Ordinals explained: New era of NFTs on Bitcoin network?

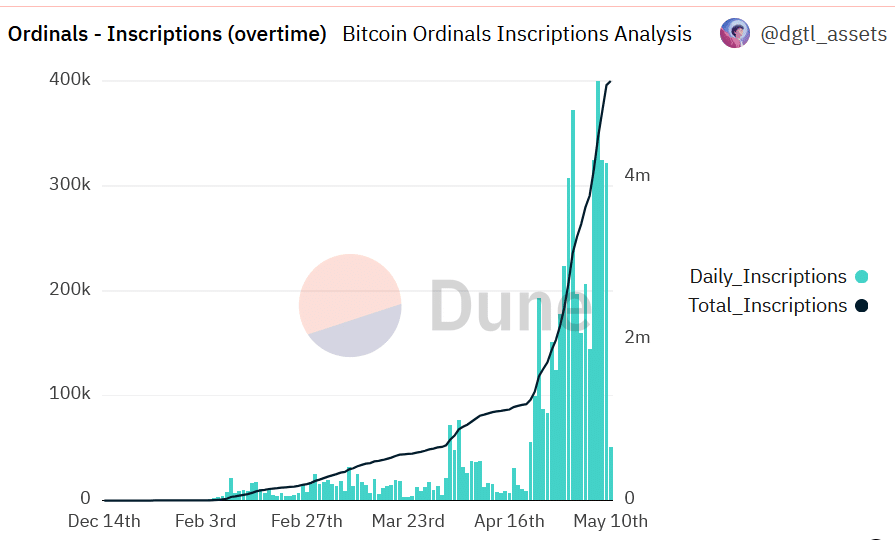

The Bitcoin (BTC) network is witnessing a paradigm shift as ordinals, an advanced breed of non-fungible tokens (NFTs), rapidly gain traction within the crypto sphere. April 2023 saw the daily ordinals inscriptions record smashed several times, illustrating the escalating curiosity surrounding these digital assets. While ordinals may create new opportunities for the Bitcoin network, skeptics raise concerns about potential negative consequences.

Table of Contents

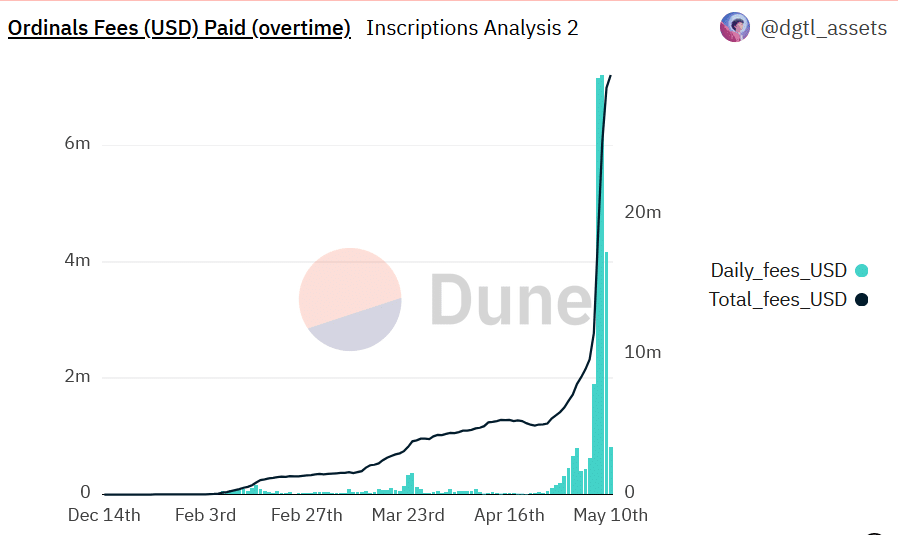

Ordinals, a class of digital assets closely related to non-fungible tokens (NFTs), are inscribed onto satoshis, the smallest denomination of bitcoin. In April, ordinals experienced a surge in popularity, accounting for a significant portion of the network fees.

In May 2023, the cumulative fees paid for ordinals over time have reached an astounding $300 million, with the majority of this expenditure occurring between April and May.

Ordinals gained prominence after the Taproot upgrade, which facilitated improved transaction management, privacy, and reduced transactions costs.

How do ordinals work?

To truly understand ordinals, we need to talk about satoshis. Named after bitcoin’s founder, Satoshi Nakamoto, a satoshi is the smallest fraction of bitcoin – one hundred millionth of a bitcoin, to be precise.

What’s interesting about satoshis is that each carries a unique number, determined by the order in which it was mined. This unique number, or “ordinal,” is what gives each satoshi its identity.

Think of satoshis as tiny digital canvases, each with a unique identifying number. Now, when you “inscribe” these satoshis with data – text, images, audio, or more – they transform into unique digital assets, which can be used in numerous applications, from games to artworks.

Inscription is a process of storing information on the blockchain, reflecting ownership of digital objects. When a transaction is confirmed by bitcoin miners and added to the blockchain, it’s as good as etched in stone – it becomes immutable proof of ownership.

When you inscribe data on the Bitcoin blockchain, it gets associated with a particular satoshi, much like marking a personal item with your name. This marked satoshi then allows the transfer and assignment of ownership of that on-chain data or inscription.

So, in a nutshell, ordinals are like digital stamps, unique and secured on the Bitcoin blockchain. Using an open, permissionless protocol, you can use ordinals to create your own digital assets, owning, selling, and transferring them as you wish.

NFTs vs. Bitcoin ordinals

The primary distinction between conventional NFTs and Bitcoin ordinals stems from their foundational infrastructure.

Traditional NFTs, often built on Ethereum (ETH) or alternative blockchains, operate on separate layers from their base networks and frequently employ smart contracts to enable creation and transfer.

Both NFTs and ordinals function as distinctive digital assets with provable scarcity. However, what sets ordinals apart is their direct integration with the Bitcoin network, which means they share bitcoin’s security and immutability.

That said, there’s a flip side to this coin. The integration of ordinals with Bitcoin might lead to network clogging and a spike in transaction costs.

This has ignited a debate over the long-term feasibility and impact of ordinals.

Advocates argue that ordinals add value by creating new use cases for the network. Conversely, critics contend that ordinals consume precious block space and inflate network fees, contradicting Bitcoin’s fundamental principles.

Creating ordinals: in-house and third-party approaches

There are two approaches to creating an ordinal on the Bitcoin network: establishing an ordinals wallet and following a specific procedure or utilizing a third-party Bitcoin NFT marketplace.

The first method involves downloading Bitcoin Core, syncing the node to the blockchain, and sending satoshis to an ordinals wallet. For an in-depth guide, users can consult the Inscriptions handbook provided by the creators of the first ordinal.

Alternatively, a more straightforward method involves minting an ordinal via reputable Bitcoin NFT marketplaces like Gamma, which operate similarly to Ethereum-based NFT marketplaces such as OpenSea or Magic Eden.

The growth of ordinals and its implications

The ordinals ecosystem has experienced exponential growth since its inception, with over 5 million inscriptions recorded as of May 12, 2023, as per Dune Research data.

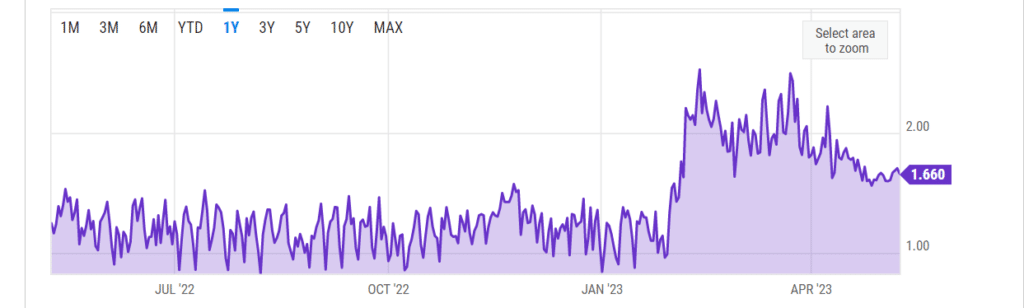

This surge is primarily attributed to the widespread adoption of the Taproot soft fork, which has reached new all-time highs in adoption and utilization.

Consequently, average block size and network fees have increased lately, highlighting the potential and challenges posed by the burgeoning popularity of ordinals.

The environmental impact of ordinals

Cryptocurrencies, particularly those using proof-of-work (PoW) consensus algorithms like bitcoin, have long been a subject of environmental contention.

Ordinals have rekindled the debate surrounding the Bitcoin network’s energy consumption. With a rise in transactions and demand for block space, ordinals contribute to the network’s overall energy usage.

Critics argue that the environmental impact of ordinals is an unnecessary burden, given that alternative blockchain networks, such as Ethereum, have transitioned to more energy-efficient consensus algorithms like proof-of-stake (PoS).

However, ordinals’ supporters stress the importance of leveraging the robust security and decentralization provided by the Bitcoin network, which they infer outweighs environmental concerns.

Legal and regulatory challenges

Like other digital assets, ordinals may face regulatory scrutiny. Governments worldwide have adopted varied approaches to regulating cryptocurrencies and NFTs, with similar expectations for ordinals.

In some jurisdictions, ordinals may be considered digital property subject to taxation, while in others, they may face stringent regulations and restrictions, only time will tell.

As the legal landscape surrounding digital assets evolves, it is crucial for ordinals creators and users to stay informed about changing regulations and ensure compliance with applicable laws.

Future of ordinals

As ordinals continue to gain popularity, their use cases and applications are likely to extend beyond digital art and collectibles.

Industries such as gaming, real estate, and intellectual property could benefit from the properties of ordinals, opening up new possibilities for the Bitcoin ecosystem.

Ongoing developments in the Bitcoin space, including Lightning Network upgrades and potential protocol enhancements, could alleviate some concerns surrounding network congestion and scalability. This, in turn, could pave the way for broader adoption and acceptance of ordinals in the future.

FAQs

What are ordinals?

Ordinals are non-fungible tokens (NFTs) built on the Bitcoin network. They enable the creation, ownership, and transfer of unique digital assets, such as digital art, collectibles, and other forms of digital property.

How are ordinals different from traditional NFTs?

While the core concept of representing unique digital assets remains the same, ordinals are built on the Bitcoin network, leveraging its security and decentralized nature. Traditional NFTs, on the other hand, are predominantly built on Ethereum or other blockchain networks.

What are the use cases for ordinals?

Besides digital art and collectibles, ordinals have the potential to be utilized in various industries, including gaming, real estate, intellectual property, and even supply chain management, as a means of verifying authenticity and provenance.

How do ordinals impact the Bitcoin network?

As demand for ordinals increases, the competition for block space on the Bitcoin network can lead to higher transaction fees and longer confirmation times. However, ongoing developments like the Lightning Network and other protocol improvements may help address these issues in the future.

Are ordinals environmentally friendly?

The environmental impact of ordinals is a topic of debate, as they contribute to the overall energy consumption of the Bitcoin network, which uses the energy-intensive proof-of-work (PoW) consensus algorithm. Critics argue that more energy-efficient alternatives like proof-of-stake (PoS) should be pursued instead. However, proponents emphasize the security and decentralization benefits provided by the Bitcoin network.

What is the future of ordinals?

The future of ordinals is uncertain, with potential for growth in various industries and the possibility of technological advancements addressing current limitations. As the crypto ecosystem continues to evolve, the true potential of ordinals and their role in the world of digital assets will gradually become clearer.