On-Chain Metrics Show Ethereum Addresses Grow 350% From 2018 Figures

Ahead of Ethereum’s move to staking after its 2.0 “Serenity” update, investment and wallet activity on the network is increasing. The protocol has received a boost in recent times, driven by both institutional and technical factors.

ETH the Preferred Crypto?

Developments last month, and this, have primed Ethereum as an attractive crypto-investment, ahead of other altcoins and Bitcoin. Institutions have invested in and adopted the underlying blockchain to create their own DLT-centric products.

Even Tyler and Cameron Winklevoss, popular Bitcoin “maximalists” and founders of the Gemini Exchange, hold “large and material” Ether amounts, the twins revealed to Camila Russo of Defiant last week. They admitted leading a significant effort to acquire and “large” amounts of the altcoin after its launch in 2015.

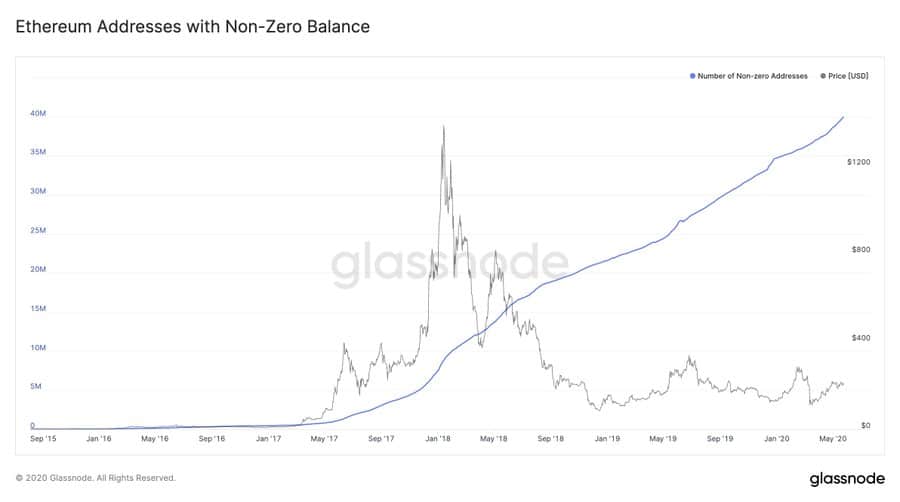

On-chain metrics for Ethereum are booming. Insights by Glassnode, a blockchain and crypto analytics firm, show ether wallets have grown 350 percent since the currency’s all-time high value of $1490 in 2018.

The firm stated via a tweet on May 25:

“There are now 40 million #Ethereum addresses holding #ETH. That’s an increase of more than 350% since $ETH saw its ATH price in early 2018.”

(Source: Glassnode)

DeFi May Be Reinvigorating ETH

DeFi projects may have to do with Ethereum’s increased popularity and the surge in wallet addresses. At the time of writing, data on Defi Pulse shows BTC-pegged ERC20 tokens, such as Wrapped Bitcoin and tBTC, outnumber the actual bitcoin stored on the latter’s lighting network.

Other projects are adopting the Ethereum blockchain for pegged currencies as well. MakerDAO, which recently discontinued the SAI token, issued $4 million worth of DAI on Ethereum last week.

Tweeting about the above development, MakerDAO founder Rune Christensen told the transaction was “extremely” bullish for Ethereum’s long-term value proposition, adding:

“This really showcases the latent demand for non-ETH assets, and it’s the beginning of a broader trend of DeFi acting as an economic vacuum that will eventually attract almost all value to the Ethereum blockchain.”

Prominent investors are recognizing Ethereum’s value as well. Andrew Keys, partner at Digital Asset Management Advisors, wrote in a ConsenSys blog in January 2020 that the protocol’s market opportunity is “estimated at well over $80 trillion.”

Similarly, Spencer Noon of DTC Capital believes the public demand for ether tokens and the Ethereum blockchain has a significant connection.

“There is a growing link between Ethereum utility and ETH demand. ETH miners have captured $3.5M in fees over the past 30 days,” said Noon, adding “we can see that the demand for block space is mostly driven by stablecoins and DeFi, which together account for >63% of fees paid.”