LINK price increases 5.8%, whale activity follows

Chainlink (LINK) has recorded significant gains over the past 24 hours. The recent surge has triggered a massive rise in the asset’s whale activity.

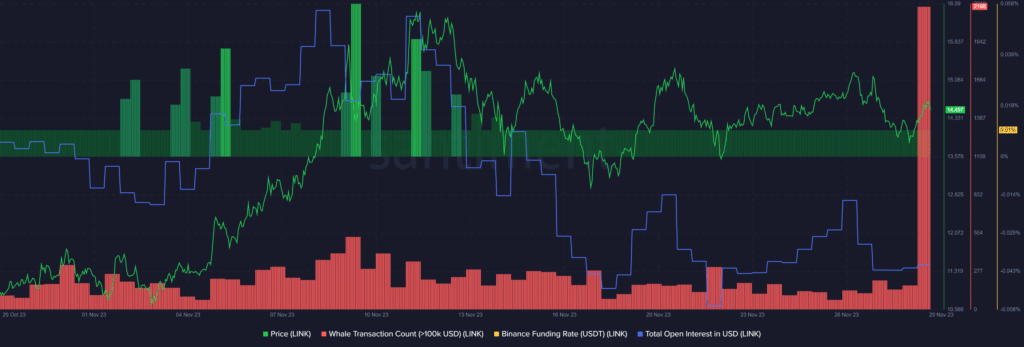

LINK is up by 5.8% in the past 24 hours and is trading at $14.72 at the time of writing. The asset’s market cap rose to $8.2 billion. However, Chainlink’s daily trading volume registered a 1.7% decline, dropping to around $570 million.

According to data provided by the market intelligence platform Santiment, whale transactions consisting of at least $100,000 worth of LINK rallied by 1,145% over the past day — rising from 176 transactions on Nov. 28 to 2,198 transactions at the time of writing.

When the whale activity of an asset grows fast, higher volatility is usually expected.

Moreover, Santiment data shows that LINK’s total open interest (OI) registered a small surge over the past 24 hours — rising from $211.5 million to $213.1 million in a day.

Per the market intelligence platform, Chainlink’s Binance funding rate currently stands at 0.01%, showing a slight domination of long traders until further movements. A rise in the amount of short trades could potentially make the price bounce.

On the other hand, LINK’s price-daily active addresses (DAA) divergence is hovering at negative 4%. When the price DAA divergence falls below the zero mark, a sell signal is automatically triggered since the asset’s price might witness sudden movements due to high whale activity.

On Nov. 17, the popular AI platform ChatGPT announced the integration of Chainlink CCIP. Per the report, the upgrade would improve the cross-chain interoperability between Ethereum and Polygon and allow users to buy and sell prompts.