32% of family offices embrace crypto, Goldman Sachs states

A recent study by Goldman Sachs indicates a rising global trend of family offices adopting digital assets, such as cryptocurrencies, NFTs, and DeFi. The study reveals that 32% of family offices have exposure to digital assets, with 26% explicitly investing in cryptocurrencies.

The study surveyed 166 family offices in the Americas, Europe, the Middle East and Africa (EMEA), and Asia-Pacific (APAC) to assess the changing investment landscape over the past few years.

Compared to the 2021 findings, the study observed a significant rise in the proportion of family offices invested in digital currencies. While only 16% of respondents had invested in digital currencies in 2021, the figure has now surged to 26%.

However, it is worth noting that overall interest in the sector has diminished. The proportion of family offices not invested and disinterested in the future has risen from 39% to 62%, while those potentially interested have decreased from 45% to 12%.

The study also disclosed that 32% of the surveyed participants currently have exposure to digital assets, encompassing cryptocurrencies, stablecoins, NFTs, DeFi, and blockchain-related funds.

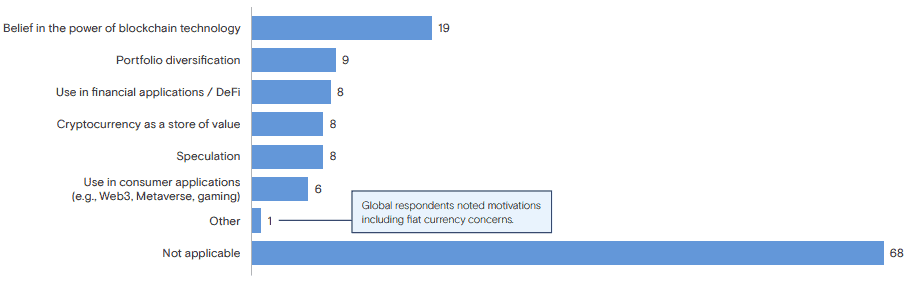

Among the motivations for entering this ecosystem, belief in the potential of blockchain technology stood out at 19%. Additionally, 9% joined the industry for portfolio diversification, 8% perceived digital currencies as a store of value, and a similar percentage purchased cryptocurrencies with hopes of future profits or speculative purposes.

Asia-Pacific leads in HODLers

Geographically, the Asia-Pacific region demonstrated the highest proportion of HODLers, accounting for 30% of the surveyed family offices.

HODLers are committed crypto investors who hold their positions regardless of price movements. They demonstrate unwavering faith in the enduring value of cryptocurrencies, refusing to be swayed by short-term market fluctuations.

Interestingly, 27% of APAC family offices without current exposure to cryptocurrencies expressed an ongoing interest in the future. In contrast, the EMEA region displayed lower cryptocurrency adoption, with only 15% of family offices investing, while a significant majority (79%) indicated a lack of interest.

Further supporting the trend of digital asset investment, a separate study conducted by KPMG China and Aspen Digital discovered that nearly 60% of family offices and high-net-worth individuals (HNWIs) in Hong Kong and Singapore had allocated a portion of their wealth to digital assets.

Paul McSheaffrey, Senior Banking Partner at KPMG China, explained the rationale behind this move, suggesting that HNWIs and family offices perceive a potential upside and are, therefore, willing to allocate a small percentage of their portfolios for exposure to digital assets.

The research revealed that bitcoin (BTC) and ethereum (ETH), the two largest cryptocurrencies by market capitalization, emerged as the most popular digital assets in Hong Kong and Singapore.