors to receive monthly cash flow, the mortgage, on the other hand, requires some household income to be tied up in monthly repayments for 20 years, effectively locking the wealth into the property’s value. Therefore, to make the comparison fair, we assume Bob, as one of the investors, doesn’t spend his rental profits or token sale income but accrues it, for example, in a bank deposit, similar to how a homeowner accrues equity. After 20 years, this accrual could result in a total of $1,200,000—140% more than $533,000 he would have earned in the traditional mortgage scenario.

From naïve to a real-world solution

While IVVIA represents a real solution to the challenges of real estate tokenization, there are some hurdles to consider. Long-term investments, like those in real estate, can run into legal complications—such as disputes, bankruptcies, or even deaths of the ivviatees. A simple smart contract doesn’t easily resolve these issues.

For IVVIA to scale up, we’ll likely need professional smart contract administrators who can manage the system impartially, handle legal complexities, and ensure compliance with evolving regulatory frameworks. Despite the challenges, the advantages of automation and decentralization still make this a far more efficient system than traditional real estate finance.

Conclusion

The idea of tokenizing real estate isn’t new, but what IVVIA brings to the table is a true economic solution. By merging the flexibility of tokenization with the stability of real estate, IVVIA solves the problem that has held back property tokenization from going mainstream. This isn’t just another blockchain use case; it’s a real change in how we think about property ownership and investment.

IVVIA works because it aligns the incentives of buyers and investors, turning property into a dynamic, tradable asset while offering individuals a flexible path to homeownership. By leveraging smart contracts, DeFi, and fractional ownership, IVVIA could very well represent the future of real estate—a fourth way that might just become the new norm.