Over 30% of family offices in US ‘actively investing’ in crypto, BNY Mellon study finds

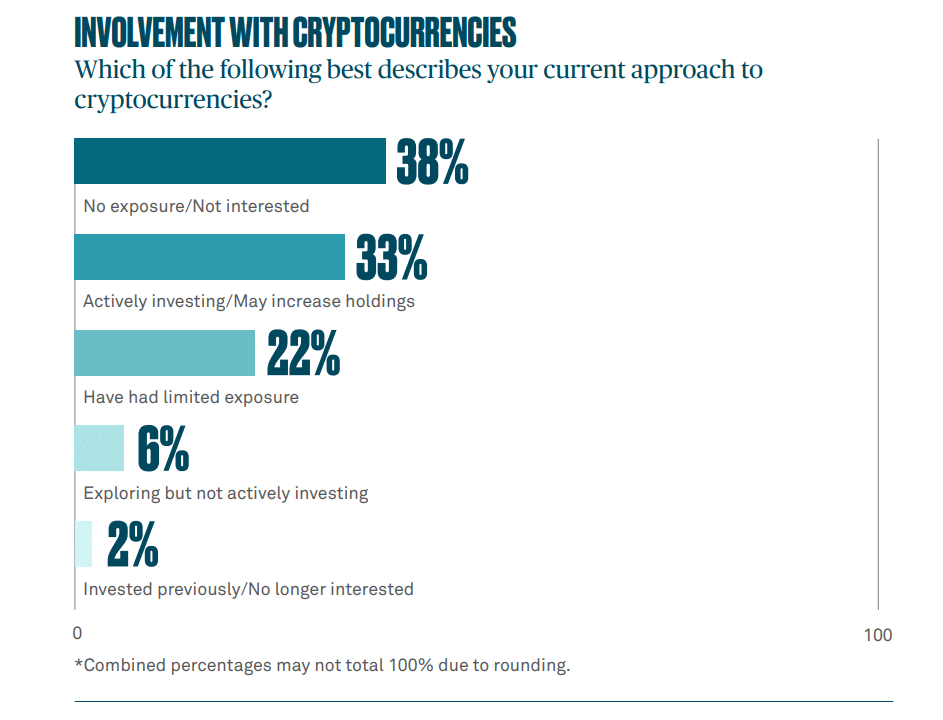

Around 55% of American family offices plan to increase their cryptocurrency investments or have had limited exposure to crypto, according to a BNY Mellon study.

More than 30% of family offices in the U.S. are actively investing in crypto and even may increase their holdings, a recent report by BNY Mellon reveals, highlighting growing interest in digital assets among wealthy families.

The report comes as the U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin exchange-traded funds (ETFs) earlier in January, integrating crypto into the mainstream investing environment. According to BNY Mellon’s findings, 33% of family office professionals confirmed that they are already investing in crypto with the potential to expand their holdings.

In contrast, 38% of respondents reported having no current exposure to or interest in cryptocurrencies. The remaining 30% indicated a varied level of involvement, with some having limited exposure or currently exploring the asset class without active investment.

“True to their entrepreneurial nature, family offices are showing themselves ready and willing to move into new and emerging opportunities. […] Cryptocurrencies account for 5% of portfolios, an allocation that would have been unthinkable a decade ago.”

BNY Mellon

The motivations for exploring cryptocurrencies among family offices appear to be diverse. Over half of the respondents mentioned “keeping up with new investment trends and opportunities” as a key driver. Additionally, 30% or more cited interest from current leadership or the next generation within the family office as influential factors.

Despite the interest, the report identified the “not well-defined” regulatory environment as a significant barrier to investment. Nevertheless, 55% of family offices expressed favor for public market ETFs that own cryptocurrencies, while 54% showed a preference for trading directly on exchanges.