Litecoin Price Analysis: March 9, 2018

So, from jump on the LTC-USD 4-hour chart, it looks like the price of litecoin broke downward instead of up. Obviously, this is due to the steep downturn within the market after BTC shit the bed on March 6.

Currently, on that same chart, the next real support point would be at $156. Since LTC-USD just sort of shot up from there before, there’s no real support points between where it is now and $156, making that a likely target to rush to even though that does represent an approximate drop of 11 percent from where it is now, essentially crushing all of the gains that it made over the last month.

The Outlook for LTC-BTC

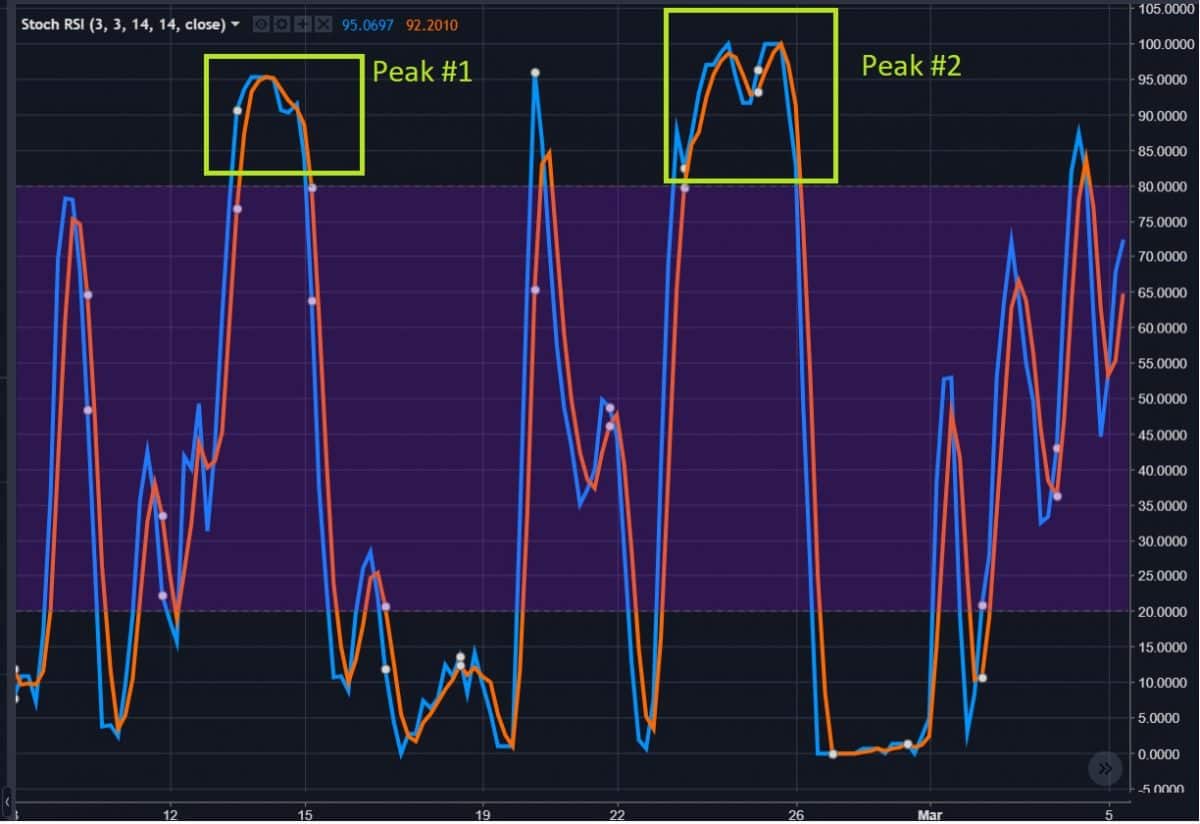

Before closing the book on LTC-USD like that though – one must evaluate the LTC-BTC charts as well. As you can see, there was a clear double top formation that took place, followed by the necessary drop that the formation dictates, then it bottomed out at 0.0180 LTC-BTC mark, ending the impact of the formation.

The formation is now out of play at this point and is not an impact on the price.

As it stands, LTC is currently at 0.018850 LTC-BTC, which makes sense because it was overbought at the higher BTC level that it reached off of the double-top formation. See below:

The author tried to mark out the areas on the STOCH RSI indicator where both of the peaks of the double tops for the LTC-BTC (4-hour) pairing were.

MACD speaks for itself. Pretty substantial that it crossed at 0.0180 BTC-LTC (bottoming out point). Divergence between MACD (blue line) and price for a while before eventually the divergence only occurred on the Histogram (histogram got larger).

In non-specialist terms the MACD was signaling while the price (in BTC) was still declining, which is notable because that doesn’t usually happen.

Above is a picture of the EMA 50 (light pink) and EMA 200 (darker blue) crossing (EMA200>EMA50) to form a death cross. While this is notable on the 4-hour timeframe for the LTC-BTC pairing, the lack of divergence between the two lines means that the pair could easily cross again. This is something to definitely look out for.

At the time of writing, the price is currently diving below the EMA50 as well, which would make it a resistance point.

The price still has yet to break the EMA-200 resistance point that has been established either.

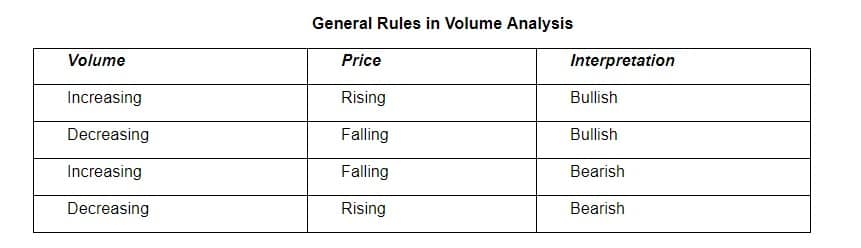

The price gain was accompanied by a decrease in volume as well – which is always an ominous sign of an impending price drop.

The author has posted this many times before from here, but it’s something that every trader should remember in general. It’s not exactly law, but it serves as an important reminder of what usually happens in these types of situations.

More general rules that are important to remember:

Source: http://www.rediff.com/money/special/trading-volume-what-it-reveals-about-the-market/20090703.htm

Conclusion

There’s a good chance that litecoin continues to depreciate in USD value and it may even start to backslide against BTC as well in the coming days as evidenced by the death cross on the LTC-BTC 4-hour chart.

Update

From the time that this analysis was created to posting, Litecoin already touched down to the $156 mark (almost exactly), then bounced back upward:

Currently, at the time of writing, the price is sitting down around $184.07. It’s actually withstood a substantial amount of price depreciation (USD) in the market, and it’s actually appreciated recently against BTC:

This would mean, that it should reasonably break through the next Fibonacci level hanging over it on the LTC-USD chart:

Given the increase in buy volume on both pairings, it looks like it could be a shoe-in to break through this next point of resistance.

Given the increase in buy volume on both pairings, it looks like it could be a shoe-in to break through this next point of resistance.

So What’s the Cause for This Random Boost?

It could be the news that the Winklevoss Twins released approximately a day ago that the Gemini exchange (owned by them) may be adding Litecoin and Bitcoin Cash in the near future:

This is somewhat corroborated by the price appreciation of BCH/BTC too:

It’s possible that litecoin has seen a greater appreciation in its price from the news due to the fact that it’s coming off of the heels of Charlie Lee’s (creator of Litecoin) proclamation that litecoin will soar in market cap value as well as the launch of LitePay.

It remains to be seen whether this news will have a long-term lasting effect on the overall lift of litecoin, but we shall see. If bitcoin continues to make further downward movements, then it is possible that Litecoin will eventually follow suit. The same supports that were listed in the original article remain valid at this point in time.

The author owns litecoin. Please do your own research before investing in cryptocurrency.