Litecoin’s price breaks above $106 for 1st time since July 2023; More gains ahead?

Litecoin’s price reached an eight-month peak of $106.2 on March 29, and recent trends observed among miners and speculative traders suggest more gains ahead.

On March 29, Litecoin emerged as the best-performing asset in the top 20 crypto market rankings after scoring 12% gains within a frenetic 12-hour period.

On-chain data trends pinpoint the key drivers behind the ongoing Litecoin price breakout and how speculative traders have positioned their bets on LTC for the coming days.

Litecoin miners leading the rally

Litecoin’s price has been spiraling downward since the completion of its third halving event on Aug. 2 of last year. A post-halving sell-off from miners and other vital stakeholders sent LTC toward a two-year low of $57 within two weeks of the Litecoin halving.

Since then, LTC had failed to reclaim the $100 territory until the market momentum swung bullish again in March 2024.

Trading above the $105 mark on March 29, Litecoin’s price has gained 33.5% this month. Critical on-chain data trends suggest that the miners have been pivotal in driving the ongoing LTC price rally.

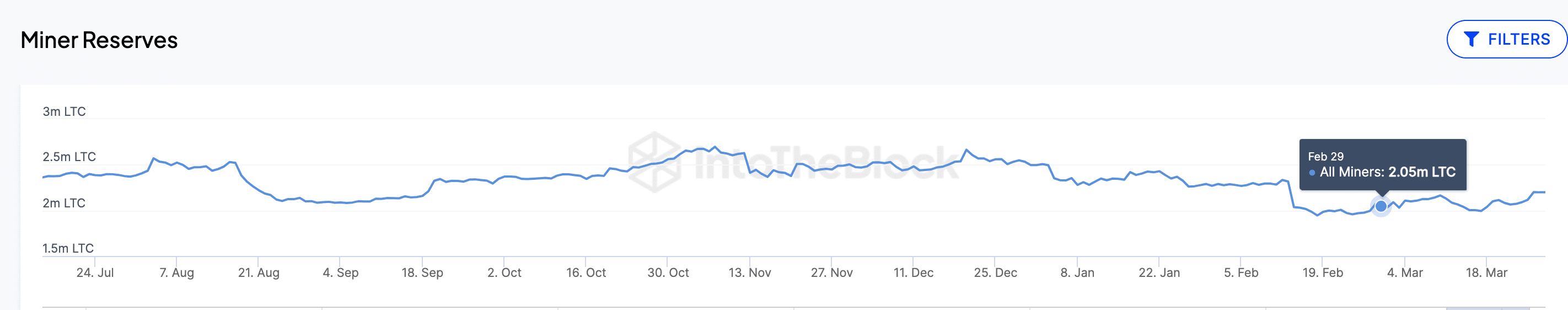

IntoTheBlock’s chart tracks real-time changes in the number of coins held in the custody of recognized miners and mining pools.

The chart above shows that Litecoin miners accumulated 150,000 LTC coins in March, bringing their balances from just over 2 million LTC on Feb. 29 to 2.2 million LTC at press time on March 29.

Valued at current prices, the newly acquired 150,000 LTC are worth approximately $16 million. The significant increase in miners’ reserves within 30 days has had a significant bullish impact on prices.

When miners enter accumulation mode, it reduces the amount of newly issued coins trickling into the market supply, leaving room for bullish buyers to exert dominance. It also reflects that most miners are confident in LTC’s near-term price prospects, hence the overwhelming preference to hold out for future gains.

Additionally, it is widely speculated that when block rewards for Bitcoin mining get halved on April 20, many unprofitable miners could turn towards other Proof of Work (PoW) networks like Litecoin.

In effect, the LTC miners could keep accumulating reserves in hopes that the forthcoming Bitcoin halving event will enhance network sophistication and possibly trigger more positive Litecoin price action.

After 33% gains, LTC price still undervalued

The 12% LTC price surge on March 29 brings the total gains for March 2024 to 33%. However, compared to recent capital inflows recorded in the Litecoin derivative markets, the LTC price still appears undervalued.

Coinalayze’s open interest chart below tracks the total value of active derivatives contracts currently listed for a specific cryptocurrency. It provides insights into the amount of capital deployed in derivative positions, including futures and options, serving as a critical indicator of market sentiment and potential price movements.

Looking at the chart above, LTC’s open interest increased from $337 million to $481 million on March 29. This shows that speculative traders have piled on $144 million in fresh capital inflows.

But more importantly, it shows that while the LTC price has grown 12% in the last 12 hours, open interest has surged 42%.

When open interest growth outpaces price action at the onset of a breakout, market participants are optimistic that the upward trend will persist, as evidenced by their willingness to establish new positions or expand existing ones.

Litecoin price forecast: $150 before Bitcoin Halving?

Drawing inferences from the miners’ $16 million accumulation wave and the $144 million capital inflows into the LTC derivatives markets, the Litecoin price looks poised to advance toward the $150 mark ahead of the Bitcoin Halving slated for April 20.

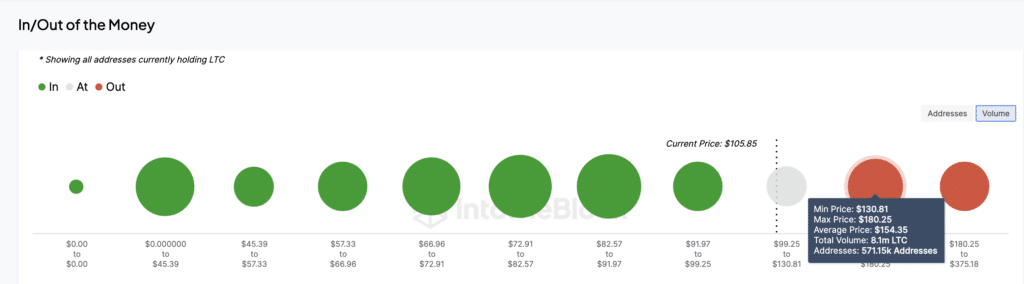

However, bulls now face a looming sell-wall at the $130 range. IntoTheBlock’s global in/out of money around price data shows that 571,150 existing addresses had acquired 8.1 million LTC at the minimum price of $130.81.

Considering that they have been holding at a loss since July 2023, most could opt to sell once they break even. However, a decisive breakout towards $150 could be on the cards if the bullish momentum intensifies.

On the downside, the bears could regain their foothold in the markets if the Litecoin price reverses below $90. But with speculative traders piling on fresh capital inflows, this seems unlikely in the near term.