Marathon shifts to international ventures ahead of Bitcoin halving

Marathon, the world’s largest Bitcoin mining firm boasting a hash rate of 19.2 EH/s, is now focusing on international joint ventures for future growth.

On Nov. 14, Bitcoin (BTC) mining expert Jaran Mellerud shared Marathon’s operations report, highlighting the company’s preparations for the upcoming Bitcoin halving, set to occur in less than six months.

As the largest public miner by hash rate and Bitcoin holdings, Marathon boasts an impressive 19.2 EH/s and owns approximately 13,396 BTC, valued at an estimated $474 million.

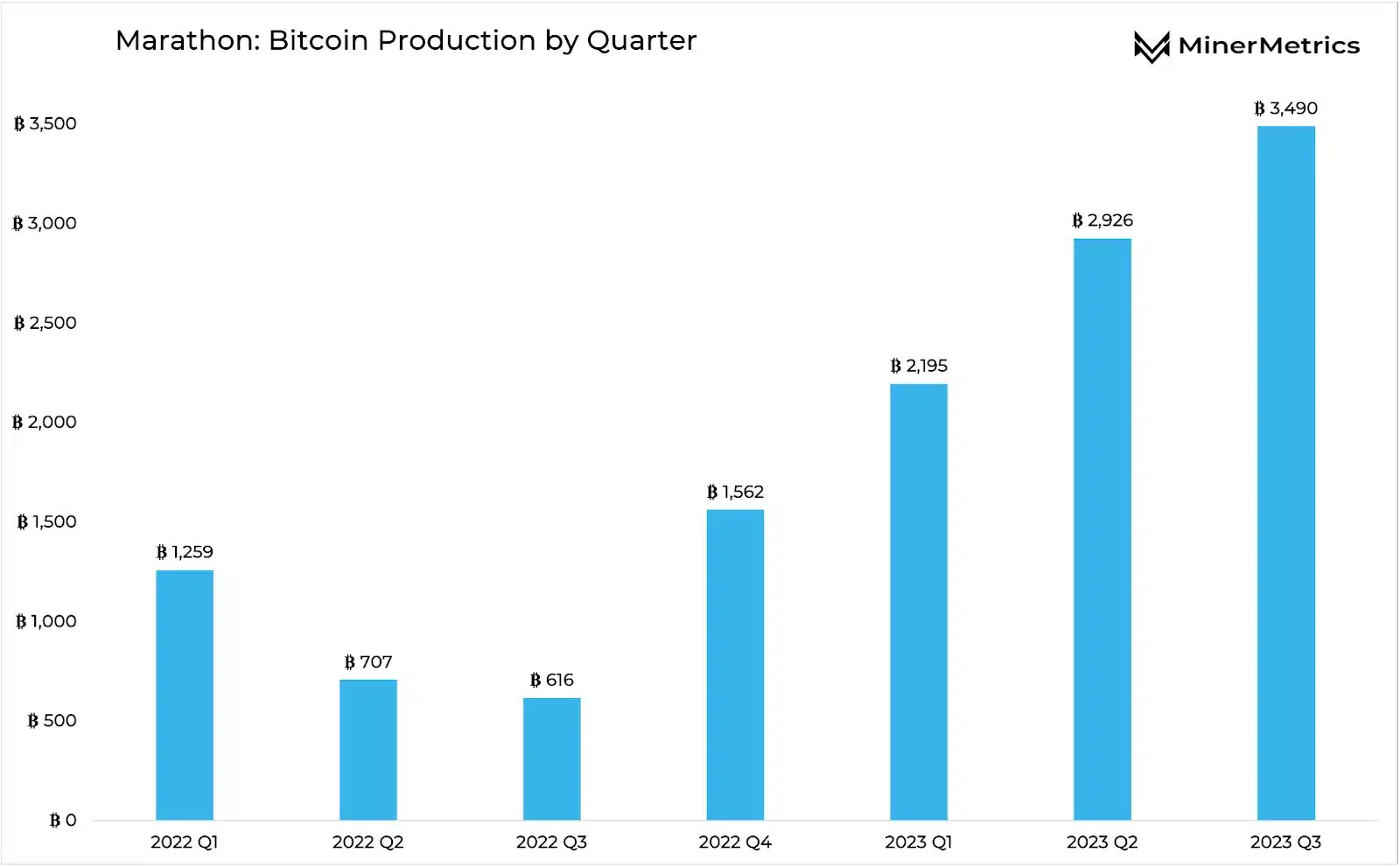

According to the report, Marathon has grown its Bitcoin production by 467% in one year, expanding its hash rate from 7 EH/s one year ago.

This growth has translated into substantial production gains, with the firm’s Bitcoin output rising from 416 BTC in Q3 2022 to a massive 3,490 BTC in Q3 2023.

The report also indicates that Marathon is on track to achieve its goal of 23 EH/s, thanks to the upcoming full operation of its Garden City, Texas facility. However, the energization of this site has faced delays since July.

However, the company has indicated a strategic turn towards international joint ventures. This approach could position it as the most geographically diversified miner, potentially leading to a gradual decrease in production costs.

The firm’s focus is shifting from U.S.-based hosted facilities, plagued by high costs and energization delays, to more global partnerships.

Plans are underway for expansion into new territories, with facilities in Abu Dhabi and Paraguay expected to increase the company’s capacity by 30% in 2024.

Despite improvements in its cost structure, Marathon still faces relatively high expenses compared to its peers. The impending halving and potential drops in Bitcoin prices below $30,000 could further impact the firm’s margins.

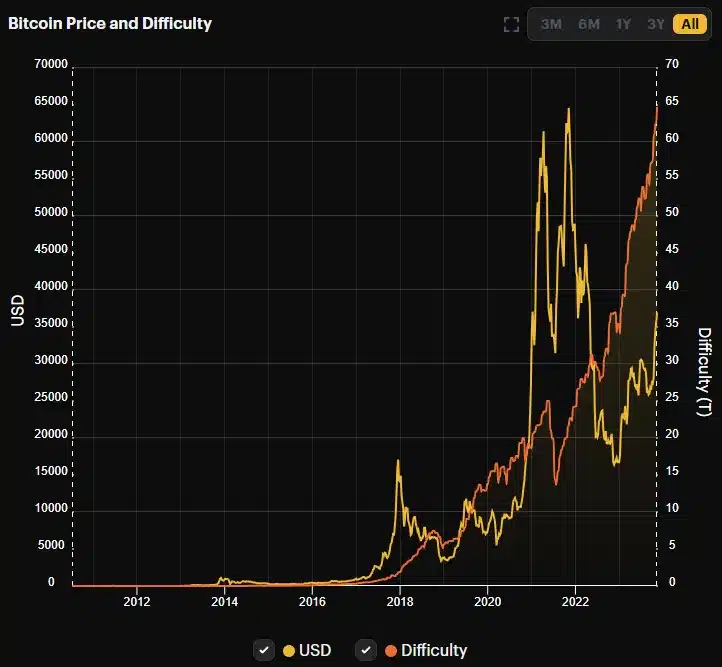

The Bitcoin network is operating at a near-record hash rate of 428 EH/s, intensifying competition among miners. The mining difficulty, a measure of the effort required to mine on the network, stands at a peak level of 64.6T.

Despite recent price increases, mining profitability remains low, with a hash price of $0.079 per TH/s per day.

Given the combination of elevated hash rates and diminished profitability, Bitcoin mining continues to be challenging for most, except for the largest operators in the field.