What Does Market Cap Mean In Crypto?

Market cap is one of the most common and effective ways in which investors measure the real value of cryptocurrencies. CoinMarketCap currently features hundreds of cryptocurrencies ranked by their market cap, making it the premier site for investors to refer to when conducting preliminary research on a coin.

So what is market cap and why is it such a useful metric for determining a cryptocurrency’s value?

Table of Contents

Market Cap Calculated

Market cap is calculated merely by multiplying the total circulating supply of a cryptocurrency by the price of each coin.

So for example, if bitcoin’s current price is $4,000, and its circulating supply is 17,573,937 BTC, then the market cap for bitcoin would be its price multiplied by its circulating supply (4,000 x 17,573,937), or 70,295,748,000.

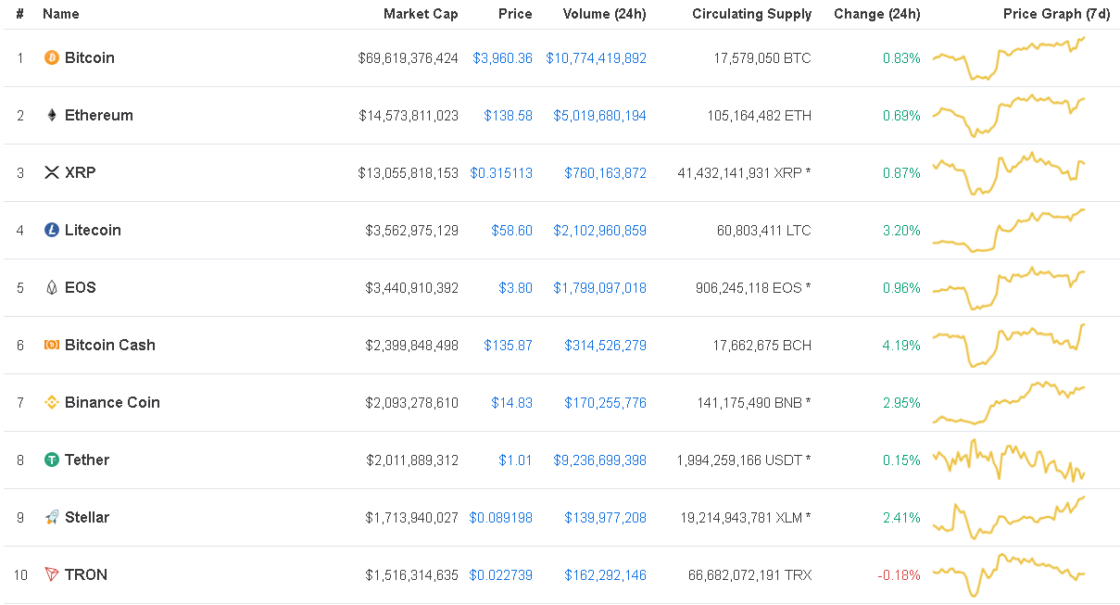

This formula means that it is very often the case that one coin can have a lower price than another, but still have a higher market cap, like in the case of XRP compared to EOS. Despite the price of XRP being less than ten percent of the price of EOS ($0.31 vs. $3.8), XRP currently has a market cap of $13 billion, while EOS only has a market cap of $3.4 billion.

This is because XRP has a massive circulating supply of 41 billion tokens, while EOS’s circulating supply is only 906 million. With a circulating supply that large, the price of each XRP token can comfortably remain under $1 and still be ranked among the top three cryptocurrencies by market cap.

Market Cap Rankings

Bitcoin is currently ranked number one with a market cap of $69.6 billion. Ether and XRP are always in a close battle for second place with market caps of $14.5 billion for ETH and $13 billion for XRP.

(Source: CoinMarketCap)

The total market cap for all cryptocurrencies is currently $135.1 billion.

(Source: CoinMarketCap)

Large, Mid, and Small Market Caps

Market cap rankings not only show investors what the most popular cryptocurrencies are, but they also show which ones are the most and least risky to invest in. Market caps are divided into three categories: large-cap, mid-cap, and small-cap.

Cryptocurrencies with a market cap of $10 billion or more are classified as large-cap. Currently, bitcoin, ether, and XRP are the only cryptocurrencies that fall into this category. These cryptocurrencies are considered to be safe investments to make (or as safe as one can get for investing in cryptocurrencies).

Cryptocurrencies with a market cap between $1 billion and $10 billion are classified as mid-cap. This currently includes all cryptocurrencies ranked from number four (EOS at $3.38 billion) to number 12 (Cardano at $1.1 billion). These cryptocurrencies are considered to be riskier.

Then finally, cryptocurrencies with a market cap of less than $1 billion are classified as small-cap. These are the riskiest of all and most susceptible to pump and dump schemes. Certain types of investors do tend to favor smaller-cap cryptocurrencies because they can also give them much higher returns over a shorter period.

The volatility of the currency determines risk. A cryptocurrency with a smaller market cap is more likely to experience volatility than one with a large market cap. This is because small market cap coins are more susceptible to price fluctuations when large buy or sell orders are made.

Zcash is a mid-cap cryptocurrency with a current market cap of $300 million. If $100 million worth of zcash were to be bought, that would mean someone has purchased 30 percent of the entire circulating supply and market cap. This would have a massive effect on volatility and price fluctuation for the privacy-centric cryptocurrency.

However, buying $100 million worth of bitcoin would only grant you 0.147 percent of its circulating supply and market cap, meaning the price wouldn’t see much fluctuation at all.

This difference is also demonstrated in the volatility index of both cryptocurrencies. Bitcoin’s volatility index (the percentage of price fluctuation over some time) is just 2.89 percent, whereas zcash’s 30-day volatility index is 16.05 percent.

Lack of Liquidity

One of the biggest hurdles preventing institutional investors from putting more money into the crypto markets is the lack of liquidity. Liquidity merely is the availability of liquid assets (like cash) in a market or company.

At $135.1 billion, the cryptocurrency market is still incredibly small. To put this in perspective, gold currently has a market cap of $7 trillion, and the S&P 500 has a market cap of $23.36 trillion.

Currently, Jeff Bezos’s net worth alone is $7 billion more than the market cap of the entire cryptocurrency market (though it’s looking like crypto may leap over Jeff Bezos once his divorce is finalized).

A lack of liquidity makes it harder for large investors (known as “whales”) to place large buy orders without waiting for a significant amount of time before the order is filled, or without inadvertently moving the price of the asset altogether. This problem only gets worse as one moves from high-cap to small-cap coins, where just a few thousand dollars is enough to drive the price of an altcoin well above a buyers target bid price.

Investing Strategy

Market cap can be a useful metric to determine how an investor might want to diversify their crypto portfolio. Most safe investors prefer to place a little over 50 percent of their funds in bitcoin or other large-cap cryptocurrencies, 20 to 40 percent in mid-cap coins, and ten percent or less in small-cap coins.

This ensures that the majority of their portfolio is somewhat protected from massive volatility, while also allowing them to benefit from any potential price surges that could occur in smaller-capped coins. Of course, when it comes to determining the true value of a cryptocurrency, nothing beats researching the fundamentals of the project, its core team, and value proposition.

Market cap is not only a great metric for evaluating the value and risk of a cryptocurrency but also the overall health of the market.

The size of today’s market cap tells commentators that the asset class is still very far away from achieving mainstream adoption. At its peak in January 2018, the total market cap was $800 billion, yet this is still only about a seventh of the market cap for gold.

Ultimately, observers will need to see more cryptocurrencies achieving high-market cap status via some crucial catalyst, such as an ETF being launched or major financial institutions adopting crypto. This would open the floodgates for institutional investors to pour trillions of dollars into the market, creating the level of demand that could see the overall market cap of the crypto space rival gold and even the S&P 500.