NVIDIA lost $280b in one day: What’s happening

Tech giant Nvidia set a record by losing more than $280 billion in market capitalization in a single day. What caused the dramatic collapse?

According to Bloomberg, the U.S. Department of Justice has issued subpoenas to Nvidia and several other companies as part of an antitrust investigation. Previously, the ministry limited itself to non-binding questionnaires, but now it has decided to take more decisive action.

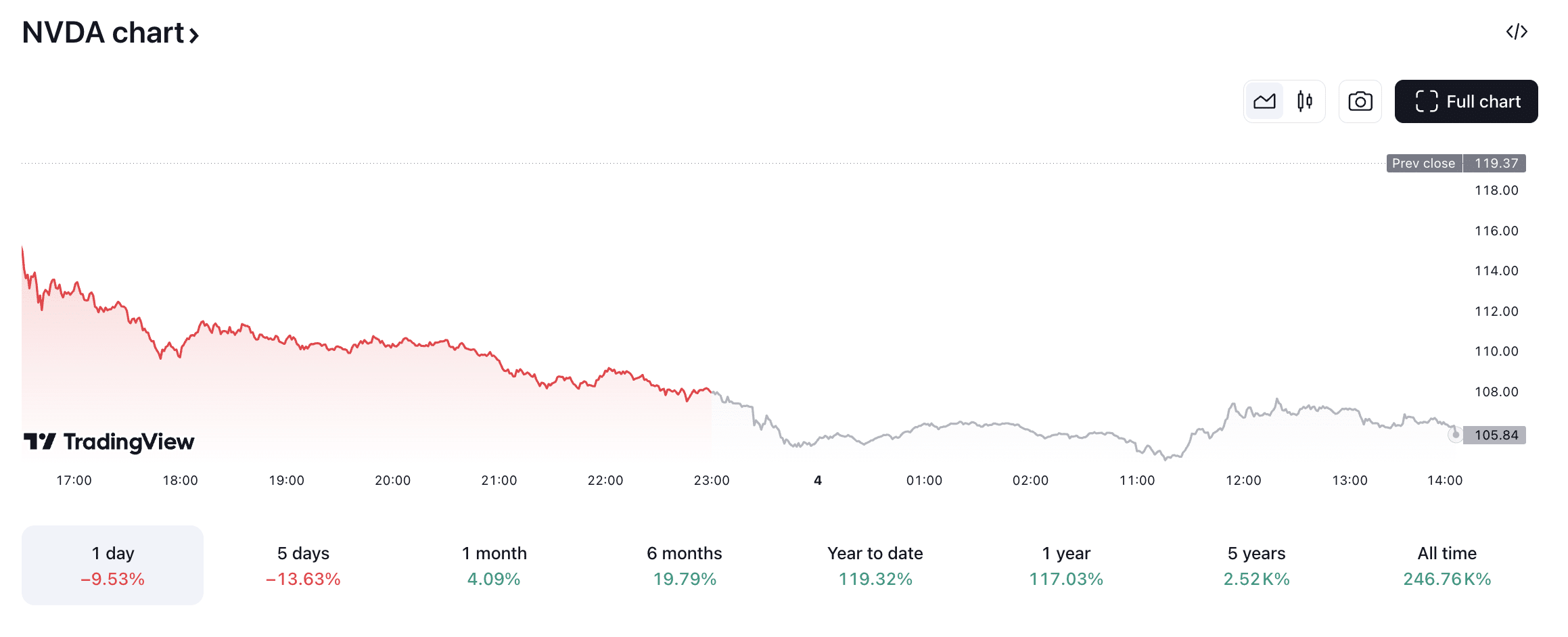

Nvidia shares responded to the news with a sharp decline. By the close of trading on Sep. 3, they had fallen 9.5% to $108 and continued to drop another 2% to $105 in the after-market.

What is going around Nvidia subpoena and why is Nvidia down

Speaking about Nvidia, antitrust authorities are concerned that the company is allegedly making it difficult for customers to switch to other chip makers and AI services and penalizing customers who do not exclusively use its AI services.

As part of the investigation, the Justice Department has contacted other tech companies, including Nvidia’s largest investor, Microsoft, for additional information.

However, the company denies all the allegations. In an official statement to Bloomberg, Nvidia representatives emphasized that the company wins on its merits, as reflected in our test results and the value to customers who can choose any solution that suits them.

How the Nvidia investigation has affected the crypto market

Nvidia has rapidly grown into the world’s largest maker of computer chips, especially those used in artificial intelligence processes. Although the company is not directly involved in cryptocurrency, the AI token sector tends to react to broader news.

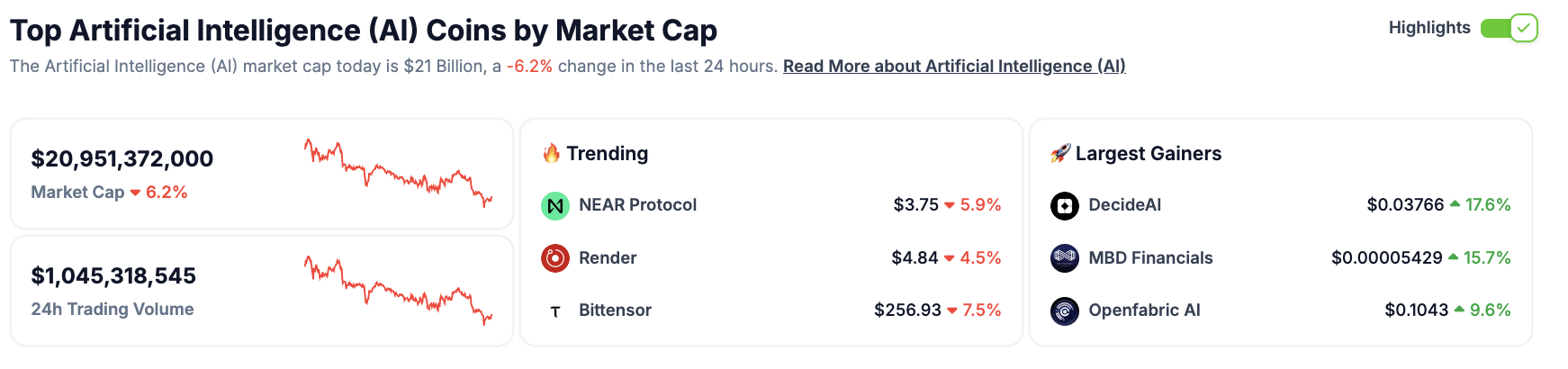

Thus, according to CoinGecko, amid Nvidia’s problems, the AI token sector’s market capitalization has fallen by more than 6%, and the top five tokens in this sector have also lost in price.

The leader in the decline among crypto assets related to artificial intelligence was the Carbon Browser (CSIX) cryptocurrency, which fell by 14% in a day to $0.01693. Next came NEURALAI (NEURAL), with a 14% drop to $2.45.

Financial report and Nvidia buyback had a negative impact on crypto

From Aug. 27 to 28, most tokens related to artificial intelligence fell by about 5%. The fall occurred on the eve of Nvidia’s revenue report’s publication when its board of directors approved a $50 billion Nvidia stock buyback.

Thus, NEAR Protocol (NEAR) fell by 4.45%, Artifical Superintelligence Alliance (FET) by 2.1%, and Injective (INJ) by 7.87%. The sector’s market capitalization fell by 6% to $23.9 billion.

However, as a rule, shortly before the publication of Nvidia’s report, the price of AI tokens grows. For example, in March 2024, coins in this sector jumped by about 25% before the company’s conference. However, this time, they responded with a fall.

What analysts say

Analysts from the trading company QCP Capital said that Nvidia’s financial report caused a negative reaction among investors and put pressure on the stock and cryptocurrency markets.

After the publication of Nvidia’s quarterly profit report, the volatility of the first cryptocurrency increased but then began to decline. QCP Capital believes that investors were expecting more impressive results from the AI chip leader.

Will we see more downside as we enter the 4th quarter of the year? With the absence of any catalysts in the near term, we anticipate prices to continue chopping within the range as we move into September.

Analysts expect the decline in stock and crypto markets to be short-lived. With the U.S. Federal Reserve poised to begin a rate-cutting cycle, increased liquidity will eventually increase risk assets.

What’s next for Nvidia

Nvidia’s stock is being pushed down by macroeconomic indicators and the threat of a recession in the U.S. as a whole. The U.S. Department of Justice is also interested in Nvidia, which is suspected of abusing its dominant position in the chip market.

U.S. antitrust officials are concerned that Nvidia is making it difficult for businesses to switch to other AI and computer chip suppliers and even imposing fines on customers who do not exclusively use its own AI services.

Nvidia remains one of the significant “beneficiaries” in the era of AI development, controlling 70-95% of the microchip market, thus putting significant pressure on the AI token market.