Polygon and Matic: What is the difference?

Polygon is a layer-2 scaling infrastructure on the Ethereum blockchain, while MATIC is its native token used to power the ecosystem. As they are often confused in the crypto community, learn the difference in our guide.

What is MATIC?

MATIC is the native token of the Polygon platform, formerly known as the Matic Network. It originated as an ERC-20 token on the Ethereum network, but when the Matic Network rebranded to Polygon and expanded its scope, the role of the MATIC token also evolved. The MATIC token is now used in Polygon’s proof-of-stake consensus mechanism and to pay transaction fees on the network.

MATIC tokens supply is limited, just like some other cryptocurrencies such as BTC. The supply of MATIC tokens is capped at 10 billion as per the platform’s rules.

The rebranding of Polygon coupled with developments on the network and its adoption, saw MATIC tokens grow in price and market cap. The token now holds a high position in the cryptocurrency rankings.

What you can do with Polygon (Matic)

The token has different use cases in the Polygon ecosystem, including payment for transaction fees and staking. Users can also earn MATIC tokens by validating transactions or executing smart contracts on the Polygon network. This is done by offering some computational resources and services to the Polygon network to function as validators.

MATIC is also a governance token on the Polygon network. Users who own and stake MATIC can vote on the network upgrades, with each vote equivalent to the amount of staked MATIC cryptocurrency.

MATIC on Polygon vs MATIC on Ethereum?

There is a difference between a MATIC token on the Ethereum network and a MATIC token on the Polygon network. Matic is an ERC-20 token on the Ethereum blockchain, while MATIC is the native token of the Polygon blockchain, a layer 2 scaling solution for Ethereum, designed to improve scalability and reduce transaction costs.

The difference means that a MATIC token on the Ethereum network and a native MATIC token on the Polygon network won’t share the same wallet address since they are on different blockchain networks. Transferring a token minted on the Ethereum network to your MATIC address on the Polygon network without using Polygon’s bridge service could potentially lead to a loss of your token. However, if you transfer a token minted on Ethereum to an Ethereum address (for example, MetaMask), it will be successful. The same is true in reverse, but only with the proper use of Polygon’s bridge for the transfer.

Polygon vs. Matic: What is the difference?

While Polygon and Matic are often used interchangeably, they have clear distinctions. Polygon is a framework for building and connecting Ethereum-compatible blockchain networks, while MATIC is its native token used to power the ecosystem.

Launched in 2019 as Matic Network, the project originally offered Plasma chain. The project rebranded to Polygon in 2021, integrating a more extensive suite of solutions, but chose to keep the name MATIC for its native utility token. This rebranding led to some confusion in the crypto community, with many people mistakenly viewing them as separate projects. You can compare Polygon to Matic as Ethereum to ETH.

Polygon explained

Born initially as Matic Network, Polygon is a project designed to address Ethereum’s challenges, such as network congestion and high gas fees. It was created in 2017 by experienced Ethereum developers Sandeep Nailwal, Jaynti Kanani, Anurag Arjun, and Mihailo Bjelic.

The key attribute of Polygon is its capability to process transactions on a parallel, Ethereum-compatible chain before feeding them back to the main Ethereum network. This system decreases network congestion, enabling smoother operations.

The platform includes different tools to build and run applications compatible with Ethereum’s blockchain. The proof-of-stake (PoS) protocol is designed to facilitate fast transactions at minimal costs. Polygon zkEVM is a solution that uses zk rollups to process transactions off-chain and then send them back to the main blockchain.

Polygon is not the only layer-2 scaling solution on the Ethereum network. Rival platforms include Solana, Cosmos, and Avalanche. However, Polygon sets itself aside from its competitors by granting developers immense control and customization when selecting a scaling solution they deem idle for their application. For instance, on Polygon, developers can choose between optimistic roll-ups and zk-roll-ups per their needs.

The solution to Ethereum’s shortcomings

High transaction fees in times of network congestion, costing hundreds of dollars, and slow transactions are some of the biggest issues faced by persons using DeFi protocols, NFT marketplaces, and other platforms built on the Ethereum network or generally transferring tokens over the network.

Polygon aims to solve this problem by offering a scaling solution on the Ethereum blockchain. According to the project, it has the capacity of more than 7,000 transactions per second (TPS).

How does Polygon work?

Polygon is a framework for building and connecting Ethereum-compatible blockchain networks, aiming to reduce transaction costs and speed up transactions. It uses its own proof-of-stake blockchain and various scaling solutions, including side chains, to achieve this. The blockchain claims to handle 7,000 transactions per second compared to Ethereum, which typically can process around 15-20 transactions per second.

Polygon also cuts transaction costs by processing transactions on its side chains, and it offers users flexibility in choosing their preferred scaling solutions. Transaction fees are generally much lower than Ethereum’s average.

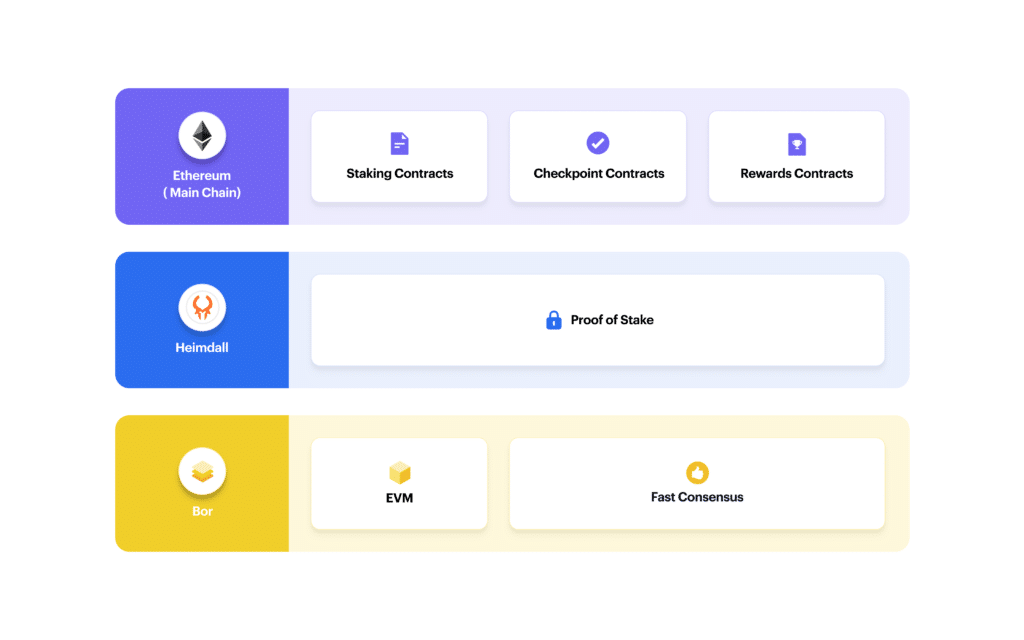

Polygon network architecture consists of three core layers:

Ethereum layer: This layer includes a set of smart contracts deployed on the Ethereum mainnet. Its main function is facilitating the proof of stake (PoS) mechanism. In Polygon, anyone can stake MATIC tokens, earn rewards, and establish checkpoints on the Ethereum mainnet, helping to ensure the reliability and integrity of the system.

Heimdall layer: As the validation layer, Heimdall handles the aggregation of blocks, organizing them into a data structure called a Merkle tree. These aggregated blocks are then regularly published to the root chain. Validators on this layer ensure the correctness of blocks since the last checkpoint and publish a Merkle root hash to the Ethereum mainnet. This process provides transaction finality and proof for asset withdrawal.

Bor layer: As the block producer layer, Bor compiles transactions into blocks. It operates in time intervals termed “spans,” during which block producers are selected and rotated. Heimdall nodes also regularly validate these blocks, ensuring the overall system’s security and consistency.

Each of these layers plays a crucial role in Polygon’s function, working together to provide a network for Ethereum-compatible blockchains.

Polygon use cases

As Polygon looks to diversify beyond Ethereum, its major use case is to facilitate the seamless integration of different blockchain projects and networks into the Ethereum ecosystem. Some of the current use cases of Polygon include:

DeFi Projects

Polygon supports several DeFi projects built on the Ethereum blockchain. By lowering the transaction costs and the transaction time in DeFi protocols, Polygon enables DEXs to offer more liquidity since most people are encouraged to deposit into the liquidity pools. Popular DeFi platforms using Polygon include 1inch, Curve Finance, SushiSwap, QuickSwap, and Aave.

Business support

Polygon offers business operations support to ParcelMoney– a crypto payroll and treasury management platform. Polygon supports the platform via its low-cost and scalable network built on the Ethereum blockchain.

Non-fungible tokens (NFTs)

On the NFTs side of the spectrum, ATARI-an NFT platform, partnered with Polygon to facilitate the platform’s growth leveraging Polygon’s low-cost and scalable network to ensure fast, safe, and efficient transactions.

Closing words

Polygon is a layer-2 scaling solution on the Ethereum blockchain network that enables it to scale and facilitate quick transactions. Sometimes called the “Ethereum internet of blockchains,” Polygon seeks to enhance the scalability, sovereignty, and scalability of Ethereum-based projects while still providing the security, interoperability, and structural benefits of the Ethereum blockchain.

Polygon is powered by MATIC-an ERC-20 token used to pay transaction fees on the Polygon ecosystem, govern the network, and pay network transaction fees. In essence, MATIC is the native coin of Polygon, just like ETH is to Ethereum.

FAQs

What is Polygon?

Polygon, previously known as the Matic network, is an Ethereum layer 2 scaling solution created to solve network congestion and reduce transactional fees within the Ethereum blockchain.

What is MATIC?

MATIC is a native token of Polygon. The token governs the Polygon network and is available through many cryptocurrency exchanges like Kraken and Coinbase.

What are Ethereum layer 2 scaling solutions?

Scalability solutions for Ethereum include Plasma, rollups, and state channels. Plasma creates “child chains” attached to the Ethereum main chain, executing transactions off-chain. State channels allow two parties to conduct transactions privately without broadcasting them publicly.

Is Polygon the same as MATIC?

Polygon is a network that runs on the Ethereum blockchain, and while it was previously called the Matic network, the network shifted its name to Polygon, and MATIC is the token that governs the activities of the network.