Lido DAO (LDO) jumps 10% following Q1 metrics report

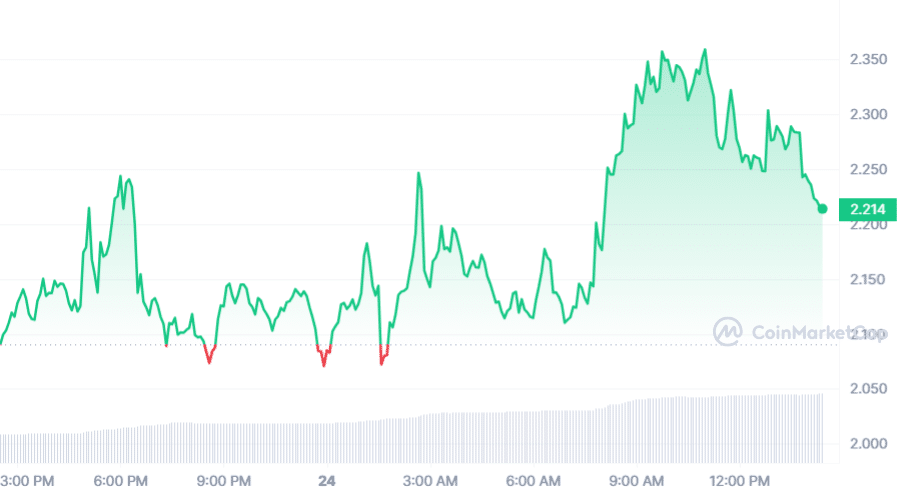

Lido DAO (LDO) has seen its token price surge following the release of its Validator and Node Operator Metrics (VaNOM) report for Q1 2024.

At the time of writing, LDO was trading at $2.35, reflecting a 10% rise over the past 24 hours. The market cap of LDO exceeded $2 billion, and the 24-hour trading volume reached $474 million, marking a 148% increase.

The VaNOM report, published on May 23, highlighted a shift in client diversity, especially at the execution level. The usage rate of the client Geth dropped to 46%, a significant decline from 96% in 2022 and 67% in the fourth quarter of 2023.

Additionally, the report indicated a reduction in the use of public clouds, falling from 46% to 40%. These changes suggest a diversification in technology and a move away from reliance on specific platforms like Geth and public clouds.

The report did not specify the reasons for these changes.

Earlier on May 21, LDO’s price surged by 40% after Lido DAO effectively managed a security breach involving Numic. The breach, identified on May 14, involved unauthorized access to a developer machine used by Numic, a Node Operator collaborating with Lido on the Ethereum protocol.

Despite concerns about potential compromise of the mainnet validators’ encrypted key material backups, there was no evidence of tampering or malicious use.

Numic responded promptly by setting all depositable keys to zero and systematically removing any potentially compromised keys. The action prevented new deposits from being directed to validators that might have been compromised.

Lido DAO contributors played a crucial role in assisting Numic with a thorough investigation of the breach. The precautionary measures were successfully implemented without disrupting validator operations, and the incident did not result in any financial losses.