NFT market in flux: June sales drop 47% but there are more buyers and sellers

The non-fungible token (NFT) market experienced a remarkable drop in activity over the past month, with significant dips across various metrics.

According to Crypto Slam data:

- Global NFT sales volume reached $476.3 million in June, marking a 47.22% decrease.

- The number of NFT buyers skyrocketed to 1.259 million — an astonishing 1700.83% increase.

- The number of sellers climbed to 744,965 — up by 1059.64%.

- The increase in buyers and sellers was juxtaposed against a 51.4% drop in NFT transactions month-over-month

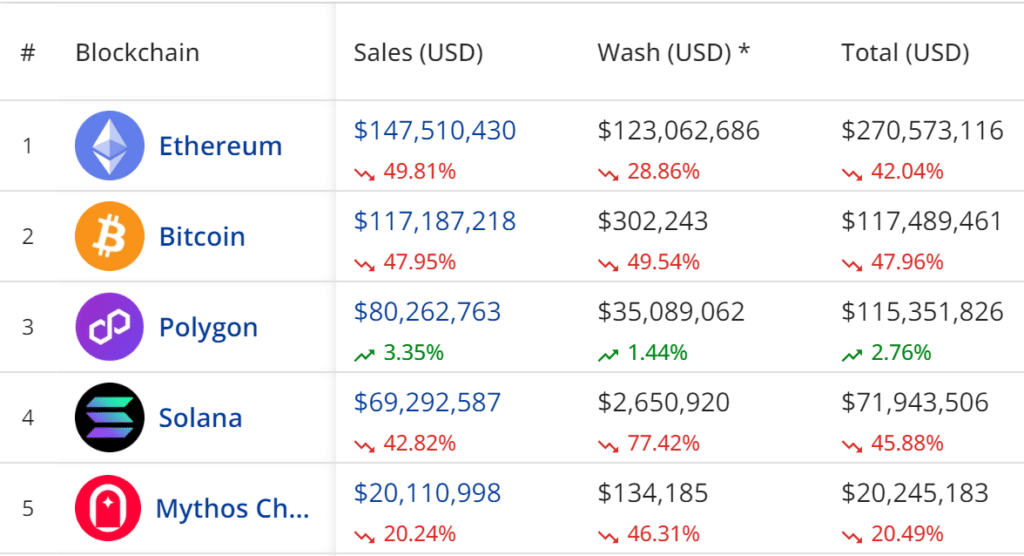

Top blockchains by NFT sales volume

Here’s a closer look at the top five blockchain:

- Ethereum (ETH) once again led the pack in blockchain sales volume, recording more than $147.5 million in NFT sales, with a notable $123 million attributed to wash trading. Including these wash trades, the total sales stood at $270.5 million. The network attracted 55,449 buyers, reflecting a 95.41% increase.

- Bitcoin (BTC) has emerged as a formidable contender in the NFT space. Despite a nearly 48% drop, it still achieved more than $117 million in sales with minimal wash trading influence. The network also had 59,482 buyers actively participating, a number that was roughly similar to May’s figures.

- Polygon (MATIC) came in at third, demonstrating its growing influence with $80.2 million in sales. The figure was a 3.35% uptick from the previous month, with more than 245,000 buyers actively trading NFTs on the platform.

- The Solana (SOL) NFT market recorded the fourth-largest NFT sales volume, raking in more than $69.2 million in sales. However, the amount was still 42.82% lower than last month’s figures. Counting about $2.65 million attributed to wash trading, Solana’s total sales reached $71.9 million from 580,100 buyers.

- Mythos Chain (MYTH) saw $20.1 million in NFT sales in June, with wash trades contributing another $134,185 to its total sales figure. The blockchain also had more buyers than Ethereum, with 57,269 getting their NFTs from there.

Leading NFT collections in June

Despite the general market downturn, several NFT collections stood out in June.

$PIZZA BRC-20 NFTs on Bitcoin led the pack, with $29.1 million in sales from more than 43,000 transactions. See below.

DMarket on Mythos followed with $18.9 million in sales from nearly 830,000 transactions. However, the collection’s earnings were 21.8% lower than the previous month.

CryptoPunks on Ethereum continued to be a strong performer, generating $16,405,442 in sales from just 141 transactions. The Bored Ape Yacht Club (BAYC) also maintained its popularity, with sales jumping 6.54% to $13 million.

Another Bitcoin collection, NodeMonkes, rounded out the top five, with $12.7 million in sales from 929 transactions.

Polygon’s OKX NFT Creation enjoyed the highest percentage growth over the last 30 days, with its sales volume going up a whopping 132,509.44% to hit $2.4 million.

Conversely, the worst-performing NFT collection in June was Blast’s Fantasy Top, which registered an 83.33 drop in sales volume, closely followed by DeGods on Ethereum, whose sales plummeted 82.9%.

Top-selling NFTs of the month

Regarding top-priced NFT collectibles, CryptoPunks #627 sold for a staggering $836,149 on Ethereum, making it the highest sale of the month. Punk #50 from Bitcoin’s Ordinal Punks collection fetched $306,725, while a Cardano NFT sold for $219,102.

The Solana blockchain was represented by Mad Lads #4575, which went for $110,917, while TTAvatars #1280003 on Polygon changed hands for $100,500.

The fan token market also saw substantial activity.

The AS Roma (ASR) token led with $1,27 billion in sales on the Chiliz blockchain. Galatasaray’s GAL token was a distant second with $344 million in sales, while Paris Saint-Germain (PSG) recorded $225.8 million.

OG and FC Barcelona rounded out the top five, with sales of $132 million and $126.2 million, respectively.

Market outlook

The juxtaposition of declining sales volume with a soaring number of buyers and sellers signals a complex phase in the NFT market.

The significant drop in transaction volume suggests that while interest and participation are at an all-time high, the average transaction size has decreased, possibly indicating a shift towards more affordable NFTs or a cautious approach by investors.

It could also imply a maturing market where the frenzy of high-value transactions is cooling off, giving way to broader, more democratic engagement.

As the market adjusts, platforms and collections that adapt to this changing landscape by offering diverse, accessible options may emerge as the new leaders in the NFT space.