Marathon Digital tops US trading charts as Bitcoin miner stocks surge

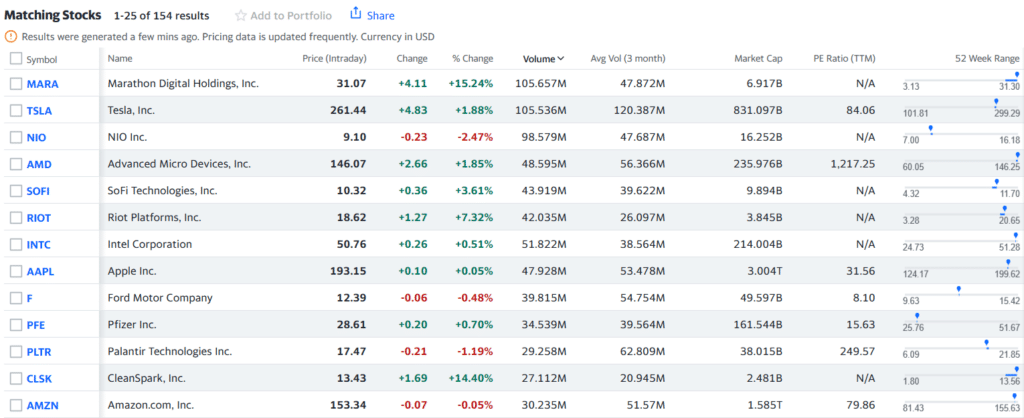

Bitcoin miner Marathon Digital has seen its stock trading volumes soar, topping U.S. mid and large-cap stocks ahead of a potential spot Bitcoin ETF approval.

In the past 24 hours, the firm’s trading volume exceeded 105 million shares, outperforming tech giants like Tesla, Apple, and Amazon, as per Yahoo Finance’s market data.

Riot Platforms, another significant player in the Bitcoin mining sector, also marked a notable presence, ranking as the sixth most-traded stock with over 40 million shares traded in the same period.

This surge in Bitcoin mining stocks is attributed to the mining industry’s expansion efforts in anticipation of the potential approval of a spot Bitcoin exchange-traded fund (ETF) in early January, coupled with the upcoming Bitcoin halving event in April.

Recently, Marathon announced its intention to acquire two mining centers for $179 million, a strategic move to boost its mining capacity by an additional 390 megawatts, supplementing its current 584-megawatt output.

Riot Platforms, on a similar growth trajectory, purchased Bitcoin mining rigs worth $291 million, marking the firm’s largest hash rate increase to date.

2023 has been a prosperous year for Bitcoin, with its value escalating by over 163% since the year’s start. However, Bitcoin mining stocks, particularly those of Marathon Digital and Riot Platforms, have outpaced Bitcoin’s growth, recording year-to-date gains of 767% and 452%, respectively, according to TradingView data.

The scenario was starkly different for Marathon last year, as the company faced a near $400 million loss in a quarter marred by declining Bitcoin prices, a power outage at its Montana facility, and financial exposure to the then-bankrupt miner Compute North.

Bitcoin mining, known for its high energy costs, faces significant financial challenges during Bitcoin price downturns, as miners’ earnings diminish while energy costs remain high.

Marathon’s CEO, Fred Thiel, highlighted the company’s resilience, having overcome debt hurdles except for a convertible note. He also noted Marathon’s recent shift to expansion, including the acquisition of two fully owned Bitcoin mining sites in Texas and Nebraska for $178.6 million.

These acquisitions have expanded Marathon’s mining portfolio by 56%, which now boasts 910 megawatts of capacity.

Thiel also emphasized the company’s focus on increased efficiency and diversification, aiming to reduce reliance on Bitcoin mining to 50% of its revenue by 2028.

Coinbase, the largest publicly traded crypto exchange, has also seen significant growth, with its value increasing by over 450% since the beginning of 2023.

The crypto sector, still recovering from the FTX collapse and other 2022 setbacks, began the year as a popular short trade. However, this strategy backfired for many traders, as over $6 billion in crypto-related shorts have been liquidated this year.