Kava defies SEC-induced market slump with a notable surge

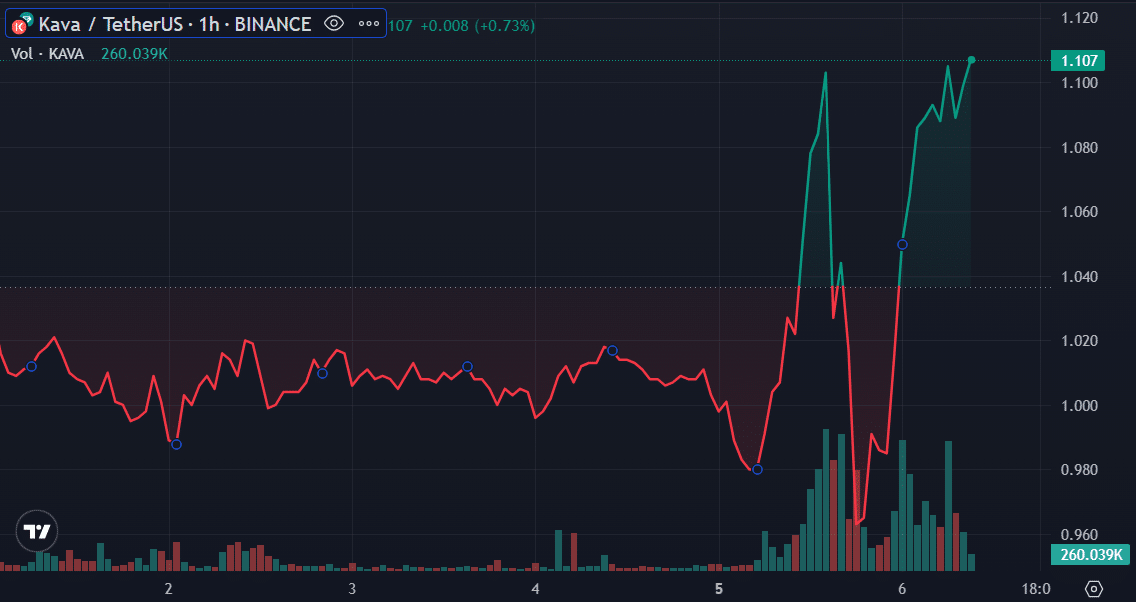

Kava (KAVA), a decentralized blockchain platform known for its crypto lending and borrowing services, has seen its native token KAVA rise by 9.48% in the last 24 hours.

This noteworthy performance comes amidst a general downturn in the cryptocurrency market, triggered by recent charges filed by the US Securities and Exchange Commission (SEC) against Binance.

In a significant development, the SEC lodged allegations against Binance, asserting that the exchange unlawfully provided securities-based services to U.S. investors without obtaining registration with the agency.

Additionally, the SEC has accused Binance of non-compliance with anti-money laundering regulations and investor protection protocols. The impact of this news reverberated throughout the cryptocurrency sector, leading to a decline in the value of several prominent coins. For instance, bitcoin (BTC) has experienced a 3.88% drop in the last 24 hours, while ether (ETH) has declined by 2.88%.

Despite prevailing market conditions, Kava has defied the trend and distinguished itself as the sole asset among the top 100 to display positive growth. At present, KAVA is currently trading for $1.12. Moreover, KAVA has experienced a remarkable increase of 55.89% over the past 30 days.

The Kava protocol

Kava operates as a layer-1 blockchain that seamlessly integrates the speed and interoperability of Cosmos with the robust development capabilities of Ethereum.

Notably, Kava facilitates a mechanism where users can securely lock multiple cryptocurrencies as collateral, enabling them to obtain loans denominated in its native stablecoin, USDX.

The resilience exhibited by Kava amidst market volatility can be attributed to its solid fundamentals, pioneering functionalities, and increasing adoption. Notably, Kava boasts an impressive ecosystem with over 125 decentralized applications (dApps) built on its platform.

Kava introduced its decentralized exchange (DEX), known as Kava Swap, to further enhance its offerings in August 2021. This platform enables users to swap and pool assets across various blockchains, expanding liquidity and facilitating interoperability.