Ondo Finance price drops amid rising whale activity: what’s next?

Ondo Finance token retreated for two consecutive days as the recent crypto bull run took a breather and as whales started to sell.

Ondo (ONDO) price dropped to $0.97, down by 13.5% from its highest level this week, indicating it has moved into a technical correction.

The main catalyst for the sell-off is the ongoing weakness in the crypto market, with Bitcoin (BTC) falling from near $100,000 to $92,000.

At the same time, there are signs that whales are selling the coin. Data from Etherscan shows that one whale moved 1.58 million coins to Gate.io. Typically, crypto holders move assets from wallets to exchanges when preparing to sell.

Another holder moved ONDO tokens worth $658,265 to the same exchange. Altogether, whales moved coins worth almost $7 million to exchanges, likely to take profits.

Meanwhile, Ondo’s network has seen slow growth in the past few days as the total value locked has remained at $643 million. Most of these assets are in the US Dollar Yield, which holds $452 million and offers a 4.90% yield. The rest, approximately $198 million, are in US Treasuries, which provide a 4.59% yield.

In a recent statement, the developers highlighted that Ondo’s tokenized treasury assets offer a higher yield than other popular assets, such as Franklin Templeton’s FOBXX and Blackrock’s BUIDL.

Ondo Finance is part of the tokenization industry, which analysts predict will experience significant growth in the coming years. A recent note from BCG estimates that over $16 trillion of assets will be tokenized by 2030.

Ondo price technical analysis

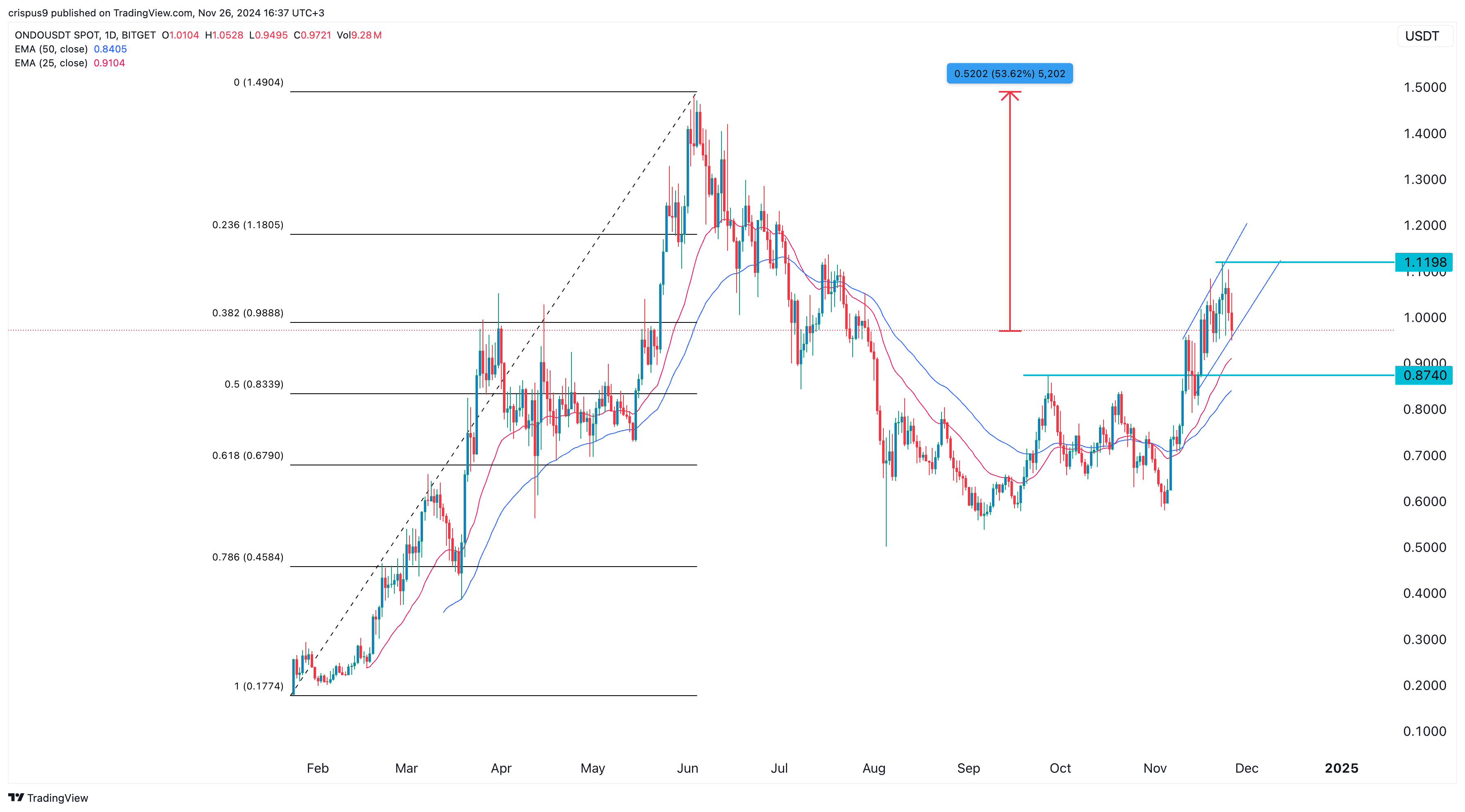

The daily chart shows that the price of the Ondo token peaked at $1.1200 during the recent bull run. It has since retreated, moving to the lower side of the ascending channel pattern. The coin remains above the 60-day and 25-day moving averages but has dropped slightly below the 38.2% Fibonacci Retracement level.

ONDO also stays above the key support level at $0.8740, its peak on September 27. Therefore, it is likely the coin will retest the $0.8740 support level before resuming its uptrend. A move above this month’s high of $1.1200 could indicate further gains, potentially reaching the year-to-date high of $1.50, about 53% above the current level.