What is a Bitcoin ATM? A beginner’s guide to buying and selling cryptocurrency

Curious about what is a Bitcoin ATM? Learn about these electronic kiosks that let you buy or sell Bitcoin and other cryptocurrencies.

Recently, the popularity and mainstream acceptability of Bitcoin (BTC) have been growing, especially given the Jan. 10 approval of spot Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC).

The move meant that more people could now take advantage of Bitcoin’s price movements without actually having to own the cryptocurrency itself. This helped boost Bitcoin’s price to its highest ever and, more importantly, made it more legitimate as something you can invest in and use to keep your money safe.

Now, the focus is on making Bitcoin easier for everyone to use. This is where Bitcoin ATMs come into play. These are machines where you can buy or sell Bitcoin, along with other well-known digital currencies, all by yourself.

In this guide, we’ll learn about these machines, how they work, where to find them, and how to buy Bitcoin at an ATM.

Table of Contents

What is a Bitcoin ATM?

A Bitcoin ATM, also known as a Bitcoin teller machine (BTM), or crypto ATM, is an electronic kiosk that lets you deposit cash in exchange for Bitcoin or other cryptocurrencies.

These machines often consist of a scanner, a cash dispenser, and an internet connection to manage the transactions. Withdrawing cash from these ATMs for Bitcoins essentially means selling your cryptocurrency to the ATM operator in exchange for fiat.

How does a Bitcoin ATM work?

At first glance, a Bitcoin kiosk might look very similar to a regular ATM, but do they work the same way? How does a Bitcoin ATM work? Mainly, it uses a system that allows different parts to communicate to each other, including you, the person running the machine, and the broader cryptocurrency network.

Firstly, there’s a verification system in place to meet regulatory standards. This system verifies users through ID scanning or SMS verification codes, helping prevent fraud and ensuring traceable transactions.

Next, BTMs connect to your crypto wallet. This connection can be established by scanning a QR code from your mobile wallet app or using a paper wallet provided by the machine.

When a transaction is initiated, the BTM communicates with a cryptocurrency exchange to process the transaction at current market rates. This process involves buying or selling cryptocurrencies.

Security is a priority, so BTMs employ measures like encryption, secure internet connections, and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations to safeguard transactions. This may involve verifying your identity through a phone number or ID scan.

Some BTMs are traditional ATMs customized with software for crypto transactions. This software manages the transaction flow, interfaces with the crypto exchange, and connects to your wallet.

To ensure regulatory compliance, the backend includes systems for transaction limits, reporting suspicious activities, and adhering to financial regulations.

Server and database management are also important aspects of the machine’s backend. The server handles transaction data, user information, and logs, while databases securely store records for future reference and regulatory audits.

Types of Bitcoin ATMs

There are generally two types of Bitcoin ATMs: one-way or unidirectional BTMs and two-way or bidirectional BTMs.

Unidirectional Bitcoin ATMs only support either the buying or selling of crypto, never both. Their operation is much simpler, and you can mostly use them to buy Bitcoin with cash.

On the other hand, bidirectional BTMs allow you to both buy and sell crypto. They are more complicated to operate and provide a broader range of services compared to one-way BTMs.

Each type of machine has its own advantages and disadvantages. For example, Unidirectional ATMs are more accessible for beginners since they are usually easier to use. They also allow for anonymity since many of them may not require ID verification. Furthermore, buying Bitcoin from them is relatively quick.

However, the limited functionalities of these one-way ATMs can be a drawback, especially if you want to sell your crypto. Additionally, transaction costs can be higher than those on web-based exchanges.

On their part, bidirectional Bitcoin machines are advantageous because they let you buy and sell crypto, allowing you to directly convert your digital assets into cash. The process is also relatively quick.

A black mark against such machines is that many of them often only support Bitcoin, meaning if you are interested in other cryptocurrencies you’ll have to use an online exchange.

Two-way Bitcoin dispensers may also have higher fees compared to their online counterparts, and also, there are still quite a few of them, especially outside the United States and Canada.

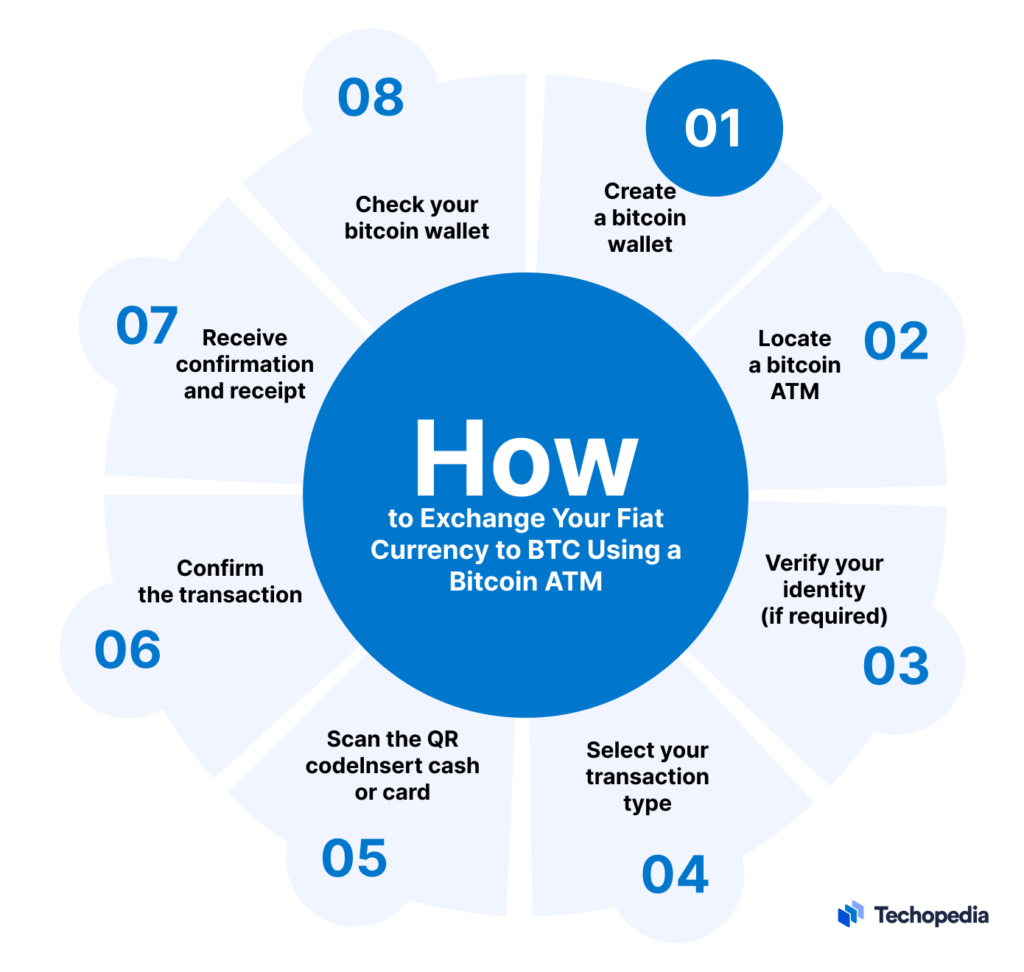

How to use a Bitcoin ATM

As we said earlier, some BTMs not only allow you to buy crypto but also let you sell your holdings. Below, we’ll describe how to use a Bitcoin ATM for each process:

How to buy Bitcoin at an ATM

To buy Bitcoin at an ATM, you need a crypto wallet to store it securely. This wallet allows you to safely send, receive, and store your crypto.

Getting a wallet is straightforward – you can use a hardware wallet or install an app on your phone or computer, and it’s ready to use. If you don’t have a crypto wallet, some BTMs will create a printable paper one for you.

The paper wallet contains two alphanumeric strings of characters and two quick response (QR) codes, which are generated randomly via a key generator. A wallet is necessary to receive and store the cryptocurrency you’ll buy from the BTM.

To find a BTM, you can use online directories, which we’ll discuss later in the guide.

When you’re at the Bitcoin kiosk, the buying process usually goes like this: first, you enter the amount of Bitcoin you want to buy. You might need to verify your identity depending on where you are and how much you’re purchasing. This step could involve providing your phone number or scanning a government-issued ID document.

After that, you provide your crypto wallet address. This is done by scanning the QR code of your wallet using the ATM’s camera. Once the ATM recognizes your wallet address, you can proceed with the payment. Besides cash, some ATMs may also accept credit cards or payment apps.

Once you’ve paid, you’ll receive the crypto in your wallet. This usually takes a few minutes, and the ATM will give you a transaction ID to track the purchase’s status. You’ll get a confirmation in your wallet app when the crypto is successfully added to your wallet.

How to sell Bitcoin at an ATM

After locating a BTM near you, select your desired option, which in this case would be the “Sell BTC” option. The screen should guide you through the process.

You’ll then enter the amount of crypto you want to sell. Depending on local rules and the amount, you might need to confirm your identity, either by scanning an ID document or giving a registered phone number through which you’ll receive a text with a code that you’ll key into the machine.

Next, the BTM will generate an address for your transaction, which you can scan using your crypto wallet app to send the crypto you are selling securely. Once the ATM receives the crypto, it will dispense cash equivalent to the crypto you have sold minus service fees. This typically happens within a few minutes, and you can track the transaction’s progress using your wallet app.

Where to find a Bitcoin ATM

Bitcoin ATMs can be found in plenty of locations around the globe, but compared to traditional automated tellers, the numbers are still quite low. As such, getting one may not be a straightforward affair.

The easiest solution for those asking themselves, how to find a Bitcoin ATM near me, is to use online tools like Bitcoin.com’s ATM map, Digital Mint, and Coin ATM Radar. Such platforms provide up-to-date information on the location of new and existing crypto ATMs.

You can enter your address, city, and state, or use your current location to discover nearby BTMs on the Bitcoin.com ATM map. The website features a list of crypto ATM providers, a brief description of how to buy or sell Bitcoin, and an interactive map that automatically logs your location and shows you the number of Bitcoin kiosks in your area and their specific locations.

Digital Mint works in a similar fashion to the Bitcoin.com ATM map, with the main difference being that its locator service is mainly centered around Canada and the United States. The platform also notifies users via text messages when new locations are launched.

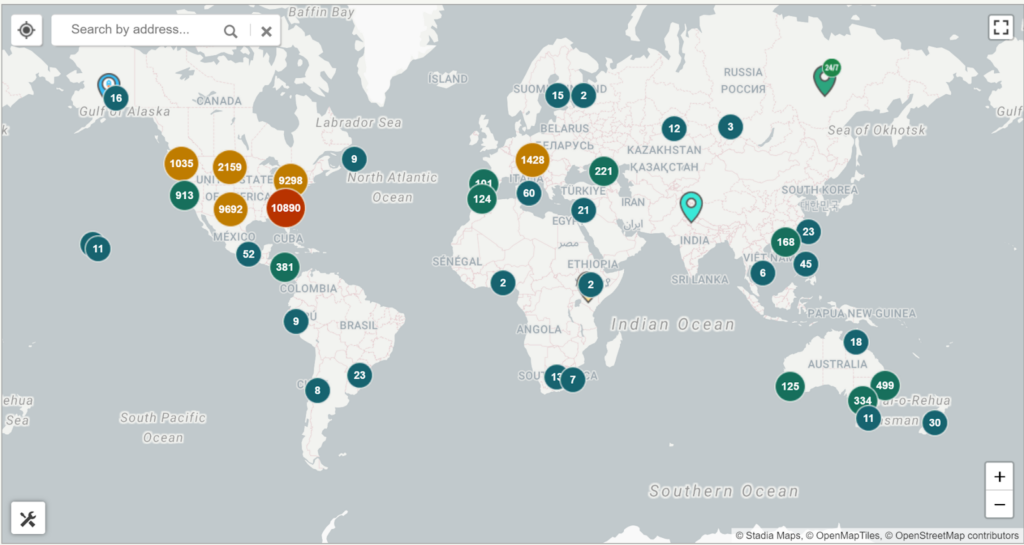

How many Bitcoin ATMs are there?

According to the Coin ATM Radar, there are currently 37,109 Bitcoin ATMs in 72 countries worldwide, with the vast majority found in the U.S.

Per the website, the U.S. has more than 30,000 machines, with Canada following at a distant second with about 2,860 machines. El Salvador, which recognizes Bitcoin as legal tender, reportedly has 216 Bitcoin ATMs, 38 more than Germany, and about the same as France, Turkey, Russia, New Zealand, and Slovakia combined.

Bitcoin ATM fees

There are two types of Bitcoin ATM fees charged: what you pay at the kiosk for services rendered, and what you pay for transferring crypto between wallets.

When you use a Bitcoin ATM machine, you pay an exchange fee. This fee goes to the ATM operator for turning your cash into Bitcoin. It covers their costs like upkeep and running the ATM. Usually, this fee is a percentage of your transaction.

Additionally, when you send crypto from your wallet to someone else’s, you pay a transfer fee. This fee is not from the ATM but goes to validators on the cryptocurrency network, who confirm and ensure transactions are real. The fee amount can change based on how busy the network is and how fast you need your transaction to happen.

How much does a Bitcoin ATM charge?

When you use a Bitcoin ATM to convert regular currency into cryptocurrency, you’ll encounter significant exchange fees. According to Crypto Dispensers, these fees can vary widely between 10% and 23%, depending on your specific ATM operator.

In addition to these Bitcoin ATM fees, there is a network fee for the transaction. Typically ranging from $1 to $3.

According to Crypto Dispensers, while higher network fees are mentioned in some cases, they usually stay on the lower end of this range and rarely exceed $6.

Are Bitcoin ATMs legal?

Bitcoin ATM machines are legal in most regions, but regulation can vary. In the United States, for example, these ATMs are overseen by the Financial Crimes Enforcement Network (FinCEN). Operators must register as money services businesses and implement strong AML and KYC measures for transactions exceeding a specific limit.

At the state level, crypto ATM operators often need a money transmitter license, following specific state rules and consumer protection laws. These laws can include transparent fee disclosure, safeguarding consumer data, and meeting operational standards. Local regulations, like zoning laws, also affect how crypto ATMs operate.

State regulators have also raised concerns regarding the operations of BTC ATMs. While legitimate companies run most of the machines, there’s a worry that crypto ATMs can also serve the interests of fraudsters and money launderers.

Internationally, laws governing crypto dispensers may vary. In the U.K., for instance, the Financial Conduct Authority (FCA) has stepped up efforts to regulate crypto ATMs.