Bitcoin Scaling: Can the Bitcoin Network Scale?

Blockchain scalability issues are holding up the potential for these new networks to outperform traditional payment methods that process thousands of transactions per second. This guide will explore Bitcoin scaling in particular and discuss the scaling solutions worked on so far.

Table of Contents

What is the Bitcoin Scaling Problem?

The Bitcoin scaling problem refers to the inability of the Bitcoin network to process large amounts of transactions in a short period of time.

Bitcoin’s transaction rate averages seven transactions per second (TPS). This is a very low transaction throughput considering bitcoin aims to become a global currency and facilitate worldwide payments like Visa and Mastercard. The two payment platforms record transaction throughputs of approximately 24,000 TPS and 5,000 TPS, respectively.

This scalability challenge arises because the Bitcoin network produces a block about every 10 minutes, and the size of such a block has an upper limit of 1MB. Essentially, BTC transactions are packed into blocks that miners then add to the blockchain after validation by full nodes. Hence, if a block is large, it can hold more transactions. A higher frequency can also result in faster transactions. Although these may seem like pretty straightforward solutions, they come with certain tradeoffs.

The History of the Bitcoin Scaling Debate

The Bitcoin scaling debate is as old as Bitcoin itself. When Satoshi announced the Bitcoin project on the cryptography mailing list for the first time in 2008, the first answer he got was regarding scaling. This comment, written by Canadian cypherpunk James Donald, stated: “[…] it does not seem to scale to the required size.” Many more scaling concerns have arisen over the years, and various solutions have been provided. The scaling debate mainly orbits around block size. Some debate has also occurred around block time.

The Block Size Debate

By design, Bitcoin has a hard block size limit of 1MB. Because of Bitcoin’s decentralization, it’s hard to alter, just like it’s difficult to change the maximum supply of 21 million coins.

In 2013, former Bitcoin Core developer Gregory Maxwell argued: “Bitcoin is valuable because of scarcity. One of the important characteristics of Bitcoin is the limited supply of coins; another is the limited supply of block space; after all, limited block space creates a market for transaction fees, and the fees fund the mining needed to make the chain robust against attacks in the form of reorganization.” In other words, the 1-megabyte block size limit is important for the network’s overall security.

Despite this argument, some Bitcoin community members (big blockers) wanted to increase the block size anyway. On the other hand, small blockers, the segment of the community against raising the block size, were happy to explore options that wouldn’t result in a hard fork. Thus, the Bitcoin scaling war was born, resulting in several hard forks as different big blockers forked Bitcoin, switching out the Bitcoin code to support various block sizes. The main hard forks include:

- Bitcoin XT: Michael Hearn launched this hard fork in 2014. It increased the block size from 1MB to 4MBs. The project lost user interest months after launch and is now defunct.

- Bitcoin Classic: Following the failure of Bitcoin XT, some developers still wanted to increase the block size. They created Bitcoin Classic in early 2016. However, the block size was now 2MBs. Although this project still technically exists, it doesn’t have much of a following.

- Bitcoin Unlimited: This was another 2016 hard fork. It allowed miners to choose the sizes of their blocks up to a maximum of 16MBs. This project didn’t gain much acceptance.

- Bitcoin Cash: This 2017 hard fork took place because certain developers were against the proposed SegWit upgrade. Segregated Witness (SegWit) is a soft fork of Bitcoin that Bitcoin Core developer Pieter Wuille proposed in 2015. It attempts to boost Bitcoin’s transaction throughput by minimizing the weight of transactions in a block. Bitcoin Cash still exists today and is the most successful Bitcoin hard fork in terms of market cap — $2.3B at the time of writing. The network has a block size of 32MBs and doesn’t use SegWit.

The small blockers executed SegWit in 2017, originally intended as a two-part protocol upgrade. The second component, SegWit2x, would have led to a hard fork with a 2MB block size. Nevertheless, it didn’t go through since the Bitcoin community failed to reach a consensus regarding its implementation. SegWit was followed by the Taproot upgrade in November 2021.

The Block Time Debate

Experts also considered the possibility of reducing the time it takes for miners to find a block. For instance, at the 2016 Scaling Bitcoin conference, attendees explored how a frequency modification could affect transaction throughput. Researchers from ETH Zürich thought Bitcoin’s block time could be securely reduced from 10 minutes to 1 minute.

The idea here was that more blocks meant more transactions. Maxwell opposed this idea asserting that “the block time question is tricky, because if it is too low, then the network could see a quick drop-off in security.”

Since then, nothing tangible has come out of this debate, probably due to the real security implications of changing it.

Current Bitcoin Scaling Solutions

Ultimately, there are two basic ways of scaling Bitcoin. The network can be scaled either by upgrading the blockchain or by introducing layers.

SegWit and Taproot are blockchain upgrades, while the Lightning Network is a layer-2 scaling solution. Here’s a brief description of these solutions.

SegWit

SegWit is a Bitcoin soft fork activated in August 2017. Unlike a hard fork, a soft fork modifies the software protocol, is backward-compatible, and doesn’t lead to the existence of two blockchains. SegWit improves transaction throughput by segregating a transaction into two parts. This reduces the transaction size, allowing more transactions per block.

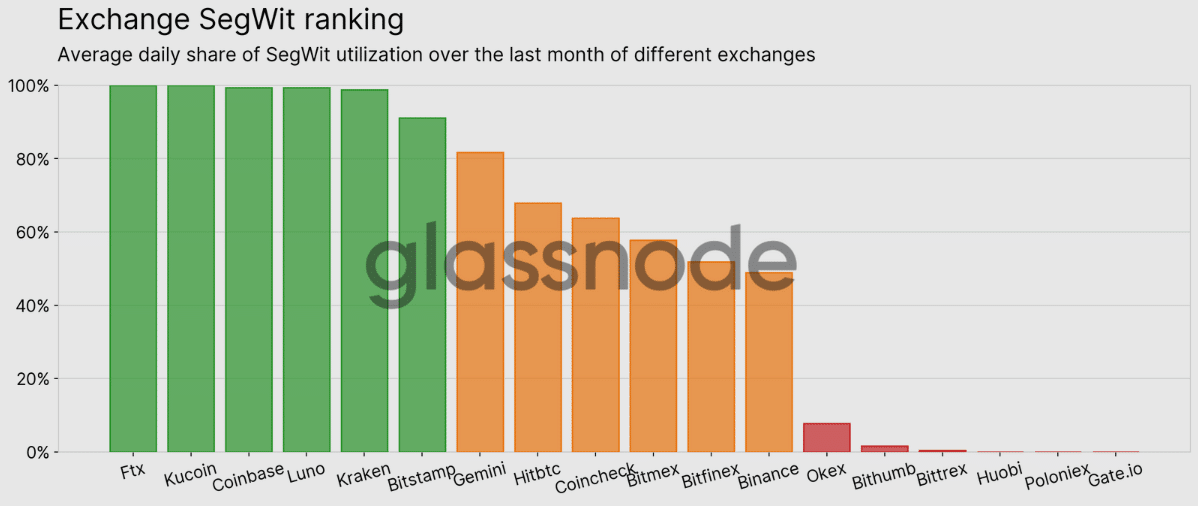

Most crypto exchanges have upgraded their infrastructure to benefit from SegWit. For example, Kucoin and FTX have achieved 100% SegWit adoption, according to a Glassnode article. Crypto wallets such as Ledger and Trezor have also adopted SegWit.

Overall, SegWit adoption has grown since 2017, based on data from Buy Bitcoin Worldwide. Still, Bitcoin’s on-chain transaction throughput remains around 7TPS.

Taproot

The Taproot upgrade took place in November 2021, following Gregory Maxwell’s 2018 proposal. The upgrade increases Bitcoin’s efficiency and privacy. It helps to cut down the duration of transactions and minimizes block capacity. The update has also brought new forms of smart contract abilities to the Bitcoin network.

The Lightning Network

The Lightning Network (LN) is a payment layer built on top of the Bitcoin network. It permits faster and cheaper BTC transactions and concentrates on high-volume micropayments. LN payment channels have been seeing more activity in the past year, reaching a capacity of 5,000 BTC in October 2022. The Lightning Network went live in 2018, and it is still under continuous development.

FAQs

Can Bitcoin ever scale?

Yes, but it will take time.

Currently, no home computer can support the bandwidth and storage it takes to handle tens of thousands of transactions per second. That’s because Bitcoin blocks would need to scale to GB capacities to facilitate such high transaction speeds. However, as computer technology increase with time, as Moore’s law suggests, Bitcoin could reach Visa’s capacity and even surpass it. In the meantime, layer-2 solutions like LN may help fast-track Bitcoin’s TPS.

What is the TPS of the Lightning Network?

The Lightning Network hopes to handle millions of transactions per second.