JUP sink by 63% amid $700m airdrop and wrong pump scheme

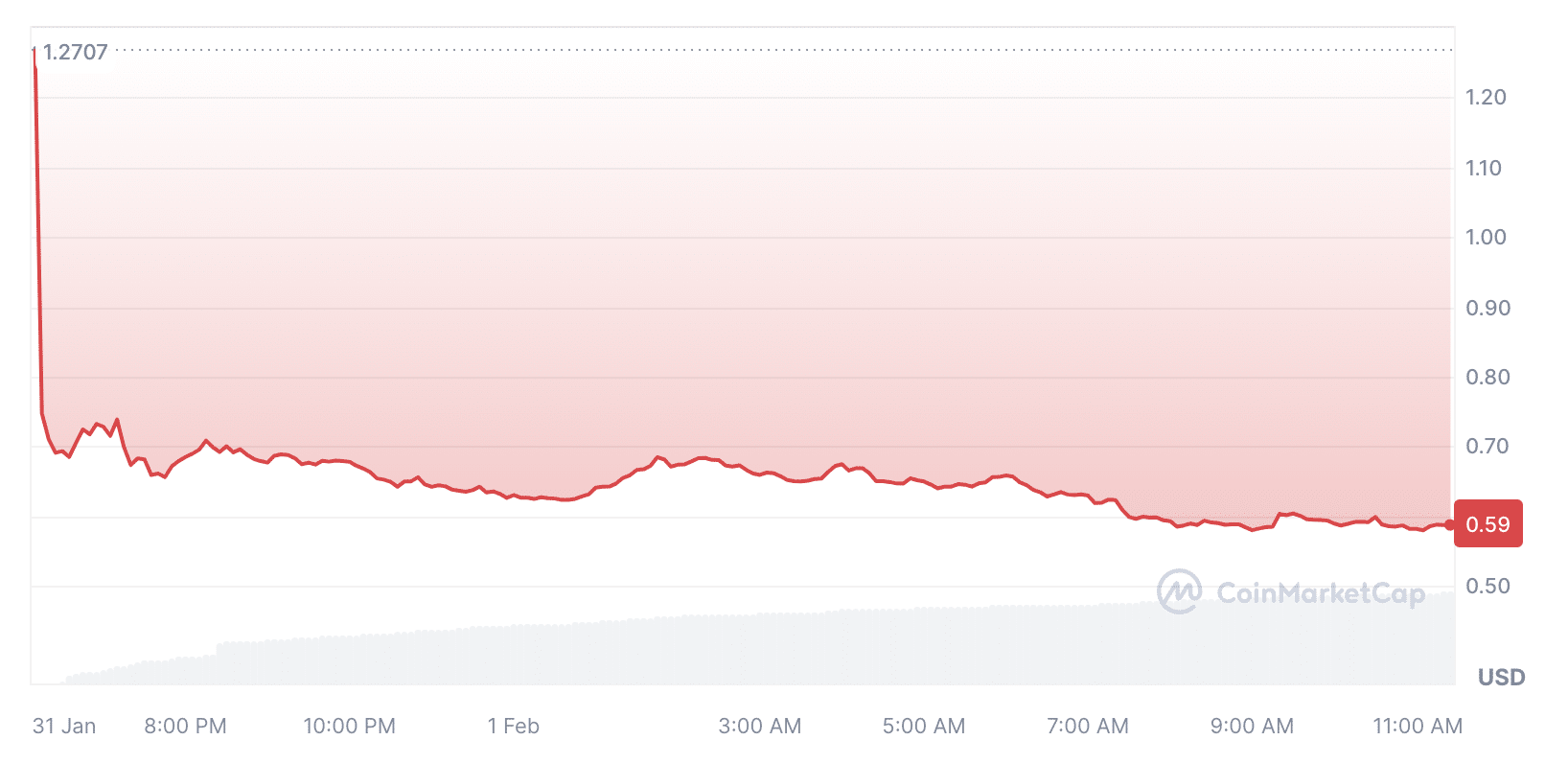

JUP, the native token of Jupiter, a decentralized exchange aggregator on Solana, crashed shortly after listing on centralized exchanges.

According to CoinMarketCap, over the past 24 hours, the token has fallen by 63% to $0.5887. At the opening of trading, JUP was trading at $1.2707.

Major trading platforms Binance, Bitfinex, OKX, and others have registered the token and opened trading. Later, the Binance team announced that Binance Futures will launch Jupiter futures. However, this did not help JUP recover its price.

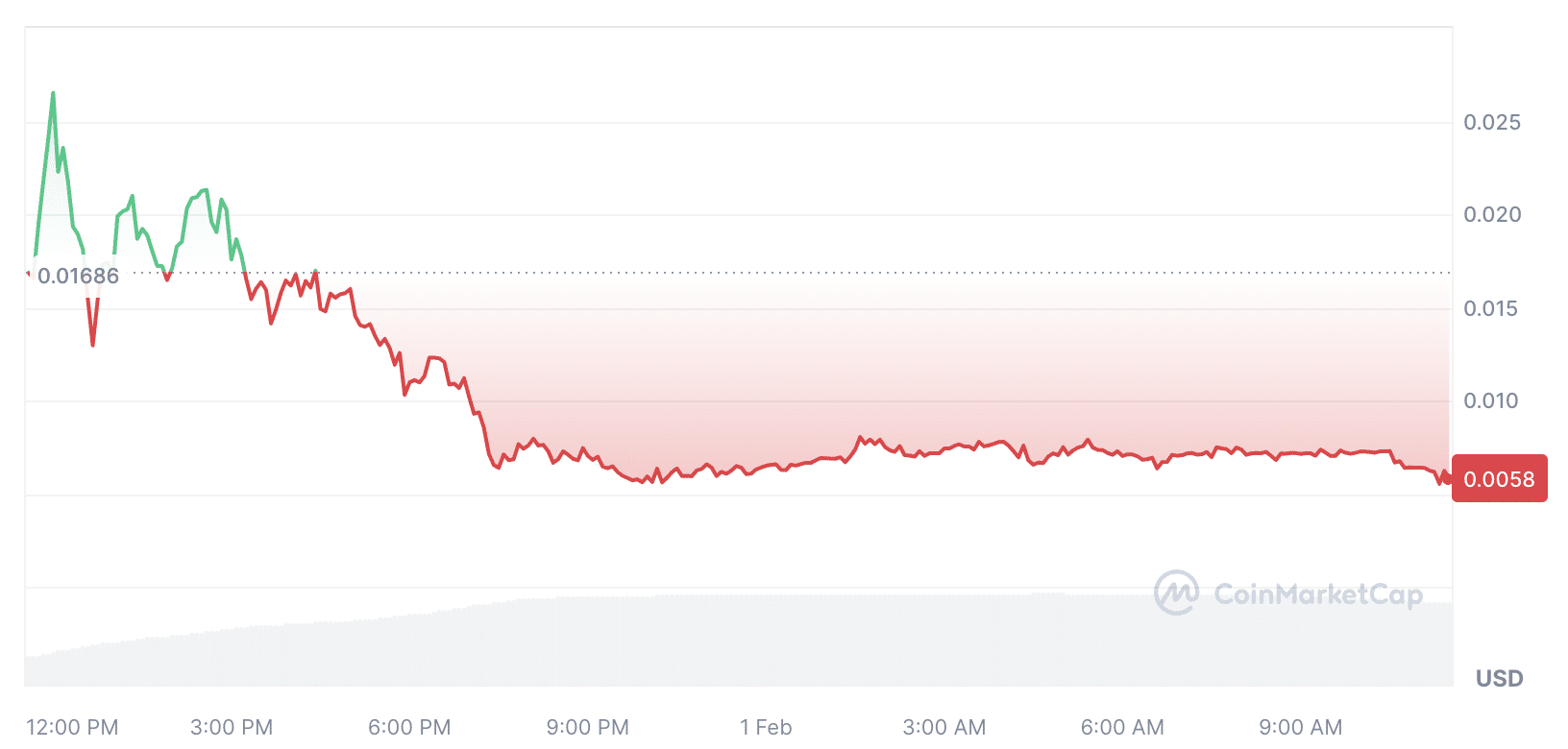

Amid the excitement surrounding the JUP listing, Traders accidentally performed a pump and dump scheme with the wrong token. Due to the similarity of the ticker, traders began to buy the wrong token, and after realizing the mistake, the rate started to plummet. The project’s website says it is no longer operational.

The collapse in the price of the Jupiter token was accompanied by a large-scale distribution of JUP worth $700 million. According to Jupiter’s plans, 40% of the 10 billion JUP tokens will be distributed among members of the Jupiter community. In the first stage, it is planned to withdraw 1 billion JUP tokens to the wallets of Solana users.

The founder of Jupiter Meow commented on the collapse in the token price after the distribution. According to him, recipients of airdrops get a massive pool for ongoing sales. In contrast, potential buyers get the assurance that there is a large pool that can withstand the considerable sales pressure from airdrops, which will cause them to turn away en masse immediately.

“We, as a team, take on the risk that we have zero certainty about how much we will end up with because the community and those who have buyer remorse get first dibs.”

Meow, Jupiter founder

He believes the system remains good because it forces the team to set a reasonable price, prevents wild swings, and provides strong confidence in consistency between early buyers, the team, and community hodlers.