Matrixport projects 7% plunge for Bitcoin within ‘next two weeks’

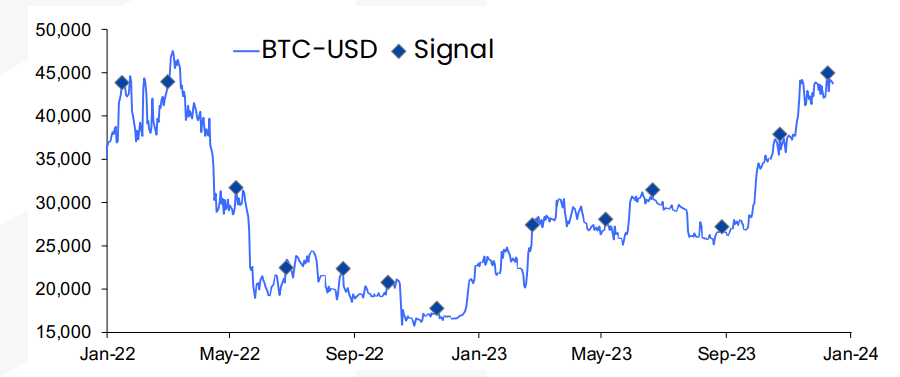

Analysts at Matrixport say one of their trading signals has turned bearish for Bitcoin for the first time since August 2023.

In a blog post on Jan. 8, the Singapore-based crypto management firm warned traders that a decline in Bitcoin’s (BTC) price should be expected within the “next two weeks” given that the breakout attempt could fall short.

As the crypto market has reached a consensus that the U.S. Securities and Exchange Commission (SEC) will approve spot Bitcoin exchange-traded funds (ETFs) by Jan. 10, smart money might use the approval for profit taking, analysts at Matrixport warn.

Although leverage has been “flushed out of the market” recently and the downside is expected to be limited, the range of $36,000 – $38,000 could be retested. In January, Bitcoin’s funding rate on crypto exchanges collapsed from 66.1% down to 7.4 %, indicating that the largest cryptocurrency by market capitalization appears to be “technically vulnerable” as a sharp funding increase in early 2024 was “unsustainable,” the analysts claim.

The warning comes just a few days after Matrixport said in a blog report that “it might even be a very long shot to expect” that SEC Chair Gary Gensler would vote to approve Bitcoin spot ETFs.

“An ETF would certainly enable crypto overall to take off, and based on Gensler’s comments in December 2023, he still sees this industry in need of more stringent compliance. From a political perspective, there is no reason to approve a Bitcoin Spot ETF that would legitimize Bitcoin as an alternative store of value.”

Matrixport

Following this statement, Bitcoin quickly plunged by 10% to $40,800, according to CoinGecko data. As crypto.news reported, high-profile figures in the crypto world, such as Will Clemente and Lark Davis, pointed fingers at Matrixport for initiating the sell-off, underscoring the crypto market’s sensitivity to rumors and news.

However, Matrixport co-founder Jihan Wu later clarified that the company does not influence its reporting by analysts, indicating that the widespread reaction to the report was unexpected.