Pendle climbs 14% as Pendle Finance recovers from domain hijack attack

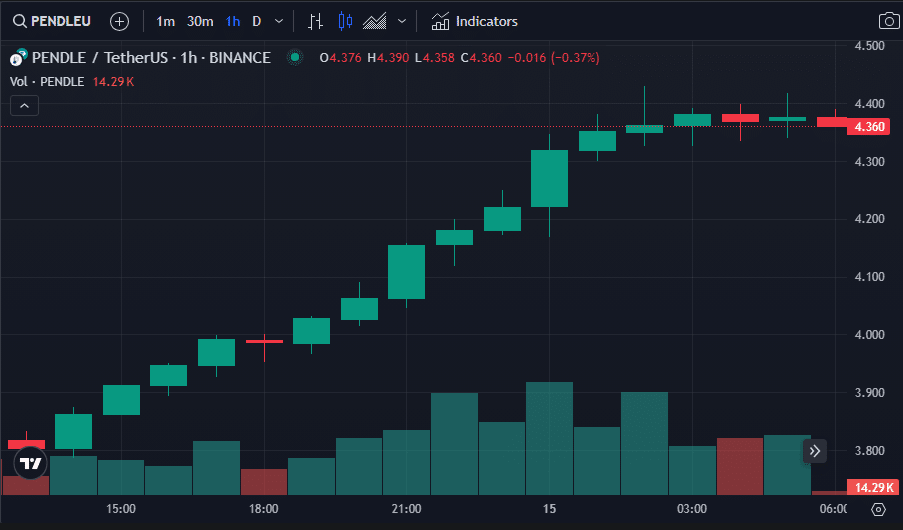

Pendle, the native token of the decentralized platform Pendle Finance, has surged 14% today to become the top gainer among the leading 100 cryptocurrencies by market cap.

At the time of writing, PENDLE was still up 13.5% in the last 24 hours exchanging hands at $4.38 per price data from crypto.news. The crypto asset also saw its daily trading volume double from the last day, hovering around $77.6 million.

Moreover, PENDLE’s market cap had also jumped to $683 million, ranking it 96th among the largest 100 cryptocurrencies. Despite the recent price rally, the digital asset is still 42% down from its all-time high of $7.52, reached on April 11.

The recent price surge comes on the heels of a security incident for the Pendle community over the weekend when their domain was hijacked. After domains migrated from Google to Squarespace, attackers exploited a vulnerability, taking control of several domains, including Pendle’s.

The Pendle team responded swiftly to the attack, shutting down their app upon detecting a malicious DNS redirect. They managed to regain control of the domain within 40 minutes, assuring their followers on X that the protocol and funds remained secure throughout the incident.

Established in 2022, Pendle Finance initially focused on the Ethereum network, providing a platform for tokenizing and trading future yields within the defi space. Later in the same year, the platform expanded its reach to other networks, including BNB Chain, Arbitrum, and Optimism.

This cross-chain expansion aims to facilitate seamless access to Pendle’s services and trading functionalities across different blockchain platforms, thereby increasing its utility and accessibility for users.

Moreover, Pendle has implemented a point distribution system designed to incentivize user engagement through various campaigns, fostering more active community participation.

Additionally, Pendle has enhanced its yield tokenization and trading capabilities by integrating with various DeFi protocols. This enables users to effectively tokenize and trade yield-bearing assets, optimizing their yield management strategies.