How to invest in Bitcoin without buying it

Learn how to invest in Bitcoin through methods that don’t require you to buy the cryptocurrency outright, such as ETFs and futures.

While directly buying Bitcoin (BTC) might be the best way to take full advantage of its potential, it’s not ideal for everyone. Fortunately, there are many financial products that allow you to learn how to invest in Bitcoin without the hassle of securely buying and storing it yourself.

Table of Contents

How to start investing in Bitcoin

Before you make any Bitcoin investment decisions, you should take a few basic steps. First, it’s crucial to understand as much as possible about Bitcoin—how it works, its potential risks and rewards, and the technology behind it—to make an informed decision.

You should also explore the different investing methods available to find the one that best suits your needs. Consider your attitude towards risk and how much money you are comfortable risking.

Additionally, keep up with the latest developments in the cryptocurrency market and any regulatory changes that may affect Bitcoin. Market conditions can change rapidly, and staying informed can help you make better investment decisions.

5 ways to invest in Bitcoin

Bitcoin mining

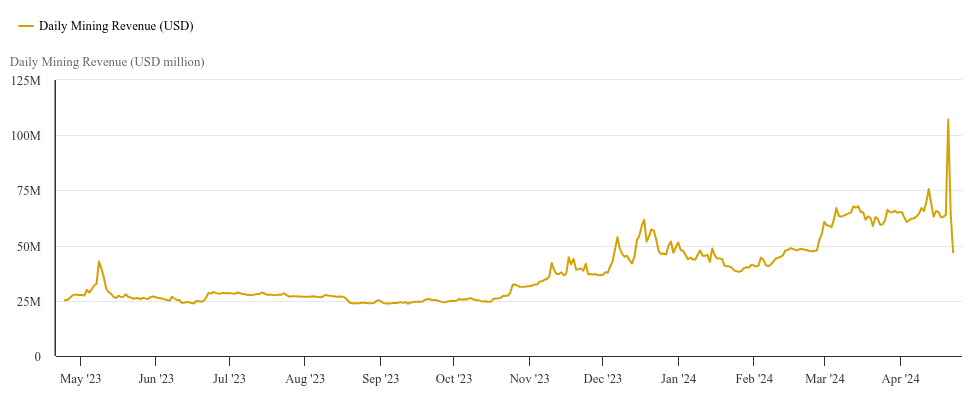

Bitcoin mining is the process by which new Bitcoins are created, and transactions are verified and added to the blockchain. It typically requires a significant upfront investment in specialized hardware and infrastructure known as application-specific integrated circuits (ASICs) designed for mining cryptocurrencies like Bitcoin. These ASIC miners are optimized to perform the necessary cryptographic calculations efficiently.

Mining consumes a significant amount of electricity due to the computational power required to solve the puzzles. Once the hardware and infrastructure are in place, investors need to set up and configure their mining equipment. This involves connecting the ASIC miners to a power source, setting up cooling systems, and configuring the mining software.

Bitcoin mining requires ongoing monitoring and maintenance to ensure optimal performance and profitability. This includes monitoring the hardware for any issues, updating software, and optimizing mining settings as needed.

However, mining Bitcoin has become less profitable for individuals. The major earnings are now concentrated with large industrial miners who can operate at scale. For the average individual miners, the high costs of electricity and the necessary sophisticated hardware make home mining an unlikely venture for significant profits.

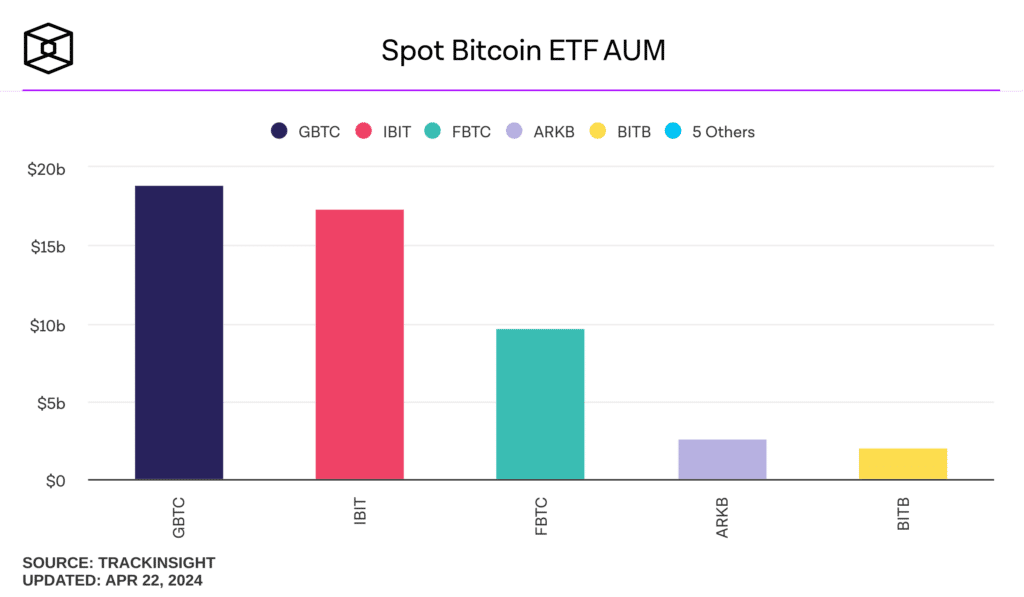

Bitcoin ETFs and ETPs

A Bitcoin exchange-traded fund (ETF) may be one of the best ways to invest in Bitcoin for those who don’t want to purchase BTC directly. It is a Bitcoin investment vehicle that offers exposure to the price of BTC without actual ownership of the digital currency. A Bitcoin ETF tracks the value of Bitcoin through actual ownership of BTC or Bitcoin derivatives.

In January 2024, the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs after numerous initial denied applications. After the approval, the crypto market saw a significant upsurge, with BTC shattering its previous all-time high.

Grayscale Bitcoin Trust (GBTC) is the world largest Bitcoin ETF. Other examples include Bitwise Bitcoin ETF and the Hashdex Bitcoin ETF.

A Bitcoin ETP is an exchange-traded product with Bitcoin as an underlying asset. For institutional investors, buying Bitcoin ETPs could be considered less risky than buying BTC outright since ETPs are established investment vehicles that operate on traditional security exchanges and don’t require any technical crypto know-how on the investor’s part.

An example of a bitcoin ETP would be the Iconic Funds Physical Bitcoin ETP (XBTI).

Bitcoin CFDs

A Bitcoin contract for difference (CFD) allows investors to speculate on the price of BTC fluctuating while using leverage to improve the size of their position. This means they don’t own the underlying digital currency but instead possess a CFD that tracks the price of Bitcoin.

When trading Bitcoin as a CFD, you are buying and selling the price behavior of financial products. This means you can benefit from the price fluctuations prevalent in the Bitcoin market.

Bitcoin futures and options

Bitcoin derivatives, such as futures and options, provide another option to add Bitcoin exposure to your portfolio. However, derivatives can be riskier than financial products tracking the spot price of Bitcoin, so they are only for experienced traders and investors.

A Bitcoin futures contract is a derivative product that allows a buyer and a seller to exchange Bitcoin at a predetermined price and a specific date in the future, allowing them to speculate on the price of Bitcoin without having to hold the cryptocurrency. You can also use leverage to trade in future markets. Leverage allows you to trade Bitcoin futures without having to pay upfront for the full value of a contract.

Bitcoin options are derivatives contracts that allow the buyer to buy the digital currency at a certain price at a specific future date. Options offer an avenue to take advantage of price fluctuations and are typically cheaper than futures contracts as you only have to pay the option premium to bet on the price of Bitcoin.

You can trade Bitcoin futures and options on platforms like the CME, Binance, FTX, and more.

Bitcoin stocks

Finally, another way of investing indirectly in Bitcoin is by buying stocks in companies that are leveraging Bitcoin in their business. Examples would include tech companies, such as Microstrategy and Tesla, which hold a significant amount of Bitcoin on their balance sheets.

Companies operate under clear rules and structures, making them more understandable to the average investor. Investors in publicly traded companies have the right to see financial statements and are informed about decisions made by top executives.

In March 2024, American tech company MicroStrategy, the largest corporate Bitcoin owner, announced it had purchased an additional 9,245 Bitcoins. The company’s Bitcoin holdings now exceed 1% of the total Bitcoin market, representing an unrealized profit of around $6 billion

Elon Musk’s Tesla still holds around $772 million in BTC, despite the fact that it sold some of its Bitcoin during market dips in 2021 and 2022.

Alternatively, some companies provide Bitcoin-related services, such as payment providers like PayPal. You can also invest in Bitcoin mining companies like Riot Blockchain and Marathon Digital Holdings.

With companies offering services other than holding Bitcoin, you also have to evaluate their products and overall sector performance. The stock’s performance will be affected by several factors that have nothing to do with the Bitcoin price. So keep that in mind when adding Bitcoin stocks to your portfolio.

Risks and considerations

It’s important to remember that no matter the method of investing in Bitcoin, the crypto market is notoriously volatile, with prices capable of fluctuating dramatically within short periods. While this volatility can create opportunities for significant gains, it also exposes investors to the risk of substantial losses. Investors and traders must be prepared for sudden price swings and have robust risk management strategies to mitigate potential losses.

It’s vital to research whichever investing method you choose and understand its particular risks. For example, trading Bitcoin through CFDs and futures involves leverage, which can magnify both potential profits and losses. High levels of leverage increase the risk of margin calls, where traders are required to deposit additional funds to cover potential losses or risk having their positions forcibly closed.

FAQs

How can I invest in Bitcoins without Bitcoin?

You can choose between exchange-traded financial products that track the price of Bitcoin (BTC), such as Bitcoin ETFs, Bitcoin ETPs, and Bitcoin ETNs, or derivatives that allow you to speculate on the price of Bitcoin without actually holding the underlying asset. Alternatively, you could also buy shares in publicly traded Bitcoin companies.

How do I make money with Bitcoin every day?

While buying and hodling Bitcoin is arguably the safest (and potentially also most financially rewarding) way to invest, there are ways you can make money with Bitcoin on a daily basis. Your possible options include Bitcoin mining and Bitcoin lending. While both of these options require an upfront investment, and mining Bitcoin is less profitable for individual miners, in theory, they pay out Bitcoin every day.

Is it too late to invest in Bitcoin?

Bitcoin still has a lot of upside price potential, given that it is still in an early development stage and nowhere near its adoption potential. While no one can say for certain what price the digital currency will reach, many experts believe that anything from $100,000 to $1,000,000 is possible.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.