NFT strategy: How to make money with NFTs

In the world of NFTs, there is no golden strategy that guarantees that you will make a profit. However, by adopting one of several NFT investment strategies that match your budget and preferences, you can increase your chances of success. In this guide, we will look at different strategies you can use to potentially make money with NFTs as a collector.

Non-fungible tokens (NFTs) have captivated collectors and investors’ minds and wallets for a good reason.

In 2021 alone, the NFT market reached $23 billion in trades, with sales such as Beeple’s “Everyday: The First 5000 Days” fetching a mind-boggling $69 million, NFTs have undoubtedly earned their place in the digital pantheon.

In 2022, despite the bearish conditions and adverse market climate, the trading volume of NFTs across blockchain platforms and marketplaces amounted to approximately $24.7 billion.

This article dives into the lucrative world of NFTs, unraveling all that you need to know to become a successful NFT trader – from secrets of making money as a collector to navigating the ever-evolving market with finesse.

Table of Contents

What is NFT strategy?

An NFT strategy is an approach to collecting and trading non-fungible tokens (NFTs) to generate an investment profit.

An NFT trading strategy involves using one or several approaches to researching, finding, purchasing, and selling NFTs, taking into account market conditions, latest trends, and historical price developments.

Factors to consider before investing in NFTs

Here are the factors you need to consider when investing in NFTs:

- Understanding the underlying asset: Comprehending the history, creator, cultural significance, and utility of the NFT is vital. NFTs backed by credible creators, strong narratives, or usability in digital ecosystems (e.g., gaming) often hold more value.

- Assessing market demand: Examine the NFT’s niche and potential for future growth. NFTs with strong communities, social media engagement, or established partnerships can indicate a higher likelihood of sustained demand.

- Rarity and uniqueness: An NFT’s scarcity and exclusivity make it more appealing to collectors. Limited edition, early-minted, or one-of-a-kind NFTs can command higher premiums.

- Evaluating risk tolerance: As with any investment, understanding your risk appetite is crucial. NFTs are a volatile and nascent market, and investing only what you can afford to lose is essential.

Staying informed: Keeping abreast of the latest news, trends, and developments in the NFT space is critical to your success as a collector.

Why invest in NFTs

Investing in NFTs can be an exciting opportunity for investors seeking to diversify their portfolios and capitalize on the growing trend of digital ownership.

With the explosion of interest in NFTs, the market is full of potential for big returns. Still, it’s crucial to have a solid investment strategy to navigate the risks and maximize profits.

A well-thought-out strategy can help you identify the right NFTs to invest in, time your purchases and sales effectively, and manage your risks by diversifying your holdings.

So, if you’re considering investing in NFTs, don’t jump in blindly – take the time to develop a sound strategy and unlock the full potential of this exciting market.

Why should you have an NFT trading strategy?

There are several reasons why you should have an NFT trading strategy in place:

- Risk management: A well-defined strategy enables you to navigate the turbulent waters of the NFT market while managing risk and avoiding emotional decision-making.

- Identifying opportunities: A well-crafted strategy helps you uncover hidden NFT gems and capitalize on burgeoning market trends before they become mainstream.

- Enhancing returns: A systematic approach to NFT investing can improve your overall performance, maximizing profit potential.

Consistency and discipline: A trading strategy keeps you grounded and focused on your goals and prevents impulsive decisions that can derail your success.

Things to keep in mind when trading NFTs

Here are the top things to keep in mind when trading NFTs:

- Please do your research: Understand the asset, its creator, and the market before investing. A well-informed decision is often a profitable one.

- Don’t follow the hype: Evaluate NFTs based on their fundamentals, not just popularity. The shiniest object isn’t always the most valuable.

- Diversify your portfolio: Spread your investments across different types of NFTs, creators, and niches to cushion the impact of market fluctuations.

- Stay updated on market trends: Monitor the NFT space and adapt your strategy accordingly. Knowledge is power, and staying ahead of the curve is paramount.

- Be prepared for volatility: NFT markets can be unpredictable, so be ready to adjust your approach and seize opportunities as they arise.

Best NFT investing strategy: how to improve chances of making money with NFTs

As the NFT market continues to grow and evolve, it’s essential to have effective trading strategies in place to maximize profits and minimize risks. Now, we’ll explore some of the best NFT trading strategies that you can implement to navigate the market successfully.

Buy fractional NFTs

Purchase shares of high-value NFTs through fractional ownership platforms, allowing you to gain exposure without buying the entire asset.

Pros

- Lower entry costs: Fractional ownership reduces the initial capital required to invest in high-value NFTs.

- Potential for high returns: As the value of the underlying NFT increases, so does the value of your fractional shares.

- Access to blue-chip NFTs: Fractional ownership opens doors to otherwise unattainable NFTs.

- Diversification: Fractional investing allows you to spread your funds across multiple NFTs, reducing risk.

Cons

- Limited control: Owning only a fraction of the NFT restricts your decision-making power and control over the asset.

- Possible liquidity issues: Fractional NFTs may not be as liquid as whole NFTs, making it challenging to sell your shares.

- Reliance on the platform’s stability: Fractional ownership platforms manage the underlying NFTs, adding a layer of dependency and risk.

- Shared ownership responsibilities: You may need to coordinate with other fractional owners for decisions related to the NFT.

Buy the floor

Target NFTs with a price floor or minimum value, as they may be undervalued and offer growth potential.

Pros

- Opportunity to identify undervalued assets: Buying the floor allows you to spot assets that may be undervalued and ripe for appreciation.

- Benefit from price appreciation: Investing in NFTs with a price floor helps you capture potential upside as the market recognizes the asset’s true value.

- Exploit market inefficiencies: This strategy leverages pricing discrepancies in the market, profiting from the inefficiencies.

- Mitigate downside risk: A higher price floor can act as a safety net, minimizing the potential for significant losses.

Cons

- Higher research demands: Identifying genuine price floors requires extensive research and market knowledge.

- Potential for price stagnation: NFTs with a price floor may not always experience rapid appreciation and could remain stagnant.

- Difficulty in identifying genuine price floors: Determining accurate price floors can be challenging, as they may be artificially inflated or manipulated.

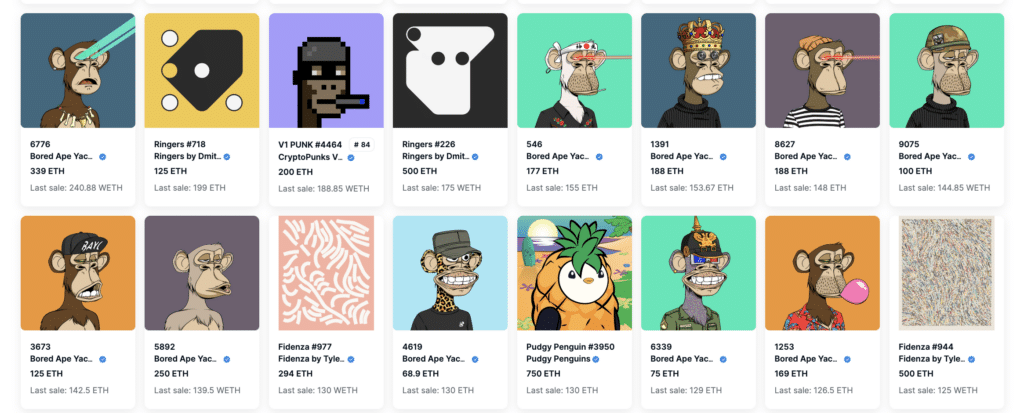

Buying the ceiling

If you are prepared to invest heavily in the NFT market, adopting the “buying the ceiling” strategy could be the right path.

Pros

- Access to high-profile assets: Buying the ceiling is an opportunity to own the rarest NFTs with limited availability and high desirability.

- Potential for significant price appreciation: Investing in ceiling NFTs can lead to a considerable upside if the project gains traction, as these are usually the project’s prime offerings.

Cons

- High entry barrier: This strategy requires substantial capital investment, limiting its accessibility to traders with large bankrolls.

- Risk of significant losses: If the project’s popularity declines, investors will lose a significant portion of their investment.

- Challenges in finding buyers: Given the high cost of ceiling NFTs, finding a willing buyer at the right price point can prove challenging.

- High price volatility: The prices of ceiling NFTs can be highly volatile, leading to potential price stagnation or even depreciation.

Flipping

Purchase NFTs to sell them quickly for a profit, capitalizing on short-term market trends and hype.

Pros

- Quick returns: Flipping enables you to realize profits quickly, freeing up capital for new opportunities.

- Potential for high profits: Riding the wave of market hype can lead to significant returns if executed correctly.

- The excitement of fast-paced trading: Flipping adds an adrenaline rush, requiring quick decision-making and constant market monitoring.

- Leveraging market momentum: This strategy allows you to capitalize on market trends and momentum, capturing gains from rapidly appreciating assets.

Cons

- Higher risk: Flipping is a high-risk, high-reward strategy, and sudden market shifts can lead to losses.

- Dependence on market trends: Success in flipping relies heavily on accurately predicting short-term market movements, which can be difficult.

- Increased competition: Many traders employ flipping strategies, resulting in stiff competition and potentially diminishing returns.

- Short investment horizons: This approach focuses on short-term gains and may miss out on long-term growth opportunities.

- Time-consuming due diligence: Flipping requires continuous research and attention, demanding a significant time investment.

Long-term holding

Acquire NFTs with strong fundamentals and hold them for an extended period, anticipating long-term value appreciation.

Pros

- Potential for substantial gains: Holding NFTs with solid fundamentals over the long term can result in significant returns as their value appreciates.

- Reduced impact of short-term market fluctuations: A long-term approach mitigates the effects of short-term market volatility on your investments.

- Capitalizing on long-term trends: By focusing on the long term, you can ride the wave of broader market trends and capitalize on the growth of the NFT space.

- Focus on quality assets: Long-term holding encourages investment in high-quality NFTs with strong potential for appreciation.

Cons

- Longer investment horizon: This strategy requires patience, as returns may not materialize quickly.

- Opportunity cost: Holding NFTs long-term may result in missed short-term profit opportunities.

- Illiquidity: Long-term holding can tie up your capital, making it less accessible for other investment opportunities.

- Uncertain market conditions: The future of the NFT market is unknown, and long-term holding carries the risk of unforeseen changes in market dynamics.

Staking and yield farming

Stake your NFTs on platforms that offer rewards, either native tokens or other NFTs. Some platforms allow you to stake your NFTs in liquidity pools or participate in yield farming to earn additional rewards.

Pros

- Passive income generation: Staking and yield farming can provide ongoing rewards with minimal effort if the NFT doesn’t decline.

- Potential for compounding returns: Reinvesting rewards can lead to compounding returns over time, further increasing your profits.

- Increased asset utility: This strategy allows you to put your NFTs to work, generating additional value beyond their inherent worth.

- Leveraging existing NFT holdings: Staking and yield farming enable you to capitalize on your existing NFT investments without buying new assets.

Cons

- Smart contract risk: Staking and yield farming rely on smart contracts, which may have vulnerabilities or bugs, exposing you to potential losses.

- Reliance on the platform’s success: The rewards from staking and yield farming depend on the platform’s performance and continued growth.

- Impermanent loss: Staking NFTs in liquidity pools can lead to impermanent loss if the value of the NFT or its paired asset fluctuates significantly.

- Potential for decreased NFT value: While staking, the underlying NFT may decline, leading to a net loss when accounting for rewards earned.

NFT index investing

Invest in NFT index funds that provide exposure to a diversified basket of NFTs, allowing you to participate in the broader market’s growth without picking individual winners.

Pros

- Diversification: Index funds enable you to spread your investment across a wide range of NFTs, reducing the risk associated with individual assets.

- Passive investment approach: Index investing may allow you to benefit from market growth without needing active management and decision-making.

- Risk mitigation: By investing in a diversified basket of NFTs, you can mitigate the risk of individual assets underperforming.

- Reduced research demands: Index investing eliminates the need for extensive research on individual NFTs, saving time and effort.

Cons

- Limited customization: Index funds offer a predefined basket of NFTs, which may not align with your specific investment preferences.

- Potential underperformance: Passively managed index funds may underperform actively managed portfolios or individual NFT investments if the broader market underperforms.

- Reliance on the index provider’s methodology: Index investing depends on the index provider’s selection methodology, which may not perfectly match your investment strategy or goals.

Conclusion

Navigating the NFT market as a collector is a journey that combines art and science. Armed with the right knowledge, tools, and strategies, you can uncover opportunities others may overlook. The key is to stay informed and remain agile.

NFTs are a brave new world; as a collector, you can shape its future while potentially reaping the rewards of your digital discoveries.

FAQs

Is investing in NFTs risky?

Yes. The prices of non-fungible tokens are incredibly volatile. You should only invest what you can afford to lose and start trading NFTs if you feel comfortable understanding the risks involved.

How can I identify promising NFT projects or creators?

To identify promising NFT projects or creators, consider the following:

Track record: Examine the creator’s previous works, successes, and collaborations. A strong track record often indicates a higher probability of producing valuable NFTs.

Community engagement: Gauge the level of interest and enthusiasm surrounding the project or creator. Active communities often signal a high demand for NFTs.

Rarity and scarcity: Look for NFT projects with limited supply or unique attributes that make them rare and valuable.

Utility: NFTs with real-world use cases or additional benefits (e.g., access to exclusive content or events) may be more valuable than purely aesthetic items.

Market sentiment: Monitor social media, forums, and news to understand the overall market perception of a project or creator.

Can NFTs be used as collateral for loans?

Yes, some platforms allow you to use NFTs as collateral for loans. These platforms typically require borrowers to deposit their NFTs, locked in a smart contract until the loan is repaid. If the borrower fails to repay the loan, the platform may liquidate the NFT to recoup the debt. However, using NFTs as collateral can be riskier than traditional assets due to their volatile nature and potential illiquidity.

Are there any tax implications when trading NFTs?

Yes, trading NFTs can have tax implications, depending on your jurisdiction. In many countries, profits from NFT trading are considered capital gains and may be subject to taxation. It’s crucial to consult with a tax professional or financial advisor to ensure compliance with local tax laws when trading NFTs.

What are some common mistakes to avoid when trading NFTs?

Here are the most common mistakes that you need to avoid when trading NFTs:

FOMO (Fear of Missing Out): Don’t let the fear of missing out on a trend drive your decisions. Instead, conduct thorough research and make informed choices.

Lack of diversification: Avoid putting all your eggs in one basket. Diversify your NFT portfolio to mitigate risk.

Ignoring fees: Be aware of fees associated with NFT trading, such as platform fees, gas fees, or transaction fees, as they can impact your profits.

Overlooking security: Safeguard your digital assets using secure wallets and practicing good cybersecurity habits.

Not having a clear strategy: Develop and stick to a well-defined trading strategy rather than relying on gut feelings or market rumors.

What are the risks associated with investing in NFTs?

Some risks include market volatility, illiquidity, lack of regulatory oversight, potential loss of value, and technological challenges (e.g., hacking or platform failure).

How do I determine the value of an NFT?

The value of an NFT is influenced by factors such as its rarity, creator, cultural significance, utility, and market demand. Analyzing historical sales data, community engagement, and overall market trends can also help assess an NFT’s value.

Are NFTs a good long-term investment?

NFTs can be a good long-term investment if you choose the right assets, have a diversified portfolio, and monitor the market’s development. As with any investment, there are risks, and it’s crucial to conduct thorough research before committing to a long-term strategy.