Maker token fails to hold gains despite investments

Stablecoin DAI is considering increasing the amount of money it invests in United States Treasury bonds from the current allocation of $500 million to a potential total of $1.25 billion.

According to a new active proposal made public on March 6, the change would allow MakerDAO to take advantage of the current yield environment.

The new proposal called for an increase of $750 million in the present allocation of $500 million, which is currently composed of $400 million in Treasury bonds and $100 million in corporate bonds.

MakerDAO plans to accomplish this goal by implementing a scheme using the U.S. Treasury ladder that lasts six months and involves rollovers every two weeks. This most recent proposal follows on the heels of several high-profile actions by MakerDAO, one of which was a current plan allowing holders of MKR tokens to borrow DAI.

How MakerDao utilized the deal

According to the MakerDAO, this investing technique accounts for over 50% of MakerDAO’s yearly income. As of right now, the current portfolio of MIP65 is made up of iShares $ Treasury Bond 0-1 yr UCITS ETF which has a market cap of $351.4 million worth of IB01 shares, and iShares $ Treasury Bond 1-3 yr UCITS ETF which had a market value of $150.6 million.

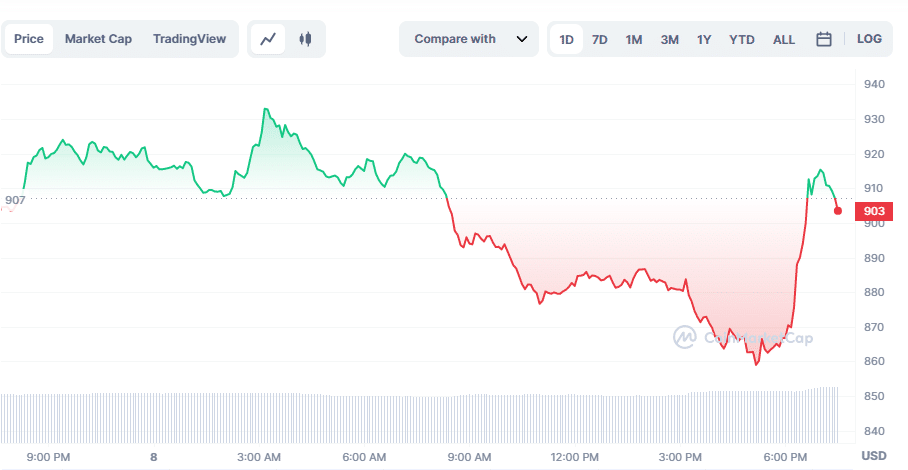

Maker’s 24-hour chart performance

Maker is struggling to recover amid the announcement of its new investment strategy. The asset, currently trading at $904.07, is in a zone of uncertainty as the asset looks came close to consolidating a bullish trend.

The uncertainty in the assets market saw maker’s price come down to $860 during the 24 hours before gaining slight support, as seen in the charts above.

As of the time of writing, the asset was 0.05% down from its previous 24-hour price after registering a short recovery run amid the downward trend earlier in the day. The current market situation reveals the competition between bulls and bears to gain market control as the trading volume registered a 15% increase.