Network gridlock: unraveling causes of crypto market downturn

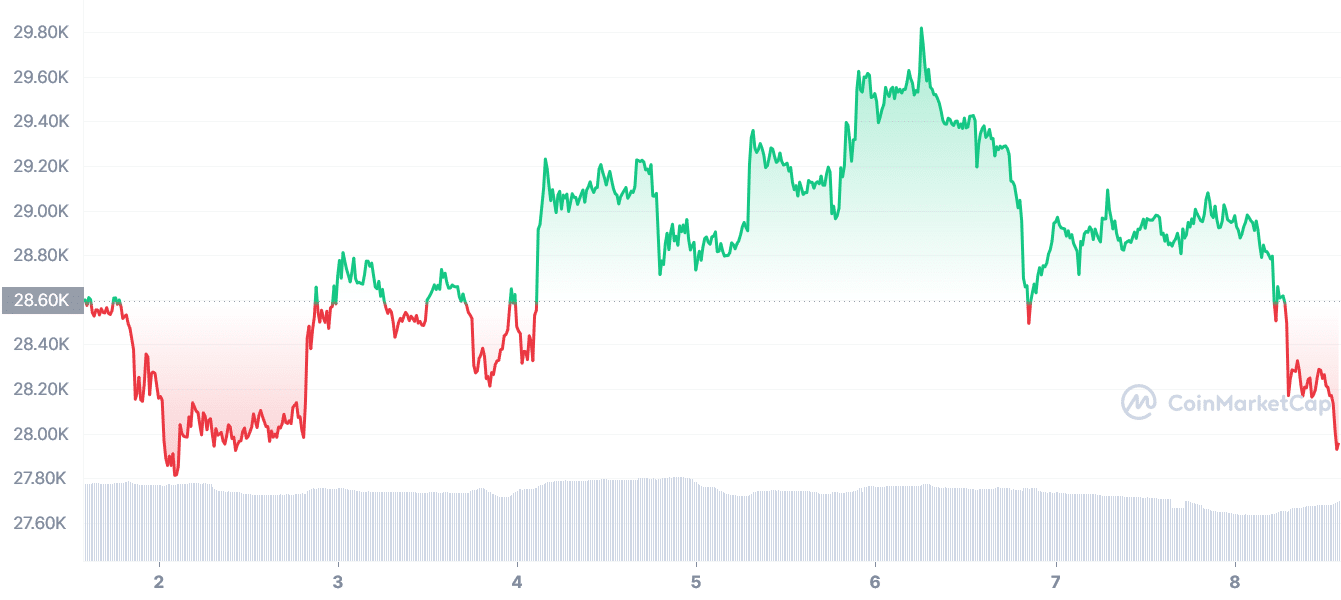

The recent downturn in the crypto market, marked by bitcoin’s (BTC) descent below $28,000 and the depreciation of altcoins, is due to a blend of network congestion, increased transaction fees, and an ongoing consolidation phase.

The congestion within the bitcoin network, mainly triggered by introducing the BRC-20 token standard and Bitcoin Ordinals, has resulted in exceptionally high fees for BTC transactions.

This situation was intensified when Binance, the top cryptocurrency exchange, temporarily paused bitcoin withdrawals owing to a massive backlog of pending transactions.

These concurrent events have shaken the market and contributed to the recent price slide. Consequently, BTC witnessed a sharp decline, hitting a 7-day low of $27,680 on May 8 before trading at $27,973 at the time of writing.

In tandem, the broader crypto market experienced a more significant drop, decreasing by over 4% in the last 24 hours to reach a market cap of $1.15 trillion as of May 8.

Meanwhile, the newly introduced Sui coin (SUI) soared to a high of $4.51 on May 3, but it has since plummeted by 75%, now trading at $4.51.

Consolidation phase: stuck in a trading range

Bitcoin’s price has entered a consolidation period in recent weeks, coming off the heels of its remarkable surge earlier in the year.

Notwithstanding the current downturn, the overarching bullish sentiment for BTC stays intact, with the cryptocurrency trading above its 21, 50, 100, and 200-day exponential moving averages (EMA).

At present, the market confronts an unprecedented lack of liquidity, indicating that heightened volatility is expected. Consequently, even a handful of substantial buy and sell orders can profoundly influence the market’s trajectory.

Meme coin frenzy: a catalyst for market sentiment shifts

The meteoric rise of meme coins, like PEPE, has recently caused significant fluctuations in market sentiment. With the PEPE coin surging almost 4,000% in the past month, it could rally further if the meme coin frenzy continues.

These impressive gains, driven primarily by their popularity on social media platforms and internet culture, suggest that the broader crypto market could benefit from the potential meme coin rally.

Ordinals: a necessary revenue source for miners

The Bitcoin community faces a dilemma concerning the congestion caused by the NFT-like Ordinal inscriptions.

While some criticize the network’s congested and expensive state, others contend that the increased fees from Ordinals are vital for incentivizing mining and securing the network.

Cash-strapped miners stand to benefit from this newfound interest in the Bitcoin blockchain, and available Layer-2 and sidechain solutions, such as the Lightning Network or Liquid, could alleviate the annoyance of congestion.

What to expect next?

Recent tweets from crypto analysts suggest that BTC could be on the verge of a significant breakout, pointing to key technical indicators.

One analyst highlights that bitcoin is about to break its monthly Bollinger bands baseline, which could lead to an inexorable first target of $63,500. The analyst noted that this bullish outlook is supported by the solid technical foundation observed in the market.

Another analyst revealed the formation of a bullish symmetrical triangle on the daily BTC chart. The analyst further notes that the EMA 50 is perfectly aligned with the diagonal support of the pattern, suggesting a promising setup. If a breakout occurs from this triangle, the first target is estimated to be $31,200.

In this context, altcoins could witness significant shifts in their trajectories. Some may follow bitcoin’s lead, with potential breakouts and bullish patterns, while the momentum of regulations and market sentiments could influence others.

As the crypto market faces challenges and uncertainties, you must exercise caution when investing in digital assets.

By staying informed of the factors contributing to the current downturn and understanding their implications, you can make well-informed decisions based on market trends and expert insights.