NewsCrypto to Change The Cryptocurrency Staking Game?

Staking is a quickly gaining popularity in the world of cryptocurrency, as the process of earning a profit while helping to secure the underlying network is an attractive proposition. After all, by staking or delegating some of the most popular cryptocurrencies like Tezos (XTZ), Cosmos (ATOM), and NewsCrypto Coin (NWC), it’s possible to earn between 6 to 10% per year with very little effort.

Up until only recently, this process has been generally regarded as rather complicated, and somewhat inaccessible to less experienced cryptocurrency users, since it previously the use of complicated wallets. However, this issue is now a thing of the past, thanks to the launch of new pooling services that can make staking both simpler and more profitable.

What is Staking, Exactly?

To get into how staking works, we first need to briefly cover how blockchains are secured. Generally, this is achieved using what is known as a consensus mechanism — essentially a fancy name that describes the mathematical system the nodes on a blockchain use to participate in the block discovery or validation process.

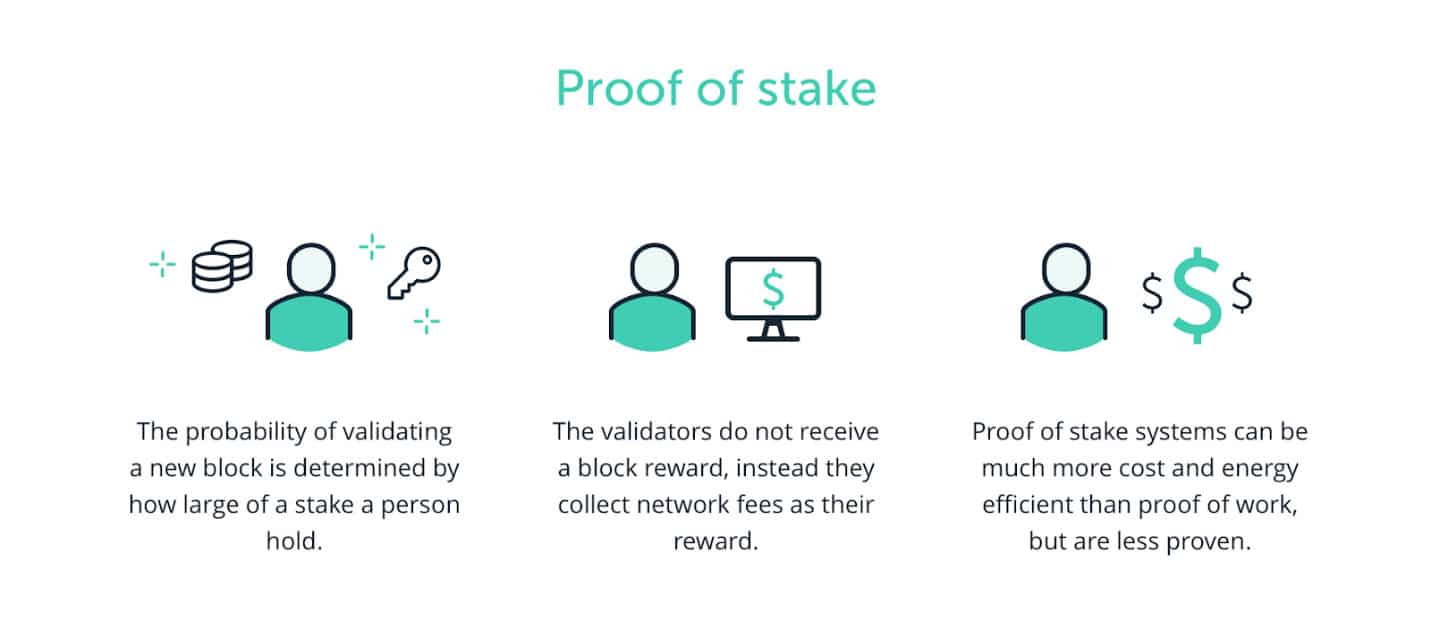

The first generation of cryptocurrencies used a consensus algorithm known as Proof of Work (PoW), which uses a complicated network of ‘miners’ to manually crack complex equations to discover a new block to add to the blockchain. This energy-intensive process was superseded by a newer consensus algorithm known as Proof of Stake (PoS), which instead uses a network of nodes that compete to validate a new block-based on how much cryptocurrency they have staked.

Nodes need to stake a chunk of cryptocurrency to become eligible to validate blocks. This stake is locked up by the network and is used to ensure that nodes stay honest, and work for the good of the network. Validators that perform earn rewards, while those that are dishonest can have their stake penalized.

For the most part, individuals staking their tokens are actually delegating them to a validator of their choice. This helps to increase the staking power of the validator, increasing the amount of rewards they earn — the majority of which is then passed on to the delegates (those that have staked their assets). Generally, coins that have been staked cannot be used for a fixed period of time, this is known as the lock period.

Most Proof of Stake cryptocurrencies work in a similar fashion to this, but there are some variations. All in all, staking cryptocurrencies acts to support the network, while rewarding participants for doing so.

Where Stakers Stay Liquid

Although staking is rapidly gaining popularity as an investment method, many participants are caught unaware when they find out that their staked assets cannot be transferred, traded, or used during the staking period — which can be several weeks in some cases.

However, with the advent of a KuCoin’s Pool-X, it’s possible for Proof of Stake coin holders to earn both staking rewards, while retaining the ability to trade their assets. Customers that participate in any of Pool-X’s staking contracts will receive an annual yield that depends on the cryptocurrency they’re staking, but will also earn an additional yield in the form of POL tokens.

POL is a TRC20 token that plays a critical role in the Pool-X ecosystem, allowing those with staked assets to gain immediate liquidity by redeeming their assets, while also being the main token used for paying fees on the Pool-X platform. These POL tokens are distributed as part of a mining process, which sees stakers rewarded with POL tokens by participating in staking or mining them using a POL node.

Like most TRC20 tokens, POL can be freely traded, or it can be used on the Pool-X platform.

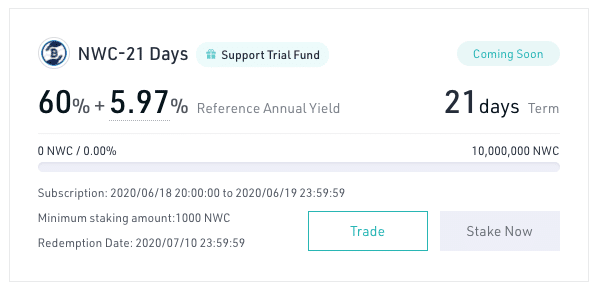

As it stands, Pool-X currently has over 20 different staking products available. These range from as low as 1.7% + 5.36% (POL) APR for EOS staking to as high as 60% + 5.98% (POL) APR for the NewsCrypto 21 day fixed product (NWC-21), which launches on June 18th.

KuCoin also recently announced a partnership with crypto-education platform NewsCrypto to launch a quiz, which sees high-scoring participants gain access to as much as 40,000 NWC in trial funds, which can then be staked as part of the Pool-X NWC-21 product to earn rewards with zero risks.