Near token could surge 225%, crypto analyst predicts

Near Protocol token remains in a strong bear market after falling by almost 50% from its highest level this year.

Near (NEAR) was trading at $4.62 on Oct. 24, as Bitcoin (BTC) and most altcoins remained under pressure.

However, Michael van de Poppe, a popular crypto analyst with over 700,000 followers on X, predicted that it will soon bounce back and move to between $10 and $15. If it rises to the upper side of his forecast, it would mean a 225% increase from the current level.

Near Protocol, a layer-1 blockchain network using sharding technology to accelerate performance, has struggled this year and has underperformed compared to other newer networks.

Data from DeFi Llama shows that its total value locked in the DeFi industry stood at $231 million, down from the year-to-date high of $323 million. The biggest dApps in the ecosystem are Burrow, LiNEAR Protocol, Meta Pool Near, and Ref Finance.

Near’s TVL is significantly lower than other newer layer-1 and layer-2 networks. For example, Base Blockchain, launched in 2023 by Coinbase, has gained $2.43 billion in assets. Similarly, Sui has gained $1.01 billion, while Arbitrum holds $2.34 billion.

Near Protocol also has a small market share in the Decentralized Exchange industry. DEX networks in its ecosystem handled transactions worth $26.3 million, making it smaller than chains like Mint, Injective, and Blast.

This performance is partly due to Near Protocol’s lack of a meme coin ecosystem, which has propelled Solana (SOL) to become the largest DEX blockchain this year.

On the positive side, Near handles substantial transactions each week. Data from Dune Analytics shows that it processed 49.2 million transactions in the last seven days, while the number of weekly active addresses rose by 11% to 11.55 million.

Near token is nearing a key level

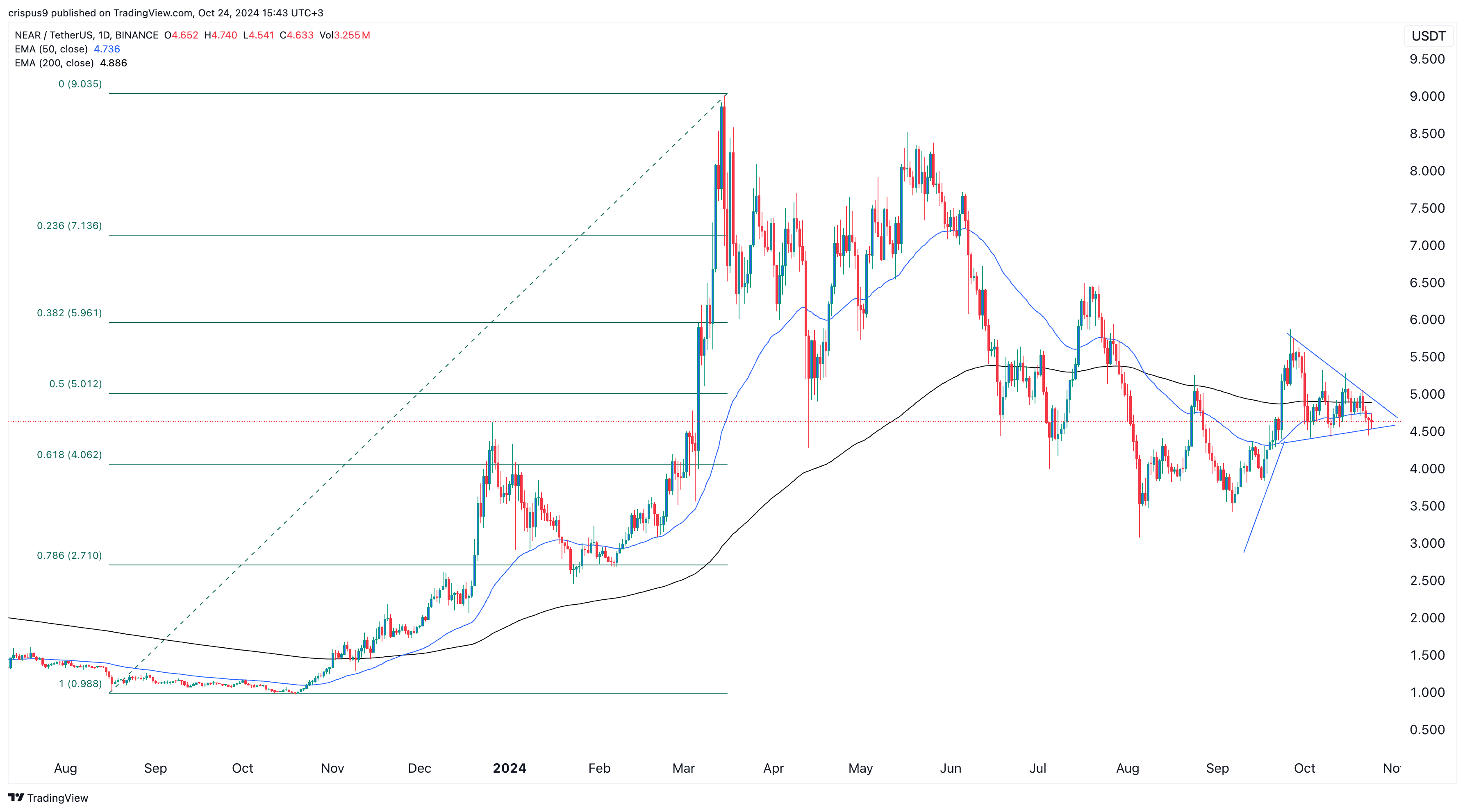

The daily chart shows that the Near Protocol token has consolidated in recent days. It has formed a symmetrical triangle pattern that is nearing its confluence level. This triangle formed during an uptrend, meaning it may be seen as a bullish pennant chart pattern. A pennant is a popular continuation signal.

NEAR has also formed an inverse head and shoulders pattern, which often leads to more upside. For this to happen, Near will need to rise above the 50% Fibonacci retracement point at $5.012 and the 200-day moving average at $4.88.