Major CEXs persist in delisting anonymous coins: the end for the privacy era?

Amid the news that Binance would delist Monero, should the crypto community brace for the decline of the era of anonymous tokens, or will alternative solutions emerge?

In the world of cryptocurrency, transactions are logged in a public ledger, meaning that one can trace a person’s identity with some effort. However, privacy-focused coins aim to change that.

Anonymous coins are digital currencies designed to uphold secrecy by obfuscating the movement of funds within their networks. The most popular anonymous tokens are:

- Monero (XMR): Monero uses ring signatures to blend private and public keys.

- Zcash (ZEC): The coin employs the zk-SNARK protocol, enabling users to prove information accuracy without revealing details.

- Komodo (KMD): A Zcash fork that facilitates public and anonymous transactions using zero-knowledge proof and a delayed proof-of-work (dPoW) protocol.

- Dash (DASH): Divides coins from multiple senders into elements, thoroughly mixing them.

- Verge (XVG): Utilizes Tor software to conceal transfer locations and user IP addresses

A few years ago, many investors, traders, and users of crypto assets held a negative view of anonymous coins. Despite this sentiment, a dedicated group of admirers still see the potential of such technology. However, the sheer volume of enthusiasts may not reach the levels seen in the past.

What is wrong with anonymous tokens?

The primary aim of anonymous cryptocurrencies is to safeguard the privacy of financial transactions. However, their proliferation has coincided with a notable rise in fraudulent attacks and financial crimes involving cryptocurrencies, with attackers leveraging these tokens to obscure the movement of illicit funds.

In response, governments worldwide have pivoted towards stricter cryptocurrency regulations, targeting what are known as confidential coins. Certain crypto platforms are opting to discontinue support for these privacy-focused tokens.

By refraining from an outright ban on digital currencies, governments aim to address two primary concerns: safeguarding investors and traders and curbing criminal activities facilitated by cryptocurrencies.

Sanctions against Tornado Cash

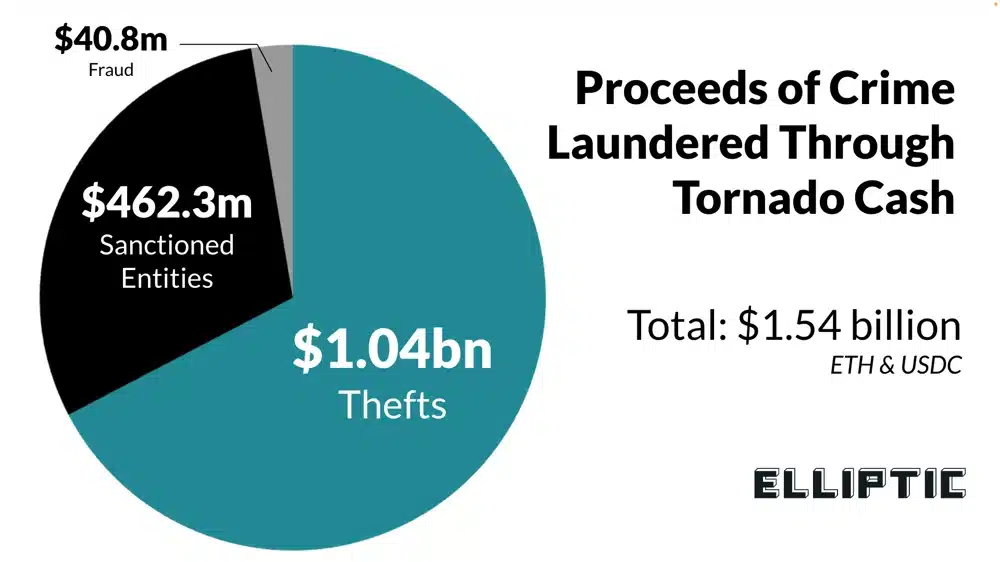

On Aug. 8, 2022, the U.S. Department of the Treasury published an update to the Sanctions List (SDN), adding the Tornado Cash cryptocurrency protocol and its associated digital wallet addresses. The decision was prompted by findings indicating the platform’s use in laundering illicitly obtained funds, where crypto-assets were acquired using proceeds from illegal activities.

OFAC also claims that Tornado Cash has become a key tool used by criminals to launder cryptocurrency funds stolen from decentralized exchanges and games such as Axie Infinity.

Sanctions against Tornado Cash represent a significant regulatory action not only targeting crypto mixers but also highlighting concerns about privacy-enhanced coins in general. The expansion of sanctions beyond individual addresses to encompass project codes sets a potentially precedent-setting action with broad implications, particularly for U.S. citizens.

These developments have sparked concerns within the cryptocurrency community about the potential banning of other anonymous cryptocurrencies. For instance, the Monero community acknowledges a possible negative outcome, especially following the arrest of Alexey Pertsev from the Tornado Cash team, as many viewed Monero as a direct competitor.

Trends in delisting anonymous coins

There’s a noticeable trend towards increased regulation in the cryptocurrency sphere, with major exchanges seeking licenses across various jurisdictions to ensure regulatory compliance.

In December 2023, the OKX crypto exchange announced the delisting of several anonymous cryptocurrencies, including Monero and ZCash. The platform cited the reason for deleting trading pairs as “not meeting its strict criteria.”

Similarly, Binance announced the delisting of anonymous cryptocurrencies like Monero in February, prompting a significant drop in XMR’s value by nearly 20%.

In June 2023, following user feedback, Binance reversed its decision to delist some privacy coins in certain European countries. Seven cryptocurrencies, including Decred, Dash, Zcash, PIVX, Navcoin, Secret, and Verge, were exempted from delisting in France, Italy, Poland, and Spain. The firm clarified that restrictions will still apply to Beam, Monero, Mobilecoin, Firo, and Horizen. The crypto exchange announced the possibility of creating an updated classification of coins that would meet the requirements of regulators.

Some crypto community members speculate that Binance’s decision to delist Monero stems from its reluctance to engage with anonymous cryptocurrencies, which may clash with government interests.

Regulatory authorities in the U.S. and elsewhere have raised concerns about the exchange. Binance’s move away from anonymous coins could be interpreted as a response to regulatory pressure.

What will happen to anonymous cryptocurrencies?

Authorities are hesitant to endorse completely anonymous payment tools. Will they treat privacy coins like they did Bitcoin? Unlikely. Regulators are pushing for strict rules requiring full transaction identification and reporting.

As a result, private coins may not fit into the general trend of global adoption of cryptocurrencies. Exchanges may continue to refuse them, and they should not expect an influx of institutional money. However, if teams abandon the anonymity function, their projects will lose their unique properties and a significant part of their users.

Alexander Ray, CEO of Albus Protocol, a KYC verification platform, expressed concerns about the future of anonymous cryptocurrencies in regulated financial settings. In an interview with crypto.news, he said:

“Regulators will increasingly view anonymous cryptocurrencies not just with skepticism but as active tools to evade transparency and AML/ATF regulations. This perspective is not just a prediction but a reflection of the evolving demands for oversight in the digital currency domain, suggesting a potentially difficult road ahead for the acceptance and sustainability of anonymous cryptocurrencies in regulated financial circles.”

Alexander Ray, CEO of Albus Protocol

Perhaps the crypto community will soon see a change in positioning among many private coins. Some may abandon their anonymous status, focusing on developing network scalability and speed. And some will remain a niche product for those who value privacy.