Nearly 50% of all illicit volume occured on TRON in 2023, TRM Labs says

Data revealed by analysts at blockchain forensics firm TRM Labs shows that TRON hosted 45% of all illicit volume in 2023.

The so-called “dirty crypto” appears to be highly centered on the TRON blockchain network, founded by Chinese entrepreneur Justin Sun, which accounted for approximately 45% of all illicit transactions last year. According to a recent research report titled “The Illicit Crypto Economy” by TRM Labs, the figure marks an increase from 41% in 2022, with Ethereum following at 24% and Bitcoin at 18%.

The San Francisco-headquartered firm found Tether (USDT) to be the stablecoin with the largest amount of illicit volume. Issued by Tether Inc. the stablecoin has “cemented its position as the currency of choice for use by terrorist financing entities,” TRM Labs says, adding that USDT accounted for over $19 billion worth of illicit funds, while the other stablecoin, USD Coin (USDC), has only $428.9 million in illicit volume.

“[…] among those terror financing campaigns that continued to accept cryptocurrency, the number of unique TRON addresses that received Tether (USDT) rose by 125%.”

TRM Labs

TRON also appears to be a preferred network for hackers associated with North Korea, who frequently exchange stolen funds, predominantly for USDT on the network. Later on, these laundered crypto funds are converted to fiat currency through high-volume over-the-counter (OTC) brokers, the firm says. As of press time, the TRON developers made no public statement regarding the findings.

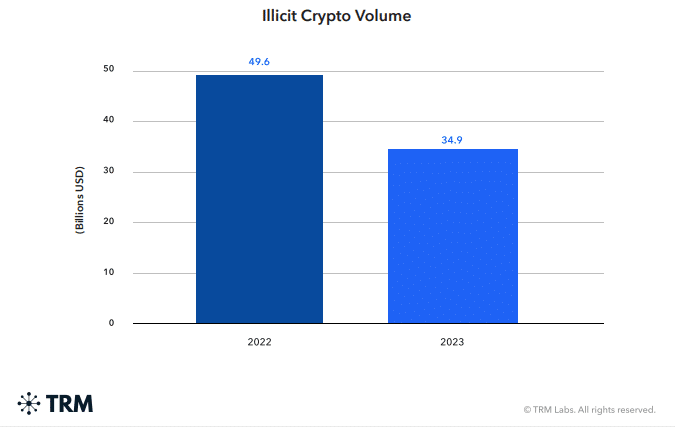

Despite the staggering figures, TRM Labs notes a decline in the volumes of hacked and sanctions-exposed funds, attributing the decline to the heightened pressure exerted by governments and law enforcement agencies worldwide.

Tether has been consistently stressing its commitment to adhering to anti-money laundering (AML) regulations in its efforts to combat global terrorism. In December 2023, Tether underscored its dedication to implementing know-your-customer (KYC) procedures and ensuring regulatory compliance in a letter addressed to members of the U.S. House Financial Services Committee and the U.S. Senate Committee on Banking, Housing, and Urban Affairs.

The issuer of USDT revealed that its KYC program underwent thorough examination by the Internal Revenue Service (IRS) on behalf of the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. Furthermore, Tether announced collaborations with the U.S. Department of Justice, Secret Service, and Federal Bureau of Investigation (FBI), leading to the freezing of numerous crypto wallets.