Liquidation Volume Reaches $120 Million as Bitcoin (BTC) and Ether (ETH) Tumble by More than 2.5%

As BTC and ETH experienced one of the largest price declines in the past few months, the liquidation volume reach an amount of $120 million, including 95% long positions.

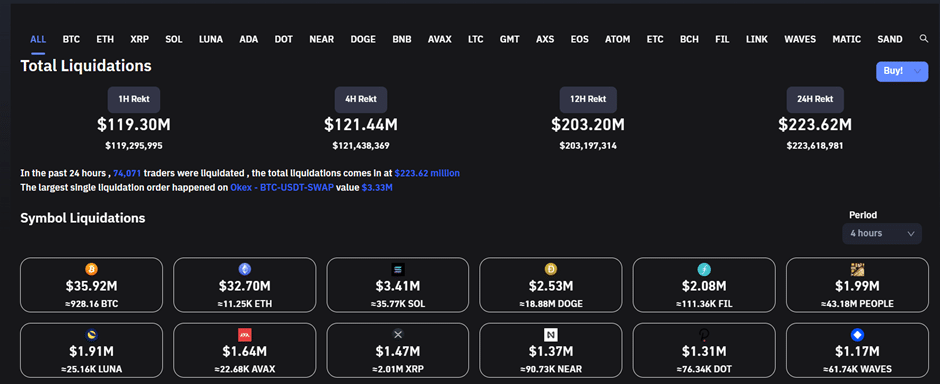

Total Liquidations as of April 18

Despite the short-term stabilization of the BTC price in the range of $39,500-$40,500 in the previous days, the rapid price and capitalization decline in the first hours of April 18th confirmed the serious bearish dominance in the crypto market at the moment.

Many traders perceived the market situation as the optimal opportunity for opening long positions because they suggested that the local bottom had been already reached. As a result, the rapid decline to the price level of $38,700 caused large-scale positions’ liquidations among those traders who invested in the BTC price appreciation. A similar situation is also observed in Ethereum’s segment.

According to Wu Blockchain, the proportion of liquidations appeared to be highly non-uniform among the major crypto assets. Thus, BTC holders suffered losses of about $35.92 million followed by Ethereum traders with the liquidation losses being about $32.70.

Other major crypto projects that experienced significant liquidations included Solana ($3.41 million), Dogecoin ($2.53 million), and Filecoin ($2.08 million). They constituted the major targets of crypto traders’ short-term investments. While traders concentrated on other assets suffered lower losses, they were also considerable. Such liquidations can seriously affect the entire structure of the crypto industry and its further development in the following months.

Most Affected Cryptocurrencies and General Situation in the Market

The past 24 hours were characterized by the significant concentration of bears’ power and their success in pushing the value of bitcoin below the support level of $39,500-$40,000.

According to CoinGecko, Bitcoin declined by 3.9% and Ethereum – by 3.9% during the past 24 hours. At the same time, the following tokens from the Top-20 lost more than 6.5% of their market value: Cardano (7.3%); Polkadot (7.9%); Solana (6.7%); Dogecoin (6.7%); and Shiba Inu (6.9%). No cryptocurrency from the Top-20 was able to demonstrate even a minor growth within the past day, confirming the negative consequences of the crypto winter.

In most cases, a series of large-scale liquidations creates a basis for the further price decline. The reason is that bulls lack financial resources for restoring the previous market position.

Moreover, new investors may be afraid of market conditions and abstain from entering the market at current prices and market dynamics. The panic environment may especially affect many short-term holders who lack strategic vision and the proper understanding of the long-term dynamics of the crypto market. Hodlers will be able to maintain their position, but their influence may be insufficient for reversing the negative market trends.

Price Implications for Crypto Market

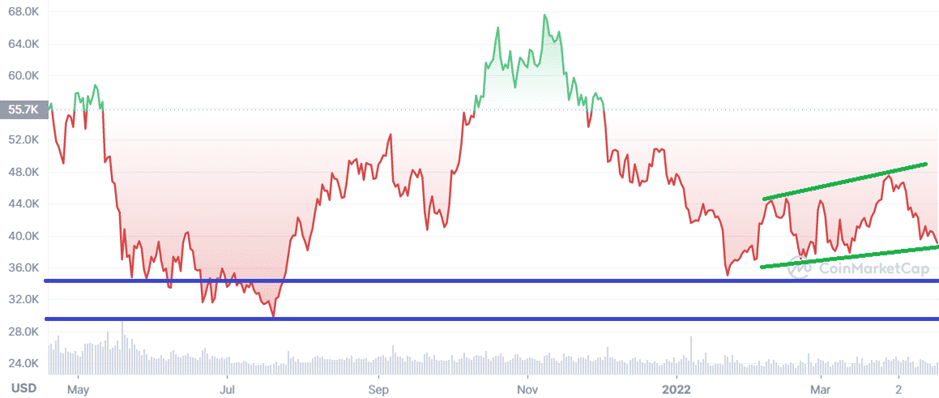

Due to the growing bearish pressure in the crypto market, technical analysis may be helpful for determining the key support levels that may determine the future price and capitalization dynamics for BTC and other major cryptocurrencies. At the present moment, the BTC price moves within the correctional channel that can be broken downwards within the following few days.

In case bears succeed in breaking the current channel, their first major target will be the BTC price of $35,500 that corresponds to one of local bottoms within the past several months. Thus, bulls should try to maintain the price dynamics within the current correctional channel in order to prevent the major capitulation in the following months. Moreover, in case bears reach the first support level, they will try to decline the market price even with the key target of $30,000 that is close to the minimum reached in August of 2021.

Similar risks are also observed in regards to Ethereum and other major altcoins that face considerable risks of price decline by 10% and more. Even meme coins that are traditionally stable in the declining market and can demonstrate growth based on Elon Musk’s tweets or other news tend to depreciate significantly due to the lack of positive fundamental factors at the moment.

Under such conditions, many investors prefer to reallocate some of their assets to stablecoins that may be more effective in preserving the monetary value of their investments. The likelihood of high volatility in the following weeks remains substantial.