Ondo Finance expands tokenized asset platform to Asia Pacific region

Ondo Finance, a platform specializing in tokenized real-world assets, has expanded its operations into the Asia Pacific region.

In line with its expansion efforts Ondo has appointed Ashwin Khosa — a former employee of Tether and Bitfinex — as its new Vice President of Business Development for the Asia/Pacific region.

However, the firm did not disclose the country or the city where the office has been opened.

The company, with a substantial 40% share of the global market, offers three key tokenized products: OUSG, providing access to US Treasuries; OMMF, linked to US money market funds; and USDY, a yield-bearing alternative to traditional stablecoins.

These offerings grant global investors the opportunity to engage with prominent US asset classes through tokenization.

Nathan Allman, the founder and CEO of Ondo, highlighted the vibrant and expanding crypto community in Asia Pacific, as well as the region’s interest in US asset exposure through tokenized means.

The latest expansion follows a sequence of notable developments from Ondo, including the release of a strategic roadmap for the upcoming 24 months and recent partnerships with Mantle Network and Solana. These alliances aim to integrate USDY into their respective blockchain networks.

Additionally, the Ondo Foundation has launched a points program and proposed unlocking the ONDO token, reflecting the company’s commitment to evolving the on-chain finance landscape.

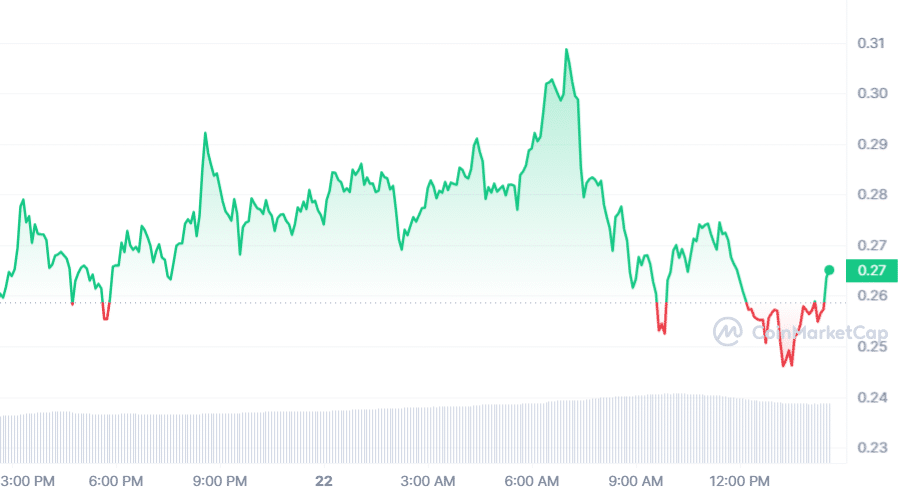

At the time of writing, Ondo price witnessed a 2.4% rise and traded at $0.265, with its trading volume soaring 28.8% to $196.7 million. However, over the last seven days, it has added more than 60% to its price.